- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I work from home for a company located in NJ, I believe my company incorrectly held state taxes - now what?

I'll get right to it - I live in VT, and work from home (basically exclusively, minus a week-long visit to the office twice per year) for a company in NJ. Last year, when turbotax asks "did you make money in any other state?" I answered "no" because I hadn't - I earned all my income while in my residence state, VT.

This year, however, my W2 is much different, and my employer did not withhold state tax for my residence state (or not nearly enough). Here are my numbers for 2018/2019 to compare:

Here are my state wages and state income tax withholdings from my 2018 W2:

BOX 16 (state wages):

VT: $49,774.24

NJ:$0.00

BOX 17 (state income tax withheld):

VT: $2,216.14

NJ:$30.33

Here are my state wages and income tax withholdings from my current/2019 W2:

BOX 16 (state wages):

VT: $0.00

NJ: $59,400.00

BOX 17 (state income tax withheld):

VT: $396.78

NJ: $913.80

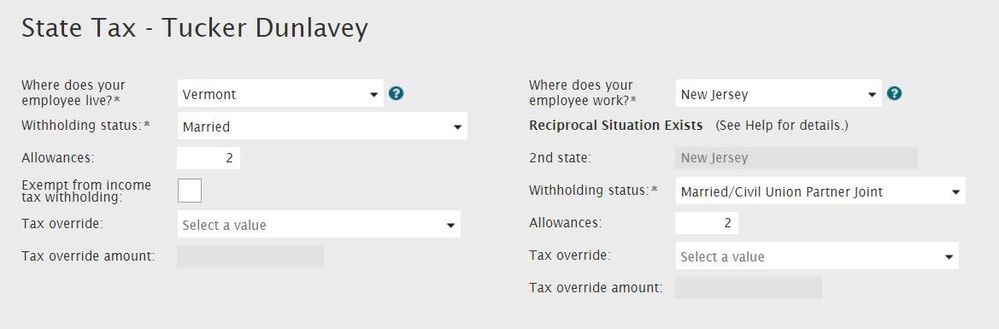

Essentially, nothing was held in 2018 for NJ state tax, besides $30, which was returned to me in-full. On my current return, it's showing that I'll owe VT $800 in state taxes. We changed payroll providers in 2019, and I think this is when things became messed up. I asked HR, and they sent a screenshot of how the new payroll is setup, which I'll attach below. You can see they stated that I live in VT but work IN NJ. I think it should be I live in VT AND work in VT. Our CPA said I can offset the amount by saying yes to "i made money in another state", and by stating I live in VT and work in NJ, and this is true, I just want to make sure I'm not out of line in doing so.

Help, please!