- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

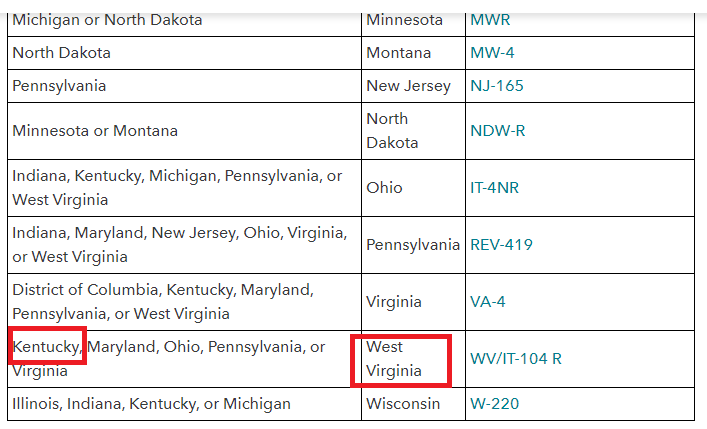

@Hal_Al is correct. West Virginia and Kentucky are reciprocal states so answer no to the question about receiving income from other states.

To enter, see Where do I report a 1099-G for unemployment or paid family leave?

Related Information:

- How do I report unemployment if I didn't get a 1099-G?

- What does "tax liability" mean? Is that the amount I still owe?

[Edited 1-28-2021|6:53 am PST New answer and screenshot]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

Thank you. I assumed that was what I was supposed to do..... but I wasn't quite sure. When I chose that and then entered my home state of KY (a reciprocal state), it is now showing a refund in KY and that I owe in WV. I assume that is ok since it would have credited the tax I owe to WV to my home state of KY, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

Do NOT answer yes to the question about receiving other state income, in the personal info section of TurboTax.

The West Virginia unemployment is not WV source income, for tax purposes. You do not need to do a West Virginia State Income Tax return.

Report the unemployment 1099-G only on your KY return.

This is not a KY-WV reciprocal state issue. This rule is the same in most states (your report unemployment as home state income, not work state).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

Even though I received it from WV and I did not pay state taxes for it? It seems I would be required to pay them state taxes on the unemployment income since I received it from WV....not KY. Of note: on my 1099-G that I received, it does not have a state, or state tax amount (boxes 10-11 I believe). I tried putting the information on turbo tax without entering a non-resident return and it does not make me pay state taxes. I know that I owe WV the state tax for the unemployment....the only way it is calculating is if I file a non-resident WV and enter the information from the 1099-G. This then shows I owe WV but am getting a very small refund in KY. Again, I assume that is because it is crediting my home state so I'm not paying those taxes twice on the same income. Anyone have insight? I really don't want to take my taxes somewhere to get done just because I'm afraid I'm entering the unemployment wrong. I've always used turbotax!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

I agree, it "seems like that". But this a very frequent (even before Covid) question here in the forum. You only file KY.. You would only file WV if there had been WV state withholding, so you could get the withholding refunded.

"I know that I owe WV the state tax for the unemployment"

I don't know, for sure how it works in KY and WV, but the general rule is you report unemployment as home state income, not work state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

To clarify, if WV DID take out state taxes on the unemployment, I would then file a non-resident return. But since they did not, I just file KY and let then tax that unemployment income via KY? Its literally a difference of $9 depending on how I enter the information. I just don't want to make a mistake and fine out a few years later lol

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

Update:

I just spoke with both KY and WV state tax depts. Both stated I would file a WV non-resident return for the unemployment income i received from WV. It will then credit my KY return so im not paying taxes on this in both states.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

That isn't the question I was confused about. I've always did it that way since I work in wv but live in ky. This is a question about unemployment where state taxes are owed. But as an update:

I just spoke with both KY and WV state tax depts. Both stated I would file a WV non-resident return for the unemployment income i received from WV. It will then credit my KY return so im not paying taxes on this in both states.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received unemployment from WV but live in KY. I am trying to file a non-resident for west virginia. Is unemployment considered wages and salaries or something else?

Whomever you spoke to in the KY and WV departments are giving you wrong information. I'm sorry that you are receiving this confusion, but @Hal_Al is 100% giving you correct information on this. Unemployment is only taxed where you live, regardless of where it was issued from. (Notice his Avatar is the Ohio flag and he has extensive local knowledge of the Ohio Valley tax laws).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17525168329

Level 1

Candyman

New Member

Laf923

Returning Member

shelley0969

New Member

jcorrea4

New Member