- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I owe back taxes , will the IRS offset my recovery rebate credit ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I owe back taxes , will the IRS offset my recovery rebate credit ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I owe back taxes , will the IRS offset my recovery rebate credit ?

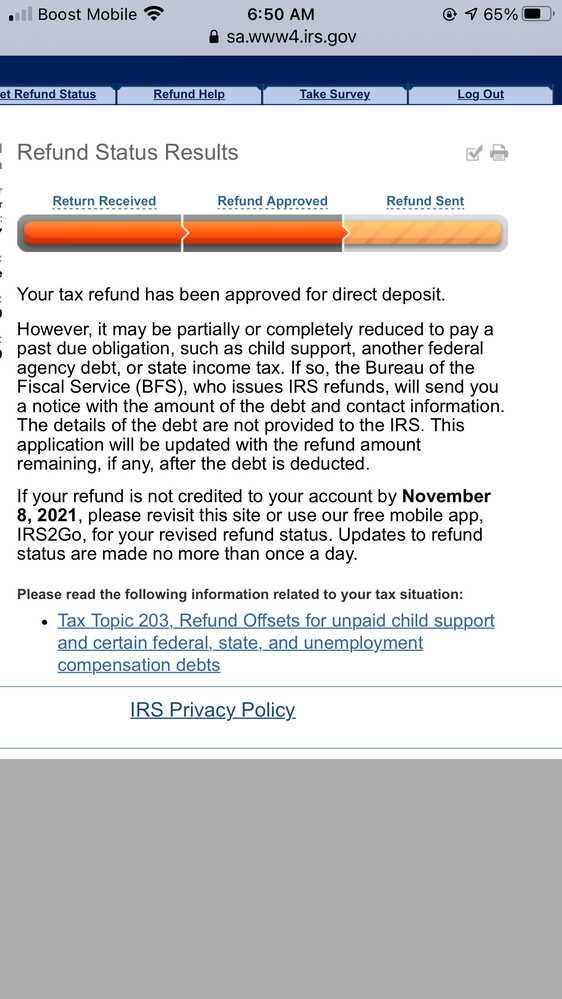

@Pureluv As explained to you in both threads that you have posted to, if you owe back child support or back taxes, then some or all of your 2020 refund--including any recovery rebate credit money-- can be used to pay your debt. If the IRS takes your refund to pay a debt you owe you will receive a lower refund (or possibly no refund) than you expected and a few weeks later you will receive a letter that explains why they took some (or all) of your refund. The amount they take will depend on how much you owed for the back child support, back taxes, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I owe back taxes , will the IRS offset my recovery rebate credit ?

That is incorrect. The advance child tax credit the 3rd one. 1400 I should be able to get that one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I owe back taxes , will the IRS offset my recovery rebate credit ?

@Pureluv wrote:

That is incorrect. The advance child tax credit the 3rd one. 1400 I should be able to get that one.

The third economic impact payment has nothing to do with the advance child tax credit. This stimulus payment of $1,400 is sent by the IRS based on the latest tax return received by the IRS, either 2020 or 2019 returns.

Go to this IRS website for the third stimulus payment information - https://www.irs.gov/coronavirus/get-my-payment#schedule

If you do not receive the third stimulus payment in 2021 you can get the payment as a Recovery Rebate Credit on your 2021 tax return that you file next year.

However, if you still have debts outstanding the IRS can take the 2021 federal tax refund which includes the Recovery Rebate Credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I owe back taxes , will the IRS offset my recovery rebate credit ?

Ok so if someones recovery rebate is taken for back child support is there anything that can be done since it is stimulas

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I owe back taxes , will the IRS offset my recovery rebate credit ?

@angi3nicol3 wrote:

Ok so if someones recovery rebate is taken for back child support is there anything that can be done since it is stimulas

No, the 3rd stimulus payment did Not have an exclusion for owing back child support.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 2

Naren_Realtor

New Member

elliottulik

New Member

Garyb3262

New Member

nalee5

New Member