- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I lived in 3 states in 2021, however, on the Personal Info page it only gives me an option to list my current state and one previously. How can I add all 3 states?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I lived in 3 states in 2021, however, on the Personal Info page it only gives me an option to list my current state and one previously. How can I add all 3 states?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I lived in 3 states in 2021, however, on the Personal Info page it only gives me an option to list my current state and one previously. How can I add all 3 states?

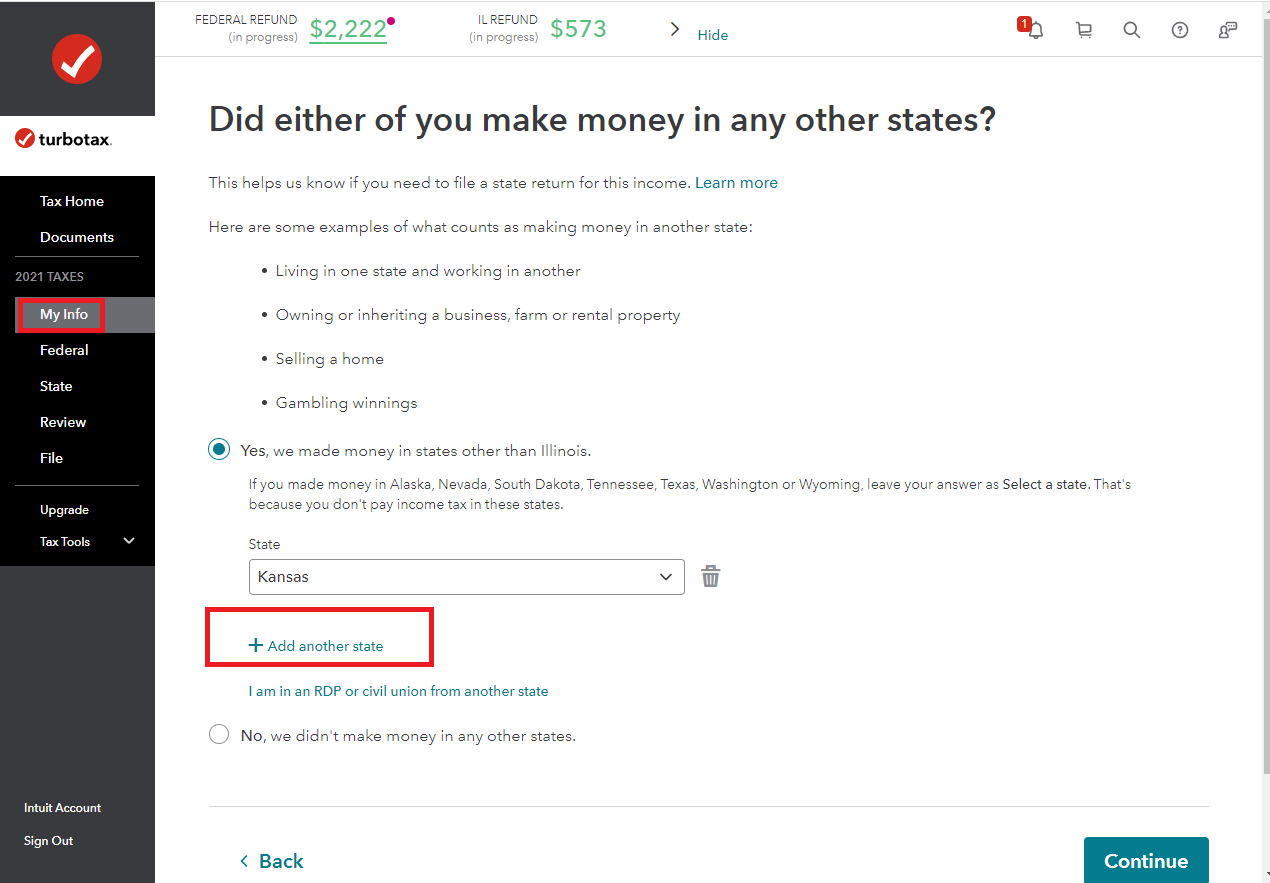

On the left hand side menu, select My Info. On the Personal info Summary screen, scroll down to Other state income. If it lists one state, select Edit. On the Did you make money in any other states? screen, answer Yes. You'll be able to Add another state.

If you were a resident of two different states during the tax year (for example, if you moved from one state to another), you'll normally file part-year returns in both states, assuming each state collects income tax and you had income in each state.

- We suggest you prepare the return for your former state first, followed by the return for the state you currently live in.

- Important: If you also see a nonresident state return in the State section, complete that return before you work on your part-year return(s) to ensure your tax credits are calculated correctly.

Related Information:

- How do I allocate (split) income for a part-year state return?

- How do I file if I moved to a different state last year?

- How does TurboTax calculate taxes on part-year returns?

- How do I file a nonresident state return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I lived in 3 states in 2021, however, on the Personal Info page it only gives me an option to list my current state and one previously. How can I add all 3 states?

you can't

What one might do is to treat the middle state as a "Non-resident" state, taht you really set up a supposed "permanent" Residence/Domicile in. Then indicate you "Moved" from the first state, to the last state on the date you moved in there.

But the income allocations for the two part-year tax returns get complicated and perhaps a professional outside tax preparer might be advisable this year (Definitely do that if any of the states moved between were reciprocal tax states, like MD, DC, VA, WV, PA and perhaps a few more surrounding states, depending on which were involved....that gets really complicated)

_________________________________

A simple situation for nonreciprocal tax states. Lived in MO until April, cleared out stuff and went to NE to live/work from May-Sept, then picked up your stuff, and went to KS to live/work for the remainder of the year and plan to remain there for the foreseeable future.

That would be a KS resident at the end of the year, "moved" from MO to KS in Sept, and time in NE was temporary as a nonresident and you didn't really take up permanent residence there.

_______________________________

OF course, this is just one situation, and your details could change what you do to file. For instance, in the "simple" situation above, perhaps you are only in KS temporarily, and had established a permanent residence/domicile in NE , along with Drivers's Lisc. car registered, Banking, register to vote etc., and plan to return there after the temporary job in KS (usually, less than 6 months)....then the move would be from MO to NE, and just travelling temporarily to KS as non-resident.

Messy...so the details can be important.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

decoflair

Level 1

mudtech61

Level 1

kare2k13

Level 4

Falcon5

New Member

marytony

Level 3