- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

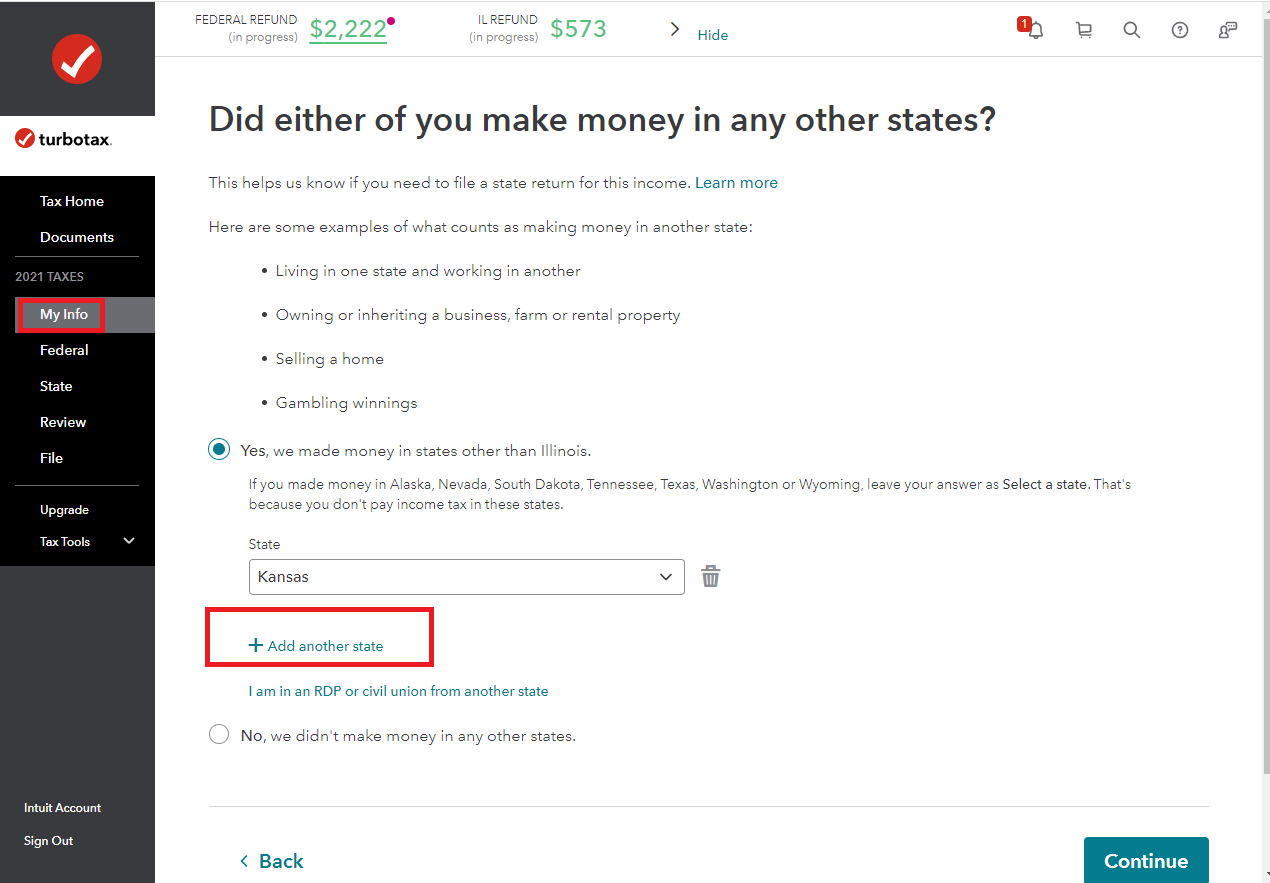

On the left hand side menu, select My Info. On the Personal info Summary screen, scroll down to Other state income. If it lists one state, select Edit. On the Did you make money in any other states? screen, answer Yes. You'll be able to Add another state.

If you were a resident of two different states during the tax year (for example, if you moved from one state to another), you'll normally file part-year returns in both states, assuming each state collects income tax and you had income in each state.

- We suggest you prepare the return for your former state first, followed by the return for the state you currently live in.

- Important: If you also see a nonresident state return in the State section, complete that return before you work on your part-year return(s) to ensure your tax credits are calculated correctly.

Related Information:

- How do I allocate (split) income for a part-year state return?

- How do I file if I moved to a different state last year?

- How does TurboTax calculate taxes on part-year returns?

- How do I file a nonresident state return?

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 23, 2022

7:08 AM