- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I live in CA, & I sold a second home in Arizona but I do not know how to enter it in AZ State Turbo tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in CA, & I sold a second home in Arizona but I do not know how to enter it in AZ State Turbo tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in CA, & I sold a second home in Arizona but I do not know how to enter it in AZ State Turbo tax?

You are correct. First, of course, you will need to enter the sale of the home itself for Federal Taxes. The following link will assist you: https://ttlc.intuit.com/replies/4241480.

Once you fill out the information, TurboTax will review the amount of gain you had from the sale of the home. You will want to write down this figure as you will need it in another spot. Once you have done this, do not revisit this section as TurboTax will reset it as if you have never entered it.

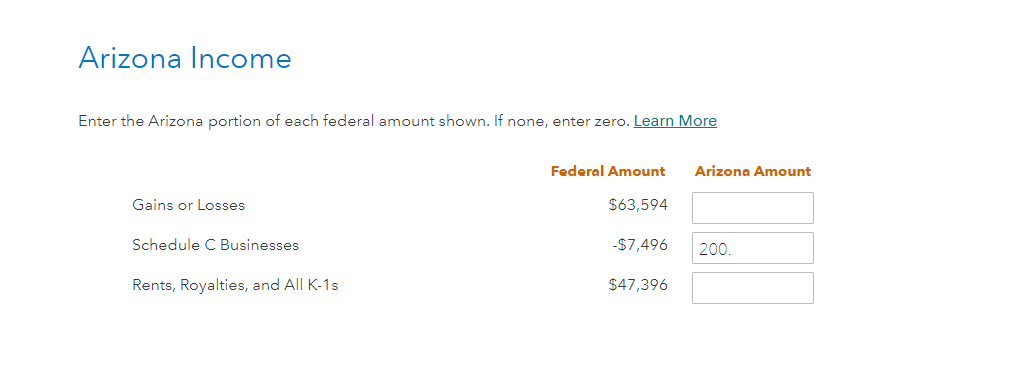

Then, when you prepare the Arizona nonresident return, you will be asked questions about Arizona Income, one of which will deal with Gains and Losses. You will enter the amount of Gain on the Sale of that second home (determined in the previous screen) in that box. You will be taxed on that amount as an Arizona nonresident. However, you will receive a credit for the amount you must pay on that income in Arizona for your California return. For this reason, you should prepare the Arizona return first.

Here are some screenshots to help identify where to get the figure on the Sale of Home screen and where to enter in the Arizona return:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in CA, & I sold a second home in Arizona but I do not know how to enter it in AZ State Turbo tax?

I have the reverse situation. I sold a house in CA but live in AZ. I paid a tax in CA for capital gains. How do I file my returns in AZ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in CA, & I sold a second home in Arizona but I do not know how to enter it in AZ State Turbo tax?

Since you already entered the sale on your federal return, this information will be transferred to your AZ return.

To get the AZ return, you can click State>>Add A State>> then choose Arizona. You will then walk through until you get to the screen that says Arizona Income. Here you will list your Arizona amount in the Gains and Losses screen. It will show you the federal amount, but you will need to enter the state amount.

Then you will just continue through to the end

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cdtucker629

New Member

intuit

New Member

azmscpa

New Member

svmunoz2

New Member

james

New Member