- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I don't know which state exempt- interest dividends are from. Says to click more than one state button, then asked to list. How do I move on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't know which state exempt- interest dividends are from. Says to click more than one state button, then asked to list. How do I move on?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't know which state exempt- interest dividends are from. Says to click more than one state button, then asked to list. How do I move on?

For details on how to enter, see: https://ttlc.intuit.com/community/state-taxes/discussion/re-exempt-interest-dividends-are-entered-fr...

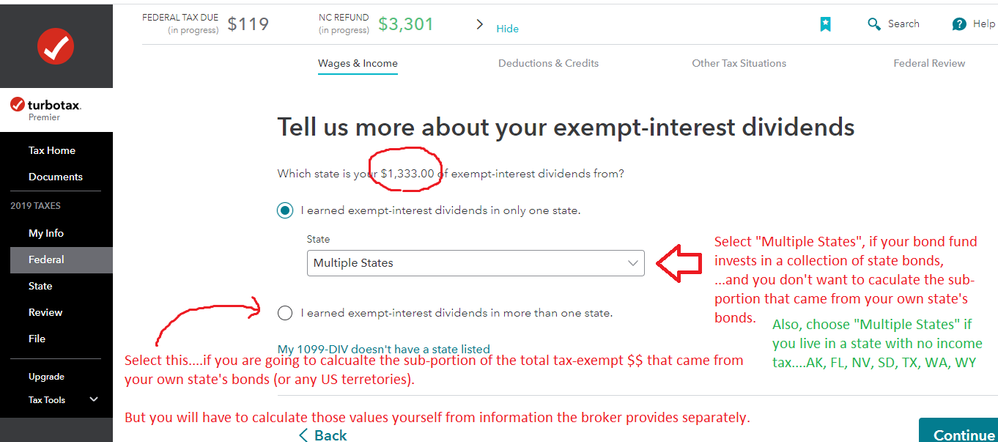

Most particularly, see the screen shot at that link. If you don't care about paying state tax on the (usually) small portion attributable to your state, click only "More than one state".

You get the breakdown by state from your mutual fund company. It is not shown on the 1099-INT or 1099-DIV. If they did not provide a breakdown, you check the box “I earned tax exempt dividends in more than one state” ("Multiple States" in the online program) on the first screen after entering the 1099-INT or 1099-DIV. Then select "More than one state" ("Multiple States" in the online program) at the bottom of the state scroll down list.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't know which state exempt- interest dividends are from. Says to click more than one state button, then asked to list. How do I move on?

Here's another picture...

IF you are not interested in breaking down the individual amount form your own state...you choose "Multiple States" in the very top box (That selection is at the END of the pulldown list of states).

The selection that shows several boxes is only used if you decide to divide things up.

_____________________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jvmorrow

New Member

HollyP

Employee Tax Expert

HappilyRetired

Level 1

user17605417776

New Member

jacksonhdj

New Member