- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I don't have information on what states my exempt-interest dividends are from. My advisor told me the amount toward my home state is quite negligible. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have information on what states my exempt-interest dividends are from. My advisor told me the amount toward my home state is quite negligible. What do I do?

TT asks for the amount of exempt-interest dividends for each state. I don't have any of that information. What do I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have information on what states my exempt-interest dividends are from. My advisor told me the amount toward my home state is quite negligible. What do I do?

Certainly, selecting TX will work (except if you are are resident of UT)..

....But a better choice would be to go to the end of the list of states and select "Multiple States" instead for the entire amount. That's the normal way it's done if you are not going to break out your own state's bonds.

____________

(Note for Desktop software users....the desktop software has a slightly different selection.. "More than one state" instead. Subtle...but the same effect)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have information on what states my exempt-interest dividends are from. My advisor told me the amount toward my home state is quite negligible. What do I do?

use the state of Texas. no income tax there and all your exempt-interest dividends will be taxed on your state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have information on what states my exempt-interest dividends are from. My advisor told me the amount toward my home state is quite negligible. What do I do?

Only the amount earned from state-tax-free securities issued in your own state can be excluded on your state return.

The breakdown by state is usually given by the mutual fund on their website as a percentage.

why would anybody enter tax-exempt amounts from 50 states?

and why would TurboTax ask you for that? You must be misreading it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have information on what states my exempt-interest dividends are from. My advisor told me the amount toward my home state is quite negligible. What do I do?

Certainly, selecting TX will work (except if you are are resident of UT)..

....But a better choice would be to go to the end of the list of states and select "Multiple States" instead for the entire amount. That's the normal way it's done if you are not going to break out your own state's bonds.

____________

(Note for Desktop software users....the desktop software has a slightly different selection.. "More than one state" instead. Subtle...but the same effect)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't have information on what states my exempt-interest dividends are from. My advisor told me the amount toward my home state is quite negligible. What do I do?

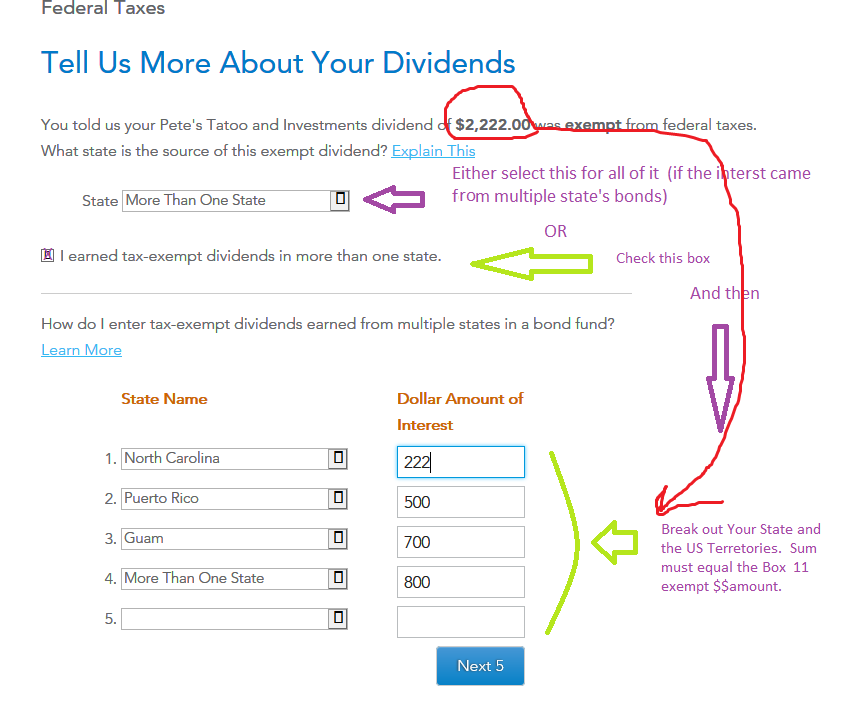

...And here's how you would do it if you did have a lot of $$ from your home state. You only break out your resident state, any US Territory bonds, and the remaining amount is lumped, "Multiple states". An example for a NC resident, for box 11 $$ on a 1099-DIV: (the checkbox on the "Tell Us More..." page is only checked if you want to do the break-out)

______________________________

________________________________________________________

But as another example. Say your box 11 on the 1099-DIV is $1000. And the info from your fund indicates that 2% came from your state. 2% of 1000 = $20. SO I could reduce my state income by $20 by doing the breakout, and save myself $1 in state taxes (at 5% state tax rate). But you have to do the proper calculations yourself to get that $20 value.....and MN and CA don't allow the breakout from a mutual fund collection of bonds unless the Fund holdings contain more than 50% of that particular state's bonds. (and IL doesn't allow a breakout at all from a mutual fund)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

claire-hamilton-aufhammer

New Member

blankfam

Level 2

dlz887

Returning Member

sierrahiker

Level 2

abcxyz13

New Member