- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

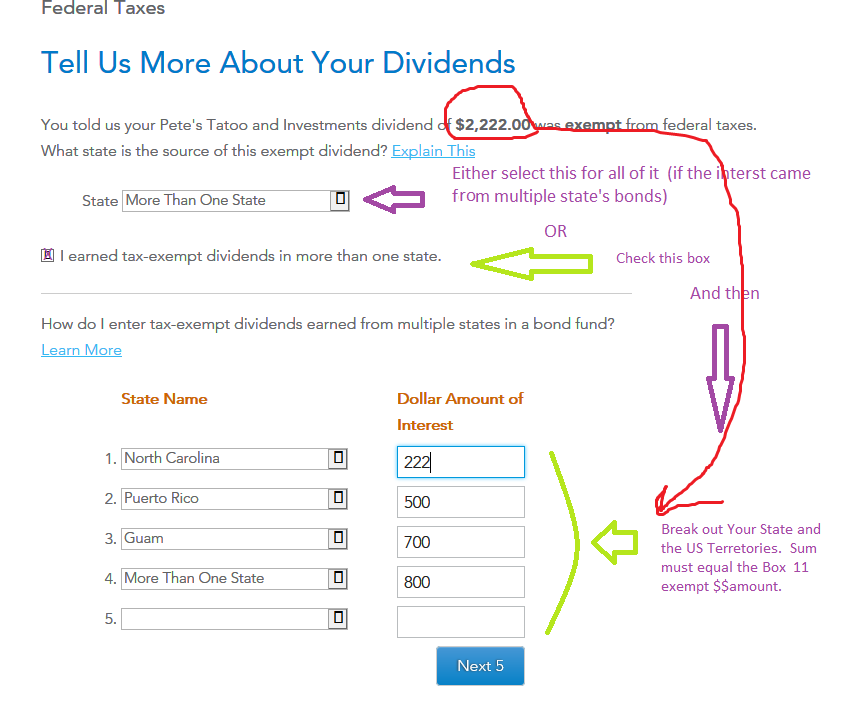

...And here's how you would do it if you did have a lot of $$ from your home state. You only break out your resident state, any US Territory bonds, and the remaining amount is lumped, "Multiple states". An example for a NC resident, for box 11 $$ on a 1099-DIV: (the checkbox on the "Tell Us More..." page is only checked if you want to do the break-out)

______________________________

________________________________________________________

But as another example. Say your box 11 on the 1099-DIV is $1000. And the info from your fund indicates that 2% came from your state. 2% of 1000 = $20. SO I could reduce my state income by $20 by doing the breakout, and save myself $1 in state taxes (at 5% state tax rate). But you have to do the proper calculations yourself to get that $20 value.....and MN and CA don't allow the breakout from a mutual fund collection of bonds unless the Fund holdings contain more than 50% of that particular state's bonds. (and IL doesn't allow a breakout at all from a mutual fund)