- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I am a flight attendant with time away from base pay (per diem), over 468 hours. This should be untaxable income for CA state tax. How do I enter this in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a flight attendant with time away from base pay (per diem), over 468 hours. This should be untaxable income for CA state tax. How do I enter this in?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am a flight attendant with time away from base pay (per diem), over 468 hours. This should be untaxable income for CA state tax. How do I enter this in?

You will enter this income in the Federal interview section of the program as it is reported to you.

However, you will adjust this income in your state return when you go through the state interview section.

- Select State in the black panel on the left hand side of your screen when logged into TurboTax.

- This will take you to a screen titled Let's get your state taxes done right. Click continue on this screen.

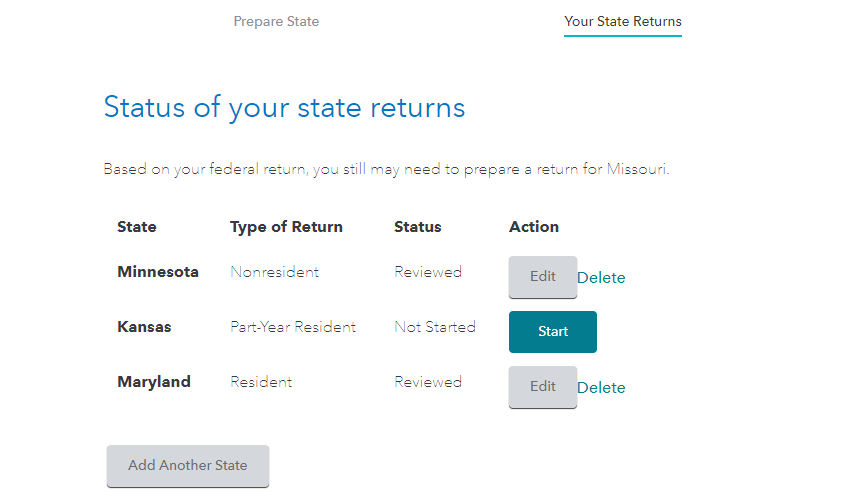

- You will see the following screen titled Status of your state returns. Select Edit to the right of California to review your entries.

Depending upon how your income was reported to you, you will either be given the option to adjust your wages through the interview screens. If this is the case, be sure to only report the income sourced to California sources on this page.

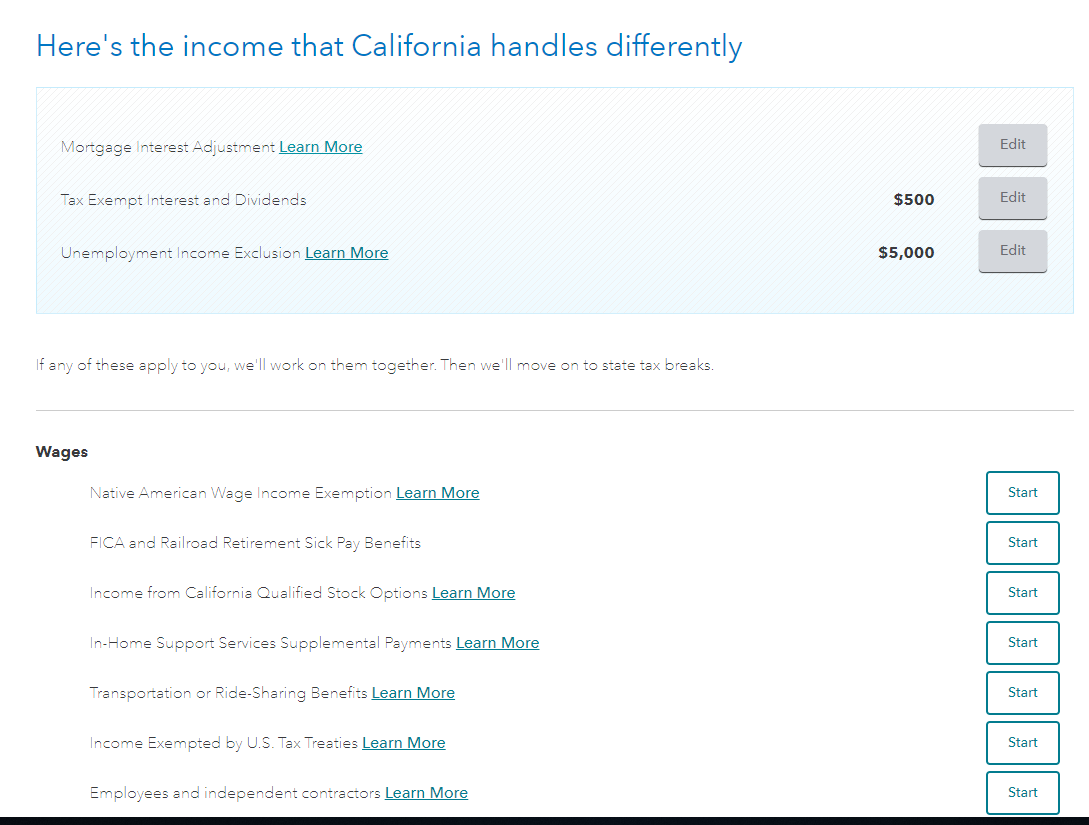

If the income is reported in another way, you will see a screen titled Here's the income that California handles differently, scroll down and select the applicable source of income to make your adjustments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

briberglund123

Level 1

gaeg-ajg

New Member

in Education

alexcat21

New Member

lifeatthelake68

New Member

ETM

Level 2