- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How do I enter non-resident income for Iowa sourced income? EasyStep never gets to the screen that is supposed to allow me to enter this information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter non-resident income for Iowa sourced income? EasyStep never gets to the screen that is supposed to allow me to enter this information.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter non-resident income for Iowa sourced income? EasyStep never gets to the screen that is supposed to allow me to enter this information.

I'm not familiar with the IA software, but, in general, you allocate income, by state, at the allocation screens, in the state software. The possible exception is that W-2 income is allocated at the W-2 screen (in the federal section) by the state abbreviation in box/line 15.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter non-resident income for Iowa sourced income? EasyStep never gets to the screen that is supposed to allow me to enter this information.

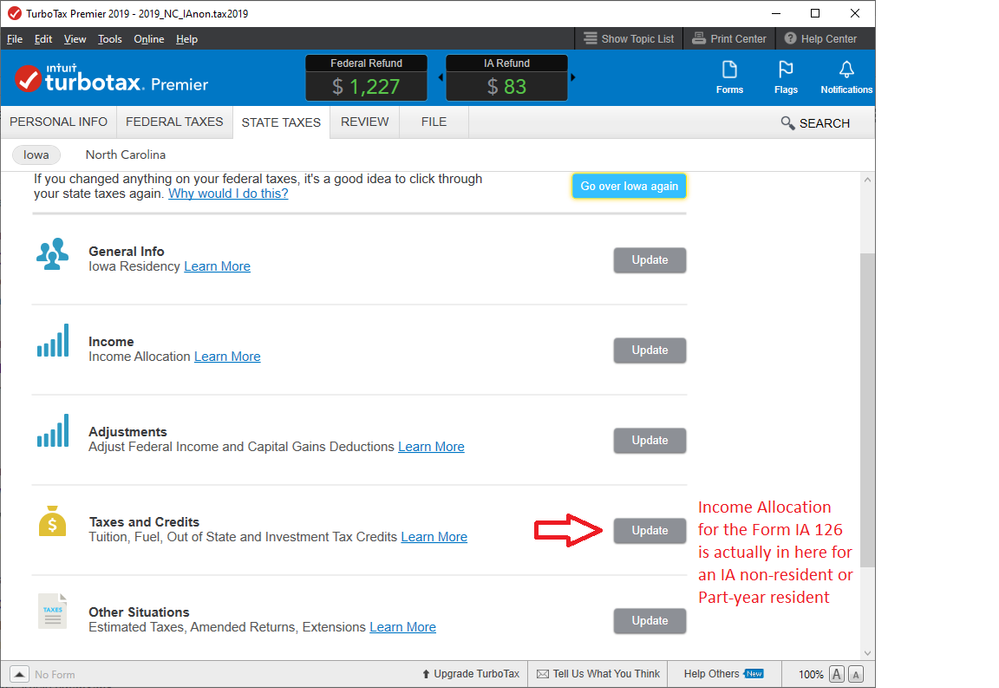

I went back thru my IA forms for a nonresident, and I found that the Software interview for IA puts the IA income allocation in a strange spot.

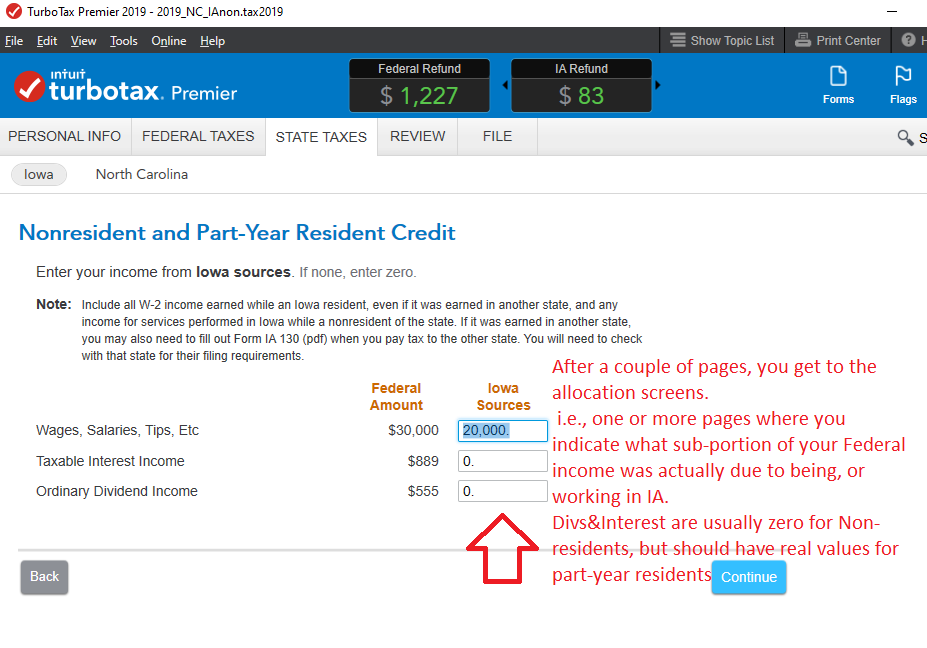

Normally you would find the place to allocate in the "Income/Income Allocation" section, but for some reason, the programmers for the IA interview places those allocations in the "Taxes and Credits" section (see pictures below). ----------[[ Of course, this is where it is located in the 2019 Desktop software. I can't check the "Online" software since it is all shut down right now ]]

_________________

For an IA non-resident (or part-year resident), IA calculates a gross tax based on all your income, then applies an internal credit for the %, or portion of your income that was not earned in IA...using the form IA-126. Maybe that's why they placed it in that section....but software-wise, people would expect to see those questions in the Income/Income Allocation section.

_________________________________________

_______________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter non-resident income for Iowa sourced income? EasyStep never gets to the screen that is supposed to allow me to enter this information.

Thank you very much for directing me to this screen! I don't know how many times I clicked through the EasyStep and kept expecting the allocation screen to appear right after the screen that says: " What's next : For each type of income you received, we'll ask you if it was earned in Iowa." And then, the question is never asked in the Income section but goes on in the next screens about nonconformity adjustments. I knew the IA 126 Form had been generated, but I did not want to just enter data in the forms screen because it looked like numbers had been posted to that form already by TurboTax. Very poor interface for this tax product!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Questioner23

Level 1

mariam-hassan1895

New Member

mariam-hassan1895

New Member

RTU

Level 2

overcurious

Level 1