- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

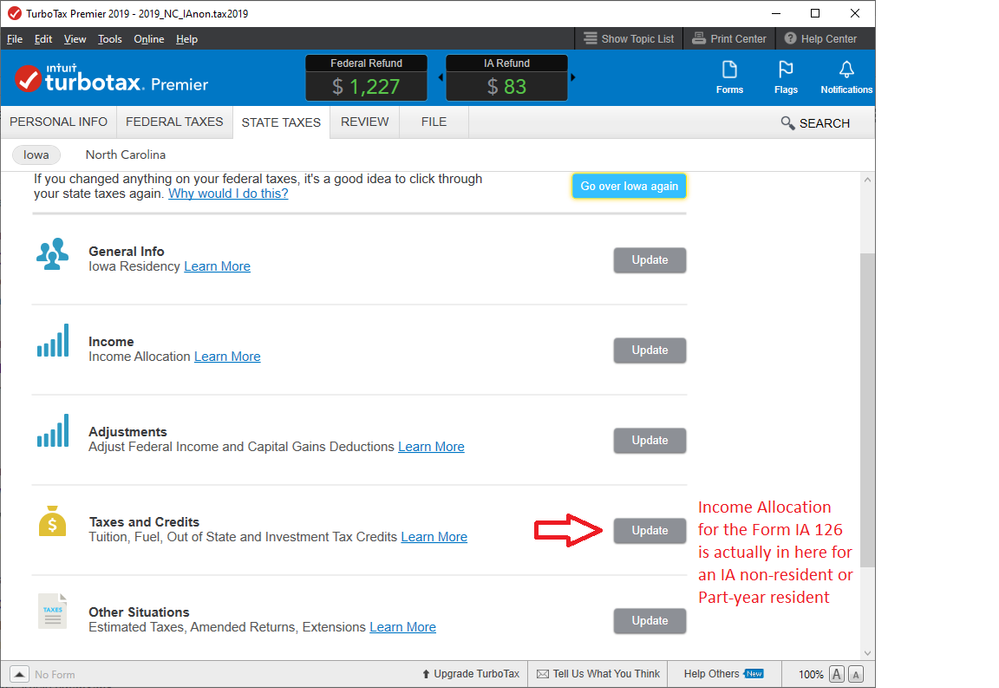

I went back thru my IA forms for a nonresident, and I found that the Software interview for IA puts the IA income allocation in a strange spot.

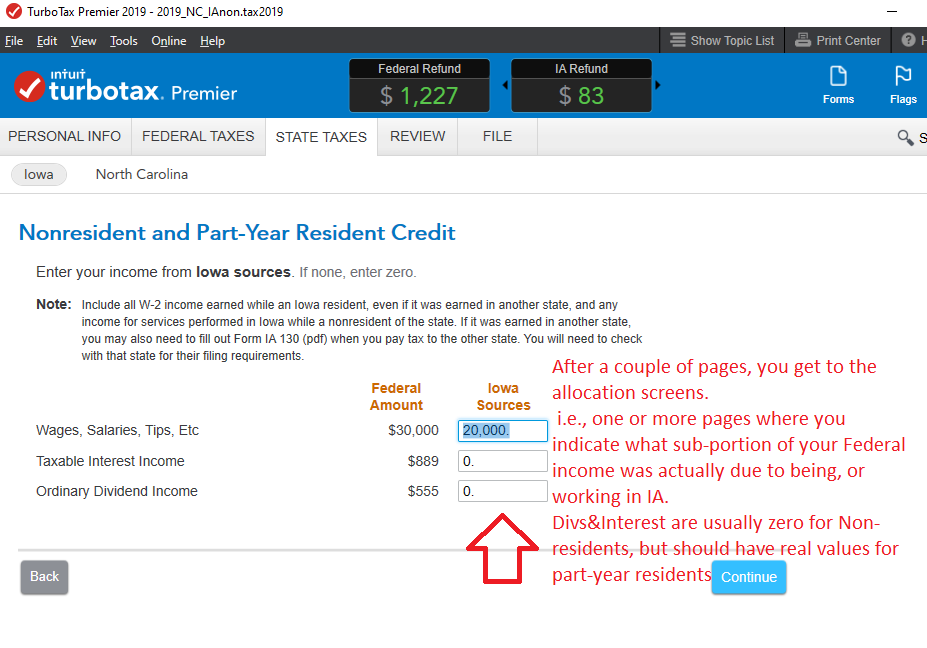

Normally you would find the place to allocate in the "Income/Income Allocation" section, but for some reason, the programmers for the IA interview places those allocations in the "Taxes and Credits" section (see pictures below). ----------[[ Of course, this is where it is located in the 2019 Desktop software. I can't check the "Online" software since it is all shut down right now ]]

_________________

For an IA non-resident (or part-year resident), IA calculates a gross tax based on all your income, then applies an internal credit for the %, or portion of your income that was not earned in IA...using the form IA-126. Maybe that's why they placed it in that section....but software-wise, people would expect to see those questions in the Income/Income Allocation section.

_________________________________________

_______________________________________