- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How do I enter a 529 contribution for the state of Michigan?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a 529 contribution for the state of Michigan?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a 529 contribution for the state of Michigan?

Click this link for the steps to Enter a Michigan 529 Contribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a 529 contribution for the state of Michigan?

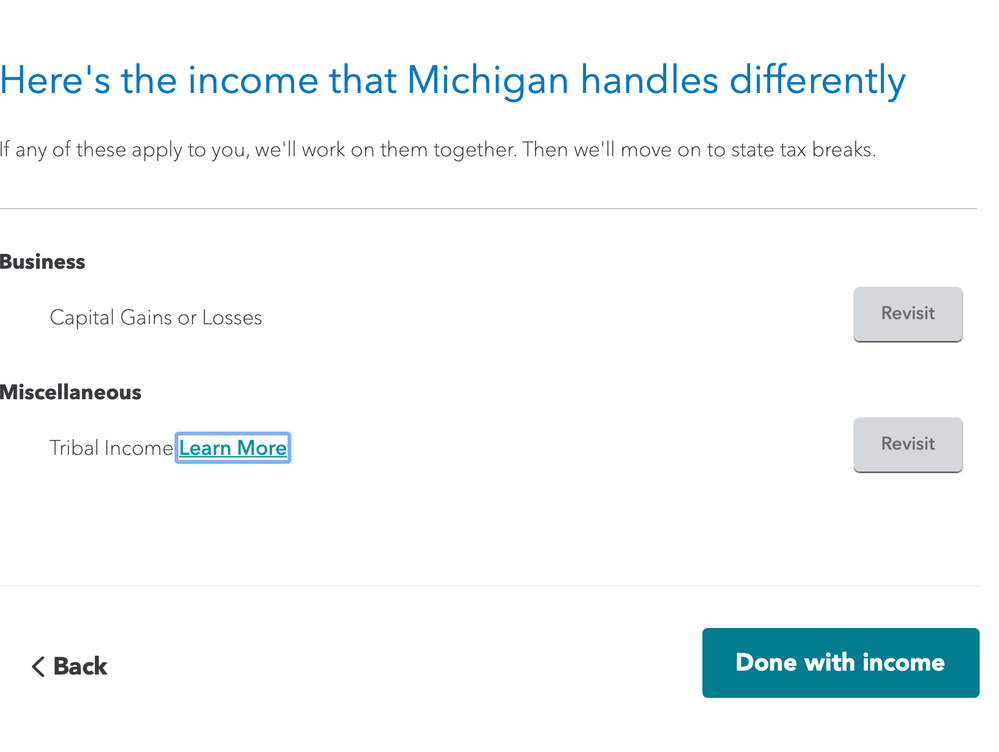

Thanks for the quick reply. I couldn't get that link to work and I believe it is out of date. When I go to my Michigan income section it says, "Here's the income that Michigan handles differently" but only lists 2 options: "Capital Gains and Losses" and "Tribal Income". Nowhere can I find 529 plans. Any ideas? Thx!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a 529 contribution for the state of Michigan?

Please see the screenshot below. Here is where you will enter the Michigan Savings plan Contribution.

s

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a 529 contribution for the state of Michigan?

Thanks, I don't have that option. I'm not a resident of Michigan, so perhaps it is not letting me for that reason. However, I checked the state statute and residency status doesn't matter. Here is my screen:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a 529 contribution for the state of Michigan?

According to this Turbo Tax link, most states require that you contribute to your own state’s plan to get the break (Arizona, Kansas, Maine, Missouri and Pennsylvania allow deductions for contributions to any state’s plan). But each state also has different rules about who can take the deduction for their contributions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a 529 contribution for the state of Michigan?

I just figured this out, so hopefully it will help others. I am a nonresident, so I did not get the prompt to enter 529 contributions.

What I had to do was change my status to full year resident. Then, in the income section, it allowed me to enter the 529 contributions I made. I then changed my status back to nonresident and I confirmed that the deduction from my 529 contribution remained.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

matto1

Level 2

sakilee0209

Level 2

mohitagarwal

New Member

galloway840

Level 2

bobjohnson25

New Member