- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How deduct NC muni bond interest from NC state tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How deduct NC muni bond interest from NC state tax?

First time Turbo Tax user here. (My accountant retired,) While muni bond income is deductible on the Federal return, in North Carolina (NC) it is not - EXCEPT if that income is from NC Muni bonds. In the TT state return portion there is a section to make adjustments to your Federal AGI. I want to deduct the NC muni bond interest but none of the categories seems to fit. Thanks!

Using Turbo Tax Deluxe 2023

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How deduct NC muni bond interest from NC state tax?

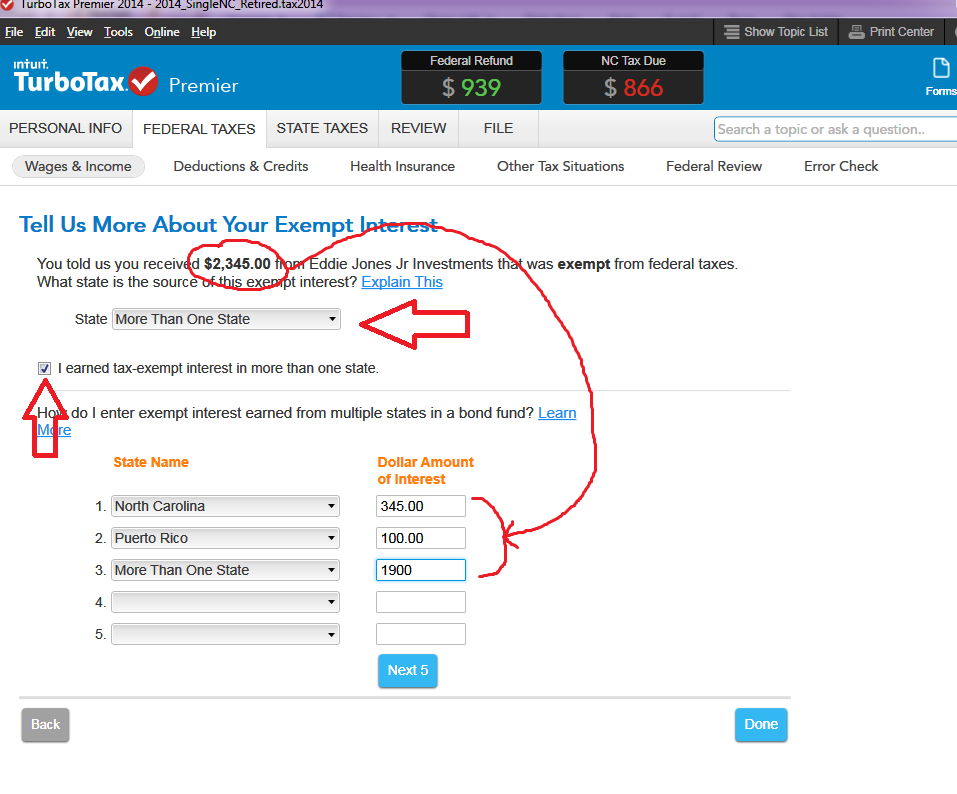

@BobbyC777 Doing it that way "can" work, but it's easier to do it in the interview....(and people using the "Online" software can't, since they don't have access to Forms Mode). When in Forms Mode, one does have to know how to use the table there...and know that XX is used for lumping the remainder of the $$ as "More than one state"

BUT..Shouldn't be a significant difference between Premier and Deluxe Desktop software for that.

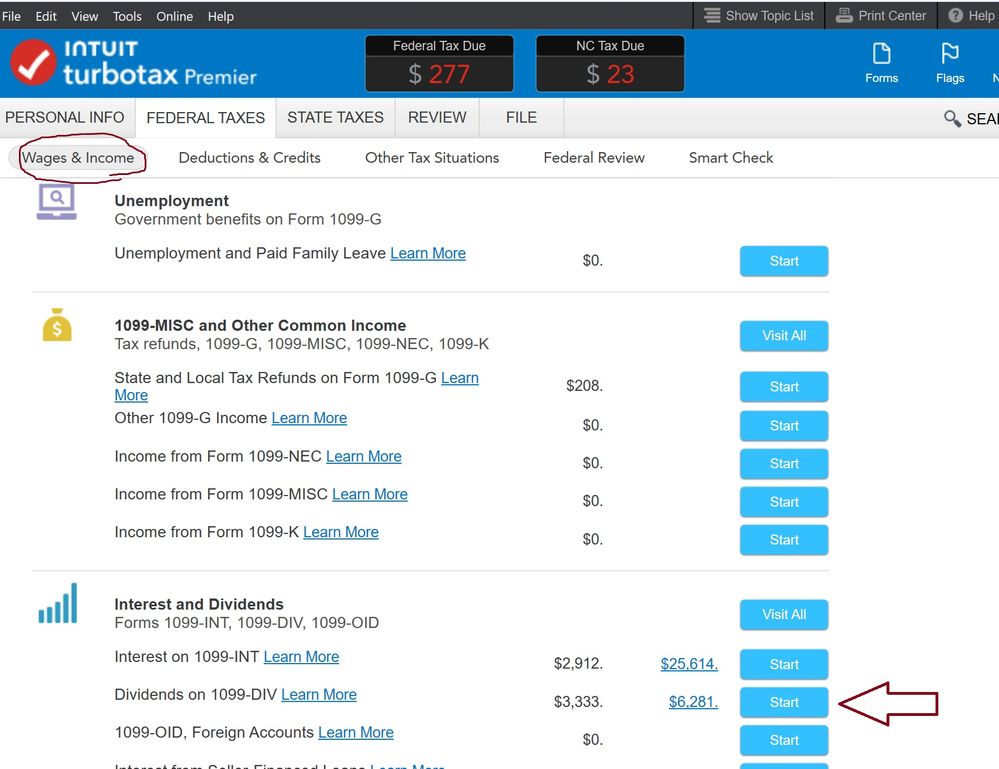

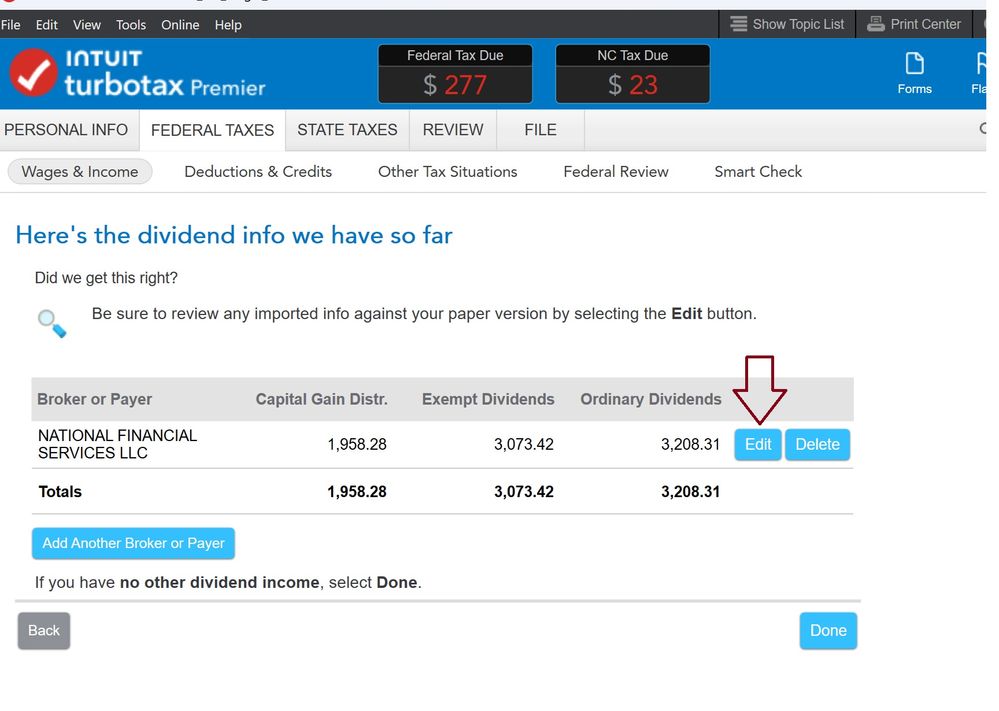

Yeah, you imported your form, and there's some handwaving post-import stuff that keeps changing as the software folks fool around with the software....but...you still could have navigated to the page I showed above, by going back to the Wages&Income page menu, going down to the 1099-DIV entry area, and going in and editing that 1099-DIV form. Then just stepping thru the pages for that form to see the allocation page.

You should practice how this is done for the future...as the same process is used when allocating $$ to NC when you hold individual NC bonds and the $$ are reported in box 8 on a 1099-INT form.

_________________________________________

____________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How deduct NC muni bond interest from NC state tax?

The NC amount is specified when you put in the 1099-INT in the Federal area.

In the tax software, for $$ in box 8 of a 1099-INT (that you enter in the Federal area), there is a follow-up page, where you specify the NC amounts (and any US Territories)...likeshown below.....then it's automatically dealt with in the NC software with no further entries required.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How deduct NC muni bond interest from NC state tax?

@StreamTrain

Thanks for the response. I understand what your response says but my experience is a little different,

First of all, I imported my data from my Merrill-Lynch account. I did not type it in myself. The data from the 1099-DIV portion of the ML 2023 Tax Reporting Statement had Line 12 as: Exempt-interest Dividends. When that got imported into TT the data is found under a page "Let's get the detail from your 1099-DIV or brokerage statement" And Box 12 there was the same as on the ML 1099-DIV,

At no point was I given the opportunity to break down that Box 12 into greater detail - like what states made up that amount.

Two things come to mind - is there a difference in this area between Deluxe & Premier? And to get that detail might I have to type the data in myself rather than have it imported? Importing was a help because it put lots of numbers in the correct place and I would have had no idea where some of those boxes went.

I appreciate the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How deduct NC muni bond interest from NC state tax?

I found how to remove the NC exempt Dividend-Interest from my NC return. In Forms Mode I went to the Form 1099-DIV for the Merrill Lynch data that came in via import. The form says Form 1099-DIV Worksheet. Going down to Box 12 I entered: NC as the resident state ID, then the amount that came from NC. On the next line I entered XX (to indicate all other states) and then the balance of the exempt Div-Int. It then worked its way through correctly to the NC return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How deduct NC muni bond interest from NC state tax?

@BobbyC777 Doing it that way "can" work, but it's easier to do it in the interview....(and people using the "Online" software can't, since they don't have access to Forms Mode). When in Forms Mode, one does have to know how to use the table there...and know that XX is used for lumping the remainder of the $$ as "More than one state"

BUT..Shouldn't be a significant difference between Premier and Deluxe Desktop software for that.

Yeah, you imported your form, and there's some handwaving post-import stuff that keeps changing as the software folks fool around with the software....but...you still could have navigated to the page I showed above, by going back to the Wages&Income page menu, going down to the 1099-DIV entry area, and going in and editing that 1099-DIV form. Then just stepping thru the pages for that form to see the allocation page.

You should practice how this is done for the future...as the same process is used when allocating $$ to NC when you hold individual NC bonds and the $$ are reported in box 8 on a 1099-INT form.

_________________________________________

____________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How deduct NC muni bond interest from NC state tax?

Another quality reply - THANKS! I went back and selected Edit for my brokerage imported data - which I had done before. I think where I went astray was that I missed the question in the ensuing interview about "I need to adjust these dividends." Eventually that asks me which state(s) are my exempt int-div from? (As I had taken care of that earlier in a work-around by filling in the Form 1099 DIV Worksheet, the data (states & amount) was now already there but I can see that this is the proper way to do it.) I'll take some notes so that I'll know what to do next year.

A bit off topic BUT since this is my first year filing with TT I think I read that somewhere I should be providing my last year's AGI just as a safeguard so that someone else doesn't file and try to get my return. Does that sound familiar? I would welcome someone else filing for me IF they pay my penalty!

Thanks again, @SteamTrain, for all your help - you are a great resource!

Bob

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How deduct NC muni bond interest from NC state tax?

During the actual filing process, the software will ask for ask for last year's AGI.

1) The AGI has to come from line 11 of your "original" 2022 form 1040. i.e. not from a later amended 2022 tax return.

2) IF you filed 2022 late on paper (After the October 2023 final deadline) i.e. did not e-file your 2022 taxes, or did not file 2022 at all, you might need to use a zero as your 2022 AGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How deduct NC muni bond interest from NC state tax?

@SteamTrain 1 year later and I took your advice for entering my NC exempt dividend interest & it all worked great, Thanks again! BobC

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rprincessy

New Member

4md

New Member

user17558084446

New Member

rtoler

Returning Member

yingmin

Level 1