- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

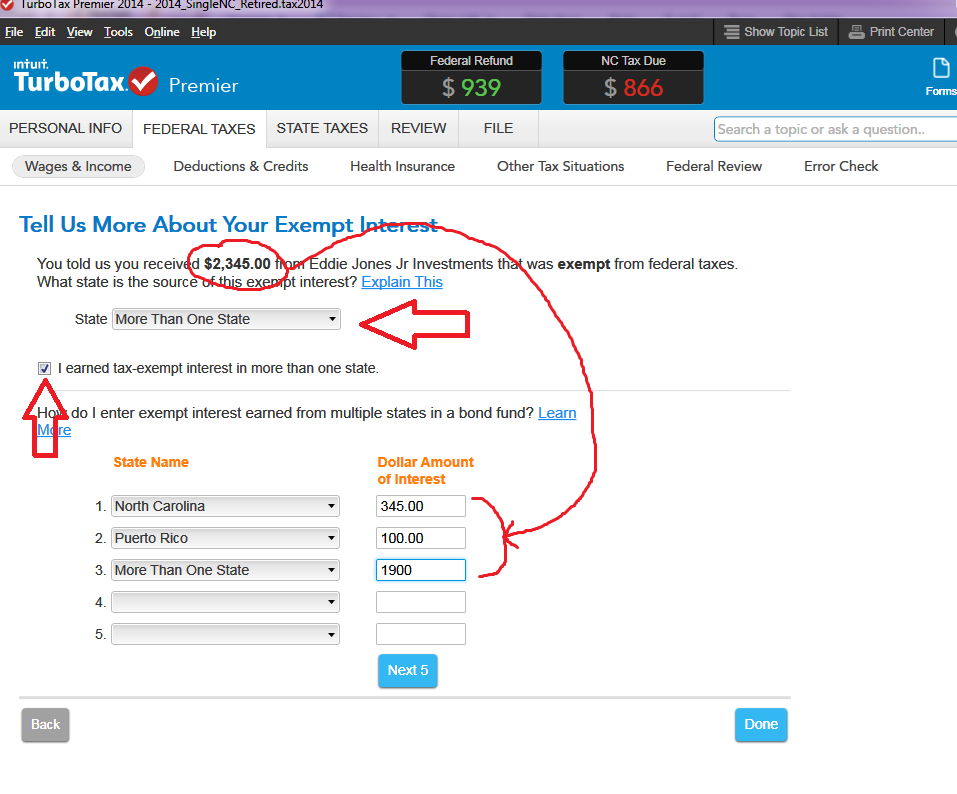

The NC amount is specified when you put in the 1099-INT in the Federal area.

In the tax software, for $$ in box 8 of a 1099-INT (that you enter in the Federal area), there is a follow-up page, where you specify the NC amounts (and any US Territories)...likeshown below.....then it's automatically dealt with in the NC software with no further entries required.

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

March 27, 2024

4:55 PM