- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How can I report a Turbo Tax bug with the Hawaii state income tax add on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I report a Turbo Tax bug with the Hawaii state income tax add on?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I report a Turbo Tax bug with the Hawaii state income tax add on?

Can you provide some details?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I report a Turbo Tax bug with the Hawaii state income tax add on?

- Turbotax defaults to the Hawaii standard deduction if you qualify for the federal standard deduction.

- That is not a universal assumption because itemized deductions are still allowed for Hawaii income taxes.

- There is an income limitation for Hawaii itemized deductions. Turbotax does not calculate the allowable itemized deduction for taxpayers who meet the income threshold.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I report a Turbo Tax bug with the Hawaii state income tax add on?

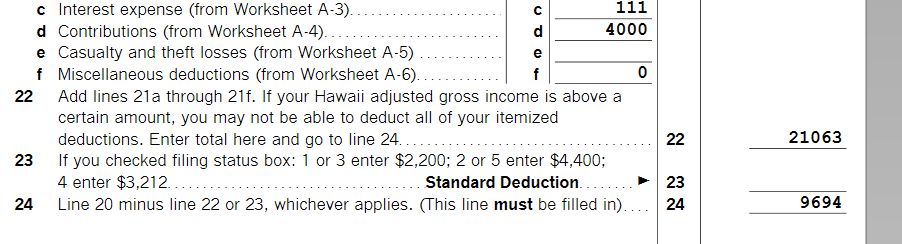

I made up a fake return. I even put in mortgage interest that was limited on federal and adjusted for the state. When you get to the screen below, you should see your itemized deduction.

FAQs | Department of Taxation states standard deduction as:

What is the standard deduction amount for Hawaii?

The standard deduction amounts are as follows: Single or Married filing separately $2,200; Married filing jointly, or Qualifying widow(er) $4,400; Head of Household $3,212.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I report a Turbo Tax bug with the Hawaii state income tax add on?

After I entered my itemized deductions, I prepared my federal return where Turbotax correctly determined that I should take the federal standard deduction. When I downloaded the Hawaii add-on, Turbotax defauled to the standard deduction of $4,400.

Try altering your fake return where the standard deduction is taken on the federal return. Then check whether Turbotax correctly takes the itemized deduction for Hawaii or incorrectly defaults to the Hawaii standard deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I report a Turbo Tax bug with the Hawaii state income tax add on?

I have changed my return to standard on the federal and am still showing itemized on the state. I am using the desktop version.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abi22

New Member

srtadi

Returning Member

domytaxes4me64

Returning Member

adrianadablopez

New Member

CRAM5

Level 2