- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Help NY State: "Part year resident returns where income was received from new jersey sources while a nonresident of new jersey are not eligible for electronic filing". What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help NY State: "Part year resident returns where income was received from new jersey sources while a nonresident of new jersey are not eligible for electronic filing". What do I do?

Did I do something wrong with my taxes? The income in question is gambling winnings from NJ.

How do I file?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help NY State: "Part year resident returns where income was received from new jersey sources while a nonresident of new jersey are not eligible for electronic filing". What do I do?

It depends.

If I am understanding your question correctly, it sounds like you are trying to file a nonresident state return for New Jersey. Is this correct?

If so, are the gambling winnings from the New Jersey lottery? If so, they would only be taxable if they are $10,000 or more. If they are from other sources, the $10,000 exemption for lottery winnings would not apply.

Please see the attached for more details on how your net gambling winnings are reported on your return.

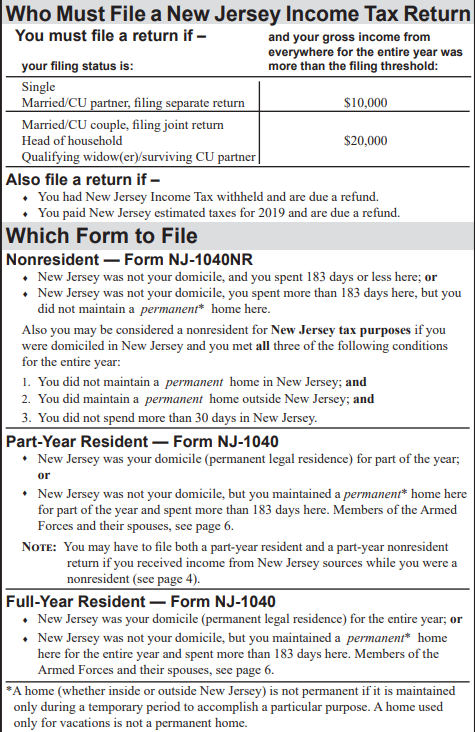

Also, you should make sure you have a filing requirement in New Jersey. See the chart below. If your overall income is below the limits, you may not need to file a nonresident state return.

If you determine you did have to file a nonresident return and you are still getting a message indicating you cannot e-file, please comment again so we can help you determine what is going on.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help NY State: "Part year resident returns where income was received from new jersey sources while a nonresident of new jersey are not eligible for electronic filing". What do I do?

I have to file a non-resident and a part-year resident return in NJ and turbotax is having me do it via mail. I have already filed my federal and the other part-year resident state tax.

Edit: @Jo I do have to file non-resident and part-year resident in Nj and turbotax is having me do it via mail and check. already filed federal and Ny state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help NY State: "Part year resident returns where income was received from new jersey sources while a nonresident of new jersey are not eligible for electronic filing". What do I do?

Unfortunately, because you are in the rare- but not unheard of- situation where you have to file a New Jersey Nonresident and Part-Year resident, you cannot efile with TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jack0845

New Member

skryken

New Member

supermommyhas4angels

New Member

christinae1314

New Member

user17638037803

Level 1