- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

It depends.

If I am understanding your question correctly, it sounds like you are trying to file a nonresident state return for New Jersey. Is this correct?

If so, are the gambling winnings from the New Jersey lottery? If so, they would only be taxable if they are $10,000 or more. If they are from other sources, the $10,000 exemption for lottery winnings would not apply.

Please see the attached for more details on how your net gambling winnings are reported on your return.

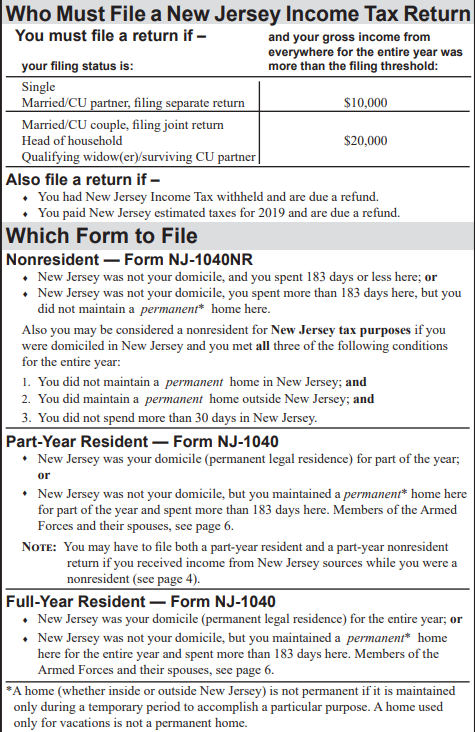

Also, you should make sure you have a filing requirement in New Jersey. See the chart below. If your overall income is below the limits, you may not need to file a nonresident state return.

If you determine you did have to file a nonresident return and you are still getting a message indicating you cannot e-file, please comment again so we can help you determine what is going on.

**Mark the post that answers your question by clicking on "Mark as Best Answer"