- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

Following....We don't qualify, but TurboTax is forcing us to Form K-40PT in order to complete the Kansas State Return. TurboTax....please fix your system.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

Two things:

1. Can one of you (or both of you) send us a sanitized version of your return (instructions below)?

2. After you do that, please look at the second set of instructions to see if this will fix your immediate issue.

***How to get a Diagnostic file from a user***

I'm going to need your help to get more information. Please send me a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

***Online Product***

- Sign into your online account.

- Locate the Tax Tools on the left hand side of the screen.

- A Drop down will appear. Click on Share my file with agent.

- This will generate a message that a diagnostic copy will be created. Click on OK, the tax file gets sanitized and transmitted to us.

- Please provide the Token Number that was generated onto a response to this thread.

***Desktop Product***

- Click into your return.

- Click Online and select "Send Tax File to Agent".

- This will generate a message that a diagnostic copy will be created. Click on OK, the tax file gets sanitized and transmitted to us.

- Please provide the Token Number that was generated onto a response to this thread.

Finally, add @ BillM223 (without the space in between) to the end of your response so I will be notified. Thanks!

***Possible Workaround On K-40PT***

If you are sure that you should not claim the credit on form K-40PT, you can try to delete the form and see if that fixes the issue in the Review.

*** Desktop***

1. go to View (at the top), choose Forms, and select the desired form (K-40PT). Note the Delete Form button at the bottom of the screen.

*** Online ***

1. go to Tax Tools (on the left), and navigate to Tools->Delete a form

2. delete form(s) K-40PT

If that doesn't address your in the Review, come back and tell us.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

I have the same issue, but I can not find the K-40PT form to delete.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

OK, if you are ready to file, let's try this:

When you have cleared any other Kansas Review issues (and federal) except for this one, in the Review when you see the screen "Check this Entry: Form K-40PT. Appraised Property Value should be entered", go ahead and enter a zero.

This will create the K-40PT. Next delete the K-40PT in the way I described above. Then e-file without running through the state review again. See if this will let you e-file.

P.S. be sure to save a PDF or printed copy of your return (you will be asked about this during the e-file screens).

Let us know if this worked for you. Add @ BillM223 (without the space in between) to your reply so that I am notified.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

I have the same issue. I get this error message: "Form K-40PT: Appraisal Property Value should be entered."

I have tried removing the form. Ultimately, I had to enter "0" in the box to get the form to show up in the Forms view to "remove" it. "Deleting" the form was not an option, but I'm assuming that is semantics.

I did not start receiving this error until I just updated my software. I had already filed, but had it rejected for a separate reason. Once I fixed THAT issue, I tried to submit, received notice that I needed to update, did so, and now I'm here.

What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

Form K-40PT is a Property Tax Relief Claim form for low income seniors. Are you intending on including the claim in your return? If not, try deleting that form (use this link if using the desktop software) and see if you can file. And if you are trying to include it, go back through that section in the Kansas return. The error may be referring to K-40H instead of the K-40PT, so go through the homestead credit section and make sure you only have one (either K-40 H or K-40 PT) and that one is correct.

Kansas has 2 property tax credits available:

- The Homestead Refund is a rebate program for the property taxes paid by homeowners. (K-40H)

- SAFESR is a property tax refund program administered under the provisions of the Kansas Homestead Act (property tax refund). SAFESR is also referred to as, "Kansas Property Tax Relief for Low Income Seniors". (K-40PT)

A claimant may receive either a Homestead or a SAFESR refund but not both.

Homestead Refund - this link explains both Kansas credits @michaelfilla

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

I have tried deleting the form, and I was successful, but I cannot file. When you say, "go through the homestead credit section," I don't know where to find that section. In the Forms view? In the EasyStep view? I don't know where to ensure I have the correct form (de)selected.

In all honesty, I don't remember seeing the word "homestead" come up when navigating the software the first time around.

Thank you DawnC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

" I cannot file." - What happens when you try? Is there an error message?

Unfortunately, e-filing is one of the things we can't test in the Community, so we are dependent on your description.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

Below is the message even after I have entered "0" in the amount, then showing the form in Form View, then I "Removed" the form.

“We Need a Little More Informaiton Before You E-file

Before you e-file, we need a little more information that we didn’t get earlier. Select Continue and we’ll show you what’s missing.

If you don’t have this information, you can file your return by mail.”

Click “Continue”

“Check This Entry

Form K-40PT: Appraisal Property Value should be entered.

Appraised Property Value [FILLABLE BOX]”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

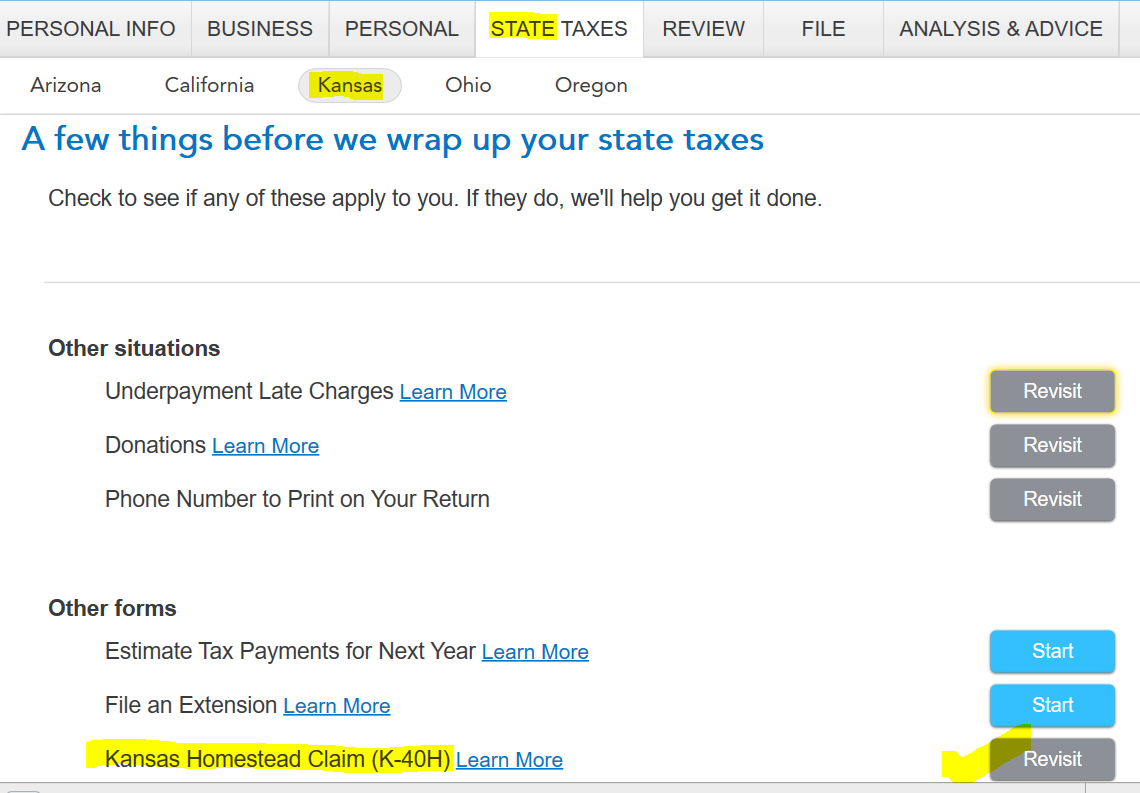

If you enter the 0 in the fillable box, can you then hit Continue and attempt to e-file? The homestead credit can be found in the OTHER FORMS section of the Kansas return. The page is titled ''A few things before we wrap up your state taxes''. It is after the income and deductions/credits section. Try to e-file with the 0 and if that doesn't work, go through the K-40H section before attempting to remove the form again. I am still looking for reference to the K-40PT and will respond here if I find something new to try.

Are you using the desktop software or TurboTax Online? @michaelfilla

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

I'm having this trouble on the Mac Desktop app.

Deleting the form does not fix the problem. I don't the form to delete. I can add it and delete, but that doesn't help either.

Your K-40H theory also doesn't hold water. I don't have K-40H either, nor do I qualify for that one either.

Someone at Intuit needs to go into the form validation configuration, fix the form validator for this one field to tell it to stop making Property Tax Paid/Due Smart Worksheet line B required when form K-40PT hasn't even been filled out and is in no way required. This is a ridiculous bug. Someone made a mistake. I write software. It happens. Just fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

The form K-40PT is not available in the list to delete.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

One needs to be 65 for a whole year to claim property tax relief for low income seniors. I may be close but not yet 65. So this for does not apply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fix issue with return takes me to Ks Form k-40PT but this does not apply to me . I do I bypass it?

@DawnC (or anyone who can help),

As I have mentioned in prior posts, filling in "0" doesn't allow for an e-file. Doing so DOES show the form in the side menu in the Forms view (where it was hidden from the menu before but still there if you searched/scrolled for it). I then would "Remove" the form, and would still not be allowed to e-file.

I found the "Kansas Homestead Claim (K-40H)" within the EasyStep view. Once I selected "Start", I was show the following notification:

Household Income Too High

You do not qualify for the Homestead Claim because your total household income is too high.

Click “Continue”

After selecting "Continue" it would simply take me to the prior screen however the Start button was changed to Revisit. I still was not allowed to e-file. I even tried this, then went through finding and removing the K-40PT as described above. No luck.

I'm not tech savvy enough to really know what to ask for, but I would like to think finding where the K-40PT form is filled out through EasyStep view would give me a start. I would like to think filling out the form "even if it is done frivilously," with "zeroed out" information, would that possibly solve the problem?

If this never gets fixed, will I get at the very least get some sort of refund due to being unable to e-file? (I REALLY don't want to have to mail this stuff in.)

mf

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mason-jennifer-a

New Member

nmartens

Returning Member

null715

New Member

SkymanCR

New Member

Cincolo

Level 3