- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- expected return on contract (total sum of distributions - past present future).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

expected return on contract (total sum of distributions - past present future).

How do I answer to this question?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

expected return on contract (total sum of distributions - past present future).

Can you give us more information? Where are you seeing this?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

expected return on contract (total sum of distributions - past present future).

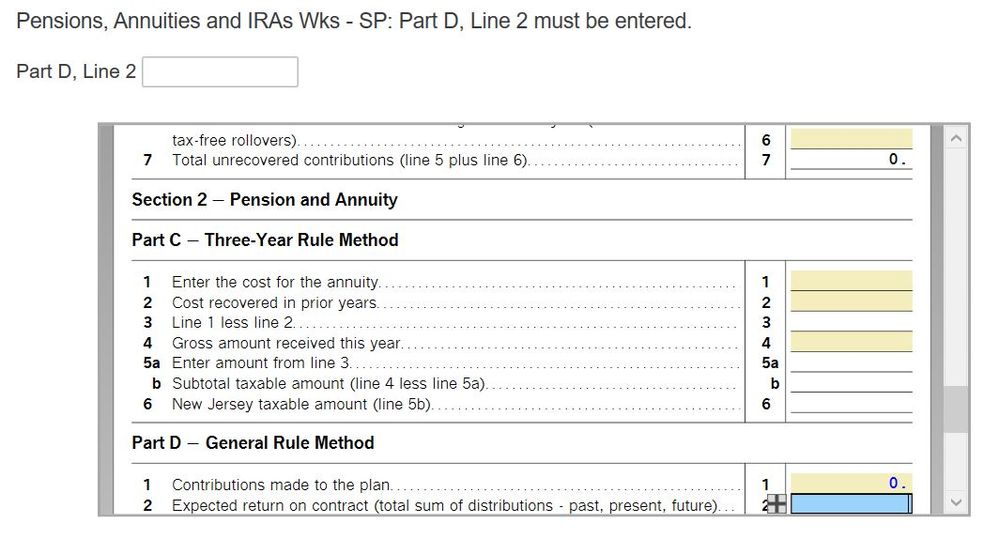

On State tax review

Part D, line 2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

expected return on contract (total sum of distributions - past present future).

What state? We can not see your screen, so we need complete information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

expected return on contract (total sum of distributions - past present future).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

expected return on contract (total sum of distributions - past present future).

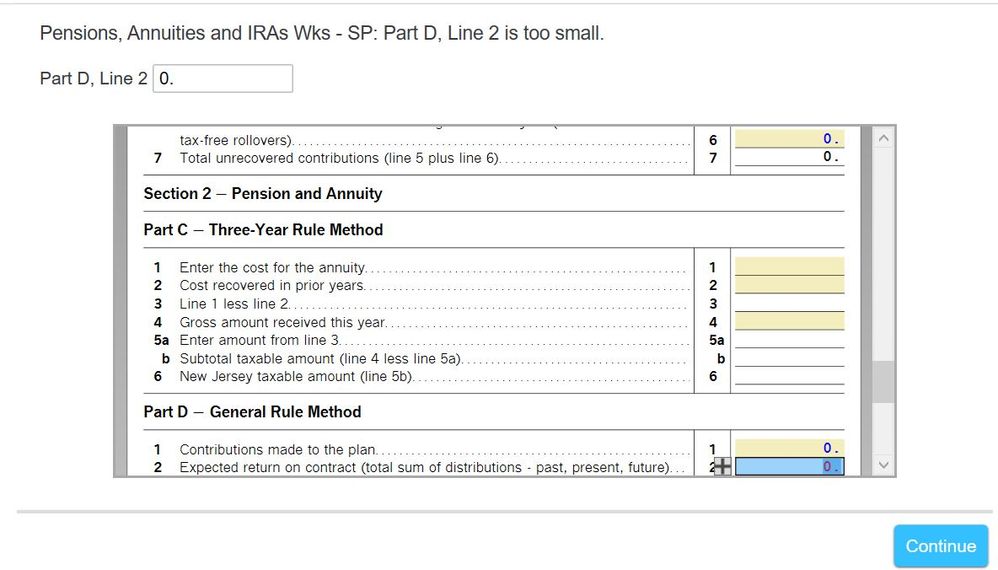

If you purchased an annuity (which it doesn't look like you did since the amount paid is zero) then you would enter the amount that you expect to receive back from that annuity in that box. If you did not purchase an annuity then just enter zero.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

expected return on contract (total sum of distributions - past present future).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

expected return on contract (total sum of distributions - past present future).

The expected return on the contract is the amount a plan participant is likely to receive over many years.

If life expectancy is a factor under your plan, you must use federal actuarial tables to calculate the expected return. The federal actuarial tables are contained in Internal Revenue Service Publication 939, General Rule for Pensions and Annuities.

If life expectancy is not a factor under your plan, the expected return is found by totaling the amounts to be received.

Learn more at GIT-1 - Pensions and Annuities.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ryalben

New Member

me_fisk

New Member

mysticalmiss67

New Member

Cdp609

Returning Member

rambo2019

Level 2