- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Energy Credit Carryover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

I received an actual payout last year, via tax refund, for my energy credit. It delayed the receipt of the funds because of the credit. Not all was applied to last year, but I was told it would carryover to this year. NOW I'm being told the remaining credit is NOT actually going to be paid to me, but it will go towards offsetting a tax bill. I don't owe any taxes this year. Where is the additional money?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

Who told you this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

One of the Turbo Tax employees on the chat.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

@phantom14_1978 wrote:

One of the Turbo Tax employees on the chat.

No one from TurboTax knows if you have taxes owed from a prior tax year. Have no idea who would have told you that from TurboTax.

If you had a credit carryover then you have to enter that amount in the Home Energy Credits section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

@DoninGA The amount is in the energy credit section, and reflected in the "deductions and credits" portion of the site. The only place it's not reflected is in the refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

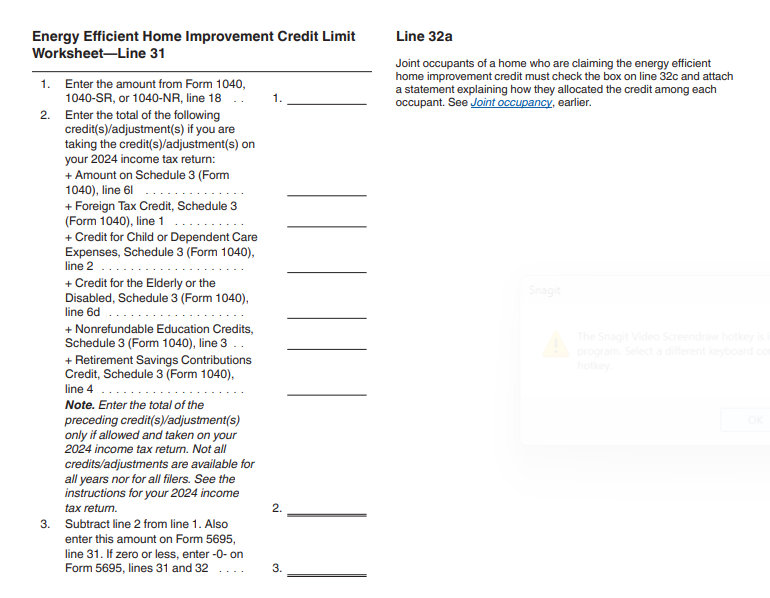

Please look at your form 5695. Your energy credit is limited by your tax liability and can be carried forward. When you look at line 31, it shows the limitation based on your tax liability. Line 32 shows the credit allowed.

Do you see:

- numbers on your form 5695 for credit?

- Do you have a tax liability showing on line 31?

- Anything on line 32?

- The amount on line 32 goes to sch 3, line 5b. Do you see it listed there?

- That number goes to the 1040, line 20, anything there?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

Follow the steps in this link to download your 2023 tax return.

You will then be able to refer to AmyC's instructions above (and locate the amounts on your 2023 tax return) to determine if you have a carryforward that should be included on your 2024 tax return.

If there are any carryforwards and they are not pulling into your 2024 return, you can manually enter the carryforward amount to ensure the credit is applied to any current year tax liability.

To enter your carryforward, follow the steps in this link to get to get to the energy credit input section of the program.

Once you are in the credit input area, scroll down to the bottom of the page titled "Energy Efficient Home Improvements." Under the highlighted section that asks "Did you make energy efficient improvements in 2024 or have a carryforward from 2023?" select yes.

Proceed to answer the questions as applicable until you see a screen titled "Do You Have a 2023 Home Energy Credit to Carryforward?" Select Yes, I had a credit carryforward. Another box will populate asking you to enter that carryforward amount. Enter that amount here and the credit will be included on your 2024 tax return.

Select continue to proceed with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

In 2023, From 5695, line 16: (mine is nothing) This is the amount to carryforward to 2024.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

Here is my answers from AmyC's post above.

Do you see:

- numbers on your form 5695 for credit? Yes.

- Do you have a tax liability showing on line 31? Nothing

- Anything on line 32? Nothing

- The amount on line 32 goes to sch 3, line 5b. Do you see it listed there? Nothing on 5b, but 5a=646

- That number goes to the 1040, line 20, anything there? 1,227

So what does this mean - do I have carryforward or not? If yes, how much?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Energy Credit Carryover

Let's back up. Form 5695 has two parts.

- Part 1 has the residential energy credit. The credit shows on line 15 with the carryforward on line 16.

- Part 2 has the energy efficiency credit. Line 32 shows the credit and there is no carryforward.

Line 31 has a worksheet that pulls in your other credits. Since your line 31 is nothing, you don't have a tax liability to reduce. Therefore, line 32 shows no credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kuroshvp

New Member

Aussie

Level 4

sgrider

New Member

mrcarlosalberto

New Member

dyana7766

New Member