- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- E-Filing NY Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-Filing NY Tax

Hi,

My wife does not have a NY income for 2021 but I did. TT mentioned this during the interview - When only one of you has Taxable NY Source Income a certification form must accompany your return. I believe this is IT-203C. If I efile the returns (Federal and NY & NJ states), will IT-203C be transmitted electronically or should I mail a paper form of IT-203C ?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-Filing NY Tax

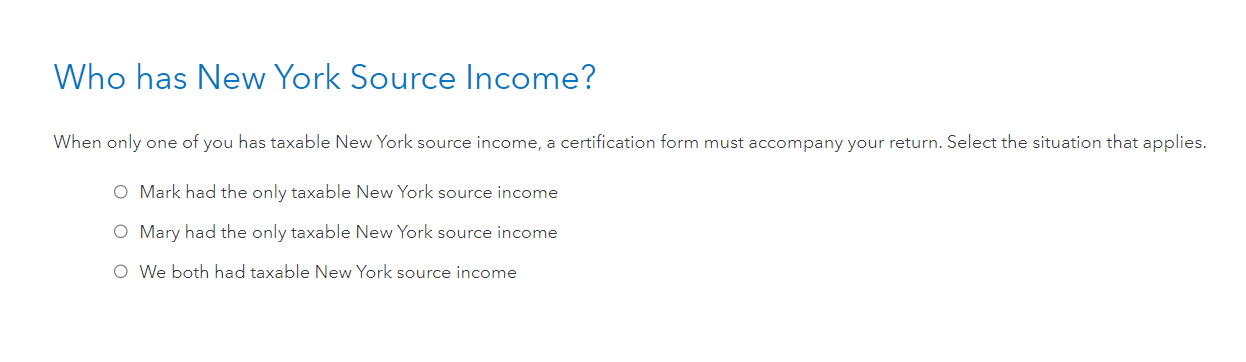

Yes, if you went through the TurboTax interview, the IT-203C is created when you answer the question "Who has New York Source Income"? (see below)

Married nonresidents and part-year residents who are required to file a joint New York State return must use the combined income of both spouses to determine the base tax subject to the income percentage allocation, even if only one spouse has New York source income. However, a spouse with no New York source income cannot be required to sign the joint return and cannot be held liable for any tax, penalty, or interest that may be due.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

reneesmith1969

New Member

tianwaifeixian

Level 4

K-REALTOR

New Member

Arieshilan321

Returning Member

tigerxducky

New Member