- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

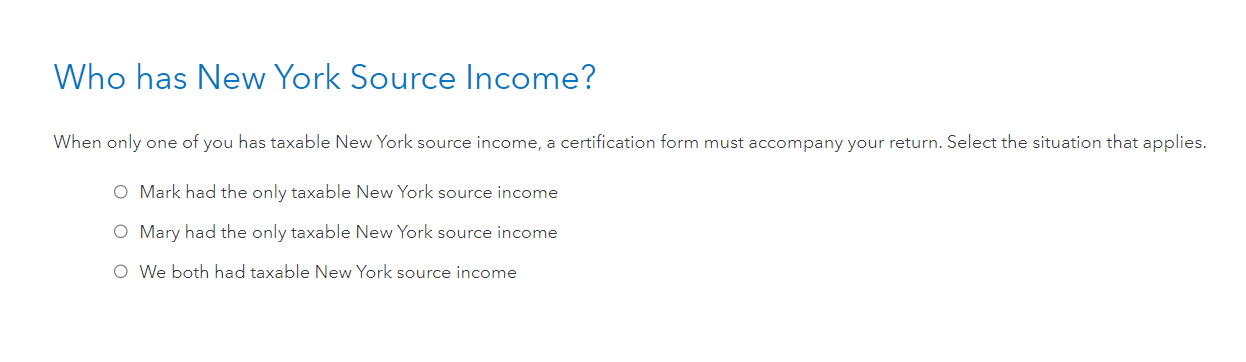

Yes, if you went through the TurboTax interview, the IT-203C is created when you answer the question "Who has New York Source Income"? (see below)

Married nonresidents and part-year residents who are required to file a joint New York State return must use the combined income of both spouses to determine the base tax subject to the income percentage allocation, even if only one spouse has New York source income. However, a spouse with no New York source income cannot be required to sign the joint return and cannot be held liable for any tax, penalty, or interest that may be due.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 20, 2022

12:03 PM