- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Double taxation between CA and NY?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

In 2023, I joined a company based out of New York. However, I am a permanent resident of California and performed 100% of my work for said company within California. On my W-2, my employer withheld taxes for both states.

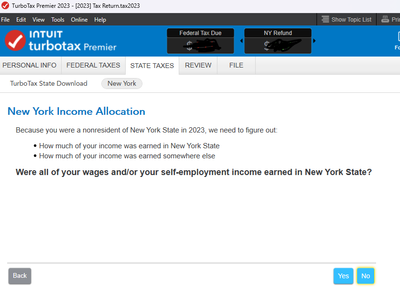

In the wizard for NY, what should my answer be for the screen below?

Additionally, is New York's "convenience rule" still applicable even though I worked entirely remotely? Finally, am I subject to double taxation for both New York and California?

Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

Yes, it is all considered as earned in New York. If you worked remotely for a company based in New York, then that income is subject to tax in New York. New York does apply the "Convenience Rule" in that it considers your income earned by your company based in New York, to be New York sourced Income.

You will file a Nonresident State Tax Return for New York and a Residential State Tax Return for California. Prepare your New York State Tax Return first. Then prepare your California State tax Return. This information will allow TurboTax to calculate how much credit California will give you for your taxes paid to New York.

Click here for information on filing tax returns for more than one state.

Click here for more information on multiple state returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

Thank you for the clarification! Just one more question: will California actually give me credits for paying NY tax? There's conflicting information all over the internet, where some are claiming CA will, while others claim it won't b/c it explicitly opposes NY's "convenience" policy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

Yes. California DOES give you credit for taxes paid to another state. There is no specific exclusion for taxes paid to NY.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

Thank you! My stress level has decreased significantly :-]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

Hi @jclizzy - unfortunately @Vanessa A is 100000% wrong here (not sure what 'Expert' means; probably an AI bot or something). You were correct & you will be taxed in both NY and CA as a result of NY's 'Convenience of the Employer' rule.

If you are working here remotely of your own accord AND your company has not established a bona fide office here in CA; 100% of the income is subject to tax in both states. CA only allows a credit for taxes paid if the income taxed by the other state has a source within the other state under California law (https://www.ftb.ca.gov/forms/2023/2023-540-s-instructions.html).

In laymens terms - if your income was sourced to NY, sure CA would give a credit. BUT, unfortunately, CA considers Wages earned while living/present in this state CA Sourced income. In contrast, NY considers these Wages sourced to NY because you went to CA for your own benefit. CA specifically denies this credit & NJ/CT both are also fighting NY's convenience of the employer rule.

If you filed and got a credit and refund - I would strongly suggest amending your returns. More than likely this will catch up to yo uand you'll hundreds/thousands in income tax, interst, penalties.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

California's tax regulations are still very clear. Taxes paid in another state for income taxed by California are deductible in California.

California resident individuals, estates, or trusts that derived income from sources within any of the following states or U.S. possessions and paid a net income tax to that state or U.S. possession on income that is also taxed by California may claim the other state tax credit:

Alabama (AL), American Samoa (AS), Arkansas (AR), Colorado (CO), Connecticut (CT), Delaware (DE), District of Columbia (DC) (unincorporated business tax and income tax, the latter for dual residents only), Georgia (GA), Hawaii (HI), Idaho (ID), Illinois (IL), Indiana (IN), Iowa (IA), Kansas (KS), Kentucky (KY), Louisiana (LA), Maine (ME), Maryland (MD), Massachusetts (MA), Michigan (MI), Minnesota (MN), Mississippi (MS), Missouri (MO), Montana (MT), Nebraska (NE), New Hampshire (NH) (business profits tax), New Jersey (NJ), New Mexico (NM), New York (NY), North Carolina (NC), North Dakota (ND), Ohio (OH), Oklahoma (OK), Pennsylvania (PA), Puerto Rico (PR), Rhode Island (RI), South Carolina (SC), Tennessee (TN) (excise tax only), Utah (UT), Vermont (VT), Virgin Islands (VI),Virginia (VA) (dual residents*), West Virginia (WV), and Wisconsin (WI).

California residents who are included in a group nonresident tax return similar to the tax return described in California Revenue and Taxation Code (R&TC) Section 18535, filed with the states listed in this section, as well as Arizona (AZ), Oregon (OR), or Virginia (VA) may also claim a credit for their share of income taxes paid to these states, unless any of these states allow a credit for taxes paid to California on the group nonresident tax return.

Attach a statement and schedule showing your share of the net income tax paid to the other state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

@jclizzy No - this guy is wrong, too @RobertB4444 please stop posting incorrect information to these unfortunate taxpayers who are paying for your services. Again, I am not sure what defines an "Expert" here but you clearly do not understand the complexities of this situation. This is not a general question of whether CA offers a credit for income derived from New York.....that is a simple yes. This has to do with remote workers in CA working for an employer with NO connection to CA / that are based in New York. This is commonly known as the "Convenience Tax".

If you keep up with current events, you would be aware of the issues with NY's 'Convenience Tax'. New Jersey & Connecticut are currently encouraging Taxpayers to bring Ny to court and are offering them a 50% income tax credit if they win! [Sources: Bloomberg - NY under Attack from NJ/CT || Bloomberg - NY 'Convenience on Employer' Stands on Wobbly Ground]

You copy pasted an excerpt from the instructions to Schedule S and just stopped midway thru wihtout getting to the detail that actual matters/explains - you need to keep reading.......

H. Income from Sources Within the Other State

Generally, residents of California may claim a credit for net income taxes imposed by and paid to another state only on income which has a source within the other state.**

For this purpose, California’s nonresident sourcing principles apply even though the results may be contrary to the other states’ principles. The following describes the sources of various types of income pursuant to California law:

- Compensation for services rendered by employees has a source where the services are performed.

- Compensation for services rendered by independent contractors has a source where the benefit of the services are received.

- Income from tangible personal property and real estate has a source where the property is located.

- Income from intangible personal property (such as interest and dividends) generally has a source where the owner resides.

- Business income has a source where the benefit of the services are received.

To summarize that for you - California sources W-2 Wages where @jclizzy performs them - WHICH IS IN CALIFORNIA. New York does not conform to this treatment of sourcing.

Section 601(e) of the New York State Tax Law imposes a personal income tax on a nonresident individual’s taxable income that is derived from New York sources.

In determining the New York source income of a nonresident employee, section132.18(a) of the personal income tax regulations provides, in pertinent part: If a nonresident employee performs services for his employer both within and without New York State, his income derived from New York State sources

includes that proportion of his total compensation for services rendered as an employee which the total number of working days employed within New York State bears to the total number of working days employed both within and without New York State. . . . However, any allowance claimed for days worked outside New York State must be based upon the performance of services which of necessity, as distinguished from convenience, obligate the employee to out-of-state duties in the service of his employer.

[ This is the convenience of the employer test.]

NY TAX MEMO: https://www.tax.ny.gov/pdf/memos/income/m06_5i.pdf

Again - this is a well known double-taxation issue and colloquially referred to as the 'Convenience Tax'.

@jclizzy feel free to reach out to me if you have any questions [PII removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

@jclizzy You can still get a credit for taxes paid for ANY DAYS THAT YOU ARE NOT IN CALIFORNIA. For example - I had a client who was in the same situation but she spent 20 days in NY, 8 dyas in NJ, 14 days in Iceland.

Those 42 days were working days she was NOT present in CA; therefore CA would not consider the income earned as CA sourced. This requried manual calculation of the Credit for Taxes Paid & may apply to you too

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

@AJFCPATax --

Both @RobertB4444 's and @Vanessa A 's answers ARE correct.

On May 18, 2015, the U.S. Supreme Court in Comptroller of the Treasury of Maryland v. Wynne [575 U. S. __ (2015)], ruled in a 5-to-4 decision that two states cannot tax the same income.

Therefore states MUST give a credit to their residents for income tax paid to another state on income taxed by both - regardless of the quirks of "sourcing" rules.

With regard to New York's taxation of remote workers (a topic which has been addressed many, many times in this forum), I offer the following citation from New York law:

The New York adjusted gross income of a nonresident individual rendering personal services as an employee includes the compensation for personal services entering into his Federal adjusted gross income, but only if, and to the extent that, his services were rendered within New York State. Compensation for personal services rendered by a nonresident individual wholly without New York State is not included in his New York adjusted gross income, regardless of the fact that payment may be made from a point within New York State or that the employer is a resident individual, partnership or corporation.

NY's "convenience" rule applies only to employees who work both within and without New York during the tax year. It does not apply to non-resident employees who never set foot in New York during the tax year. In fact, the New York tax memorandum describing the convenience rule says so explicitly:

"The memorandum addresses situations where a nonresident or part-year resident employee whose assigned or primary work location is in New York State performs services for an employer at that location and at a home office located outside of New York State."

https://www.tax.ny.gov/pdf/memos/income/m06_5i.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

And yet - New York does not care and if NY audits yo uyoull have to go to court - like the below 3/4 cases

article from LAST WEEK:

MARCH 26, 2024

The Pandemic Lockdown Tests New York’s Application of its Convenience of the Employer Rule

March 26, 2024 · 8 minute read

By David Engel, and Jill C. McNally

In the aftermath of the COVID-19 pandemic, New York’s “convenience of the employer” rule is facing challenges from individual taxpayers and from neighboring states. A Connecticut resident, who, like many, was required to work from home due to New York’s mandated work from home response to the pandemic, is once again challenging the rule’s application (as is a a North Carolina resident). In addition, New Jersey, and more recently Connecticut, are encouraging their residents to challenge New York’s law.

New York source income.

New York imposes a personal income tax on a nonresident individual’s taxable income that is derived from New York sources.1If a nonresident employee, whose primary or assigned work location is within New York, performs services for the employer both within and without New York State, the income is apportioned based on a ratio consisting of the total number of working days employed within New York State compared to the total number of working days employed both within and without New York State. Compensation earned for days worked outside of New York can be excluded from the numerator of the ratio “based upon the performance of services which of necessity, as distinguished from convenience, obligate the employee to out-of-state duties in the service of his employer.”2

Department guidance.

To satisfy the convenience of the employer test, the Department of Taxation and Finance issued a memorandum stating that if a normal workday occurs at a home office it will be treated as a day worked outside of the state if the taxpayer’s home office is a bona fide employer office. Any day spent at the home office that is not a normal workday will be considered a nonworking day. To claim a bona fide office, a taxpayer’s office must satisfy a “primary factor” or meet at least four “secondary factors” in addition to three “other factors” to meet the test.3The test is stringent and arguably not easily met. The rationale for the strict standard is that out-of-state residents should not receive special tax benefits from working from home that a New York resident could not also receive.4

The pandemic lockdown.

The COVID-19 pandemic created a unique circumstance where New York required many workers to work from home for a portion of the year.5During this period, the Department advised non-resident taxpayers whose primary office was in New York State that the telecommuting days during the pandemic were considered days worked in New York unless their employer established a bona fide employer office at their telecommuting location.6The pandemic changed nothing regarding the Department’s policy. However, the mandatory lockdown has presented an opportunity to retest the rule.

Current litigation.

A Connecticut resident and law professor at a New York law school, recently revived his challenge to the New York rule relying on the unique set of facts the pandemic gave rise to with the state mandated lockdown.7An administrative law judge (ALJ) rejected the professor’s challenges concluding that the law school did not require him to work in Connecticut, he was present in New York for a portion of the year, and that he availed himself of the New York market and derived all of the New York economic benefits that comes with that. The ALJ was unmoved by the taxpayer’s argument that his working from home was for his employer’s necessity and not his as his employer barred employees from entering the building as required by state mandate. The ALJ maintained that his work was not so specialized that it had to be done outside of New York State and further added that the taxpayer was present in New York when hosting his zoom classes and meetings with students. Citing the U.S. Supreme Court’s decision in Wayfair, the court stated that “[i]n this modern economy with its internet technology, one can be present in a state without needing to physically be there.”8The court’s decision has been appealed to the Tax Appeals Tribunal.

Another taxpayer is also currently challenging application of New York’s rule against income he received while working remotely in North Carolina due to the closure of his employer’s New York City offices in 2020. While ruling on the motion for partial summary judgment, the ALJ noted that the taxpayer did “not offer evidence showing that he was obligated to perform his work duties from North Carolina out of his employer’s necessity as opposed to any other place [the taxpayer] may have found convenient to live and work in during the COVID-19 pandemic” thereby raising “questions of fact regarding [the] employer’s need for [the taxpayer] to work out of state.” The taxpayer was denied partial summary judgment on the issue and a hearing is to be scheduled. 910

States joining the challenge.

In 2023, New Jersey enacted a law11providing taxpayers who successfully challenge rules like New York’s with a tax credit against their New Jersey gross income taxes amounting to 50% of the additional tax amount recovered. To qualify for the credit, taxpayers must: (1) be a New Jersey resident; (2) pay income tax or wage tax to another state; (3) apply for and be denied a refund from the other state on income earned while working remotely in New Jersey; (4) file an appeal of the other state’s assessment in an out-of-state tax court or tribunal;12 (5) obtain a final judgment in their favor from that tax court or tribunal; and (6) receive a refund from the other state as a result.13

Similarly, Connecticut Governor Ed Lamont has introduced the “Challenge Incentive” in his budget proposal encouraging Connecticut residents who commute to jobs in New York to challenge New York’s rule as more workers are working remotely.14Following New Jersey’s lead, a successful taxpayer will receive a 50% credit against any additional tax owed to Connecticut, in addition to waiving any penalty and interest associated with that tax, if this provision of the budget is enacted. It is not surprising these states are incentivizing taxpayers to challenge New York’s rule as they lose a lot of revenue to New York, especially with the increase in remote workers.

Conclusion.

It appears challenges to New York’s rule are heating up. The COVID-19 pandemic lockdown has presented an opportunity for taxpayers to present a new set of facts and sidestep the application of the stare decisis doctrine.15Taxpayers may have different facts to argue based on employer office policies during this time and the inability to return to a normal work environment. Should taxpayers seek to join the challenge, a credit or refund may be claimed in New York within the later of: three years of filing a return or two years from payment of the tax.1617

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vi1975

Returning Member

laurag25

Level 4

user17724081077

New Member

DXY2021

Level 3

DXY2021

Level 3