- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Double taxation between CA and NY?

In 2023, I joined a company based out of New York. However, I am a permanent resident of California and performed 100% of my work for said company within California. On my W-2, my employer withheld taxes for both states.

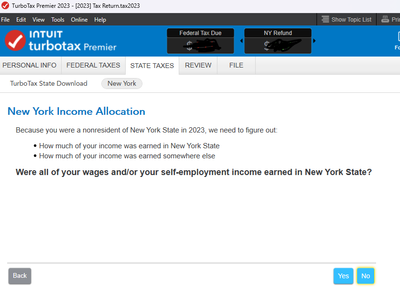

In the wizard for NY, what should my answer be for the screen below?

Additionally, is New York's "convenience rule" still applicable even though I worked entirely remotely? Finally, am I subject to double taxation for both New York and California?

Thanks in advance!

Topics:

February 21, 2024

4:22 PM