- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Does TurboTax include in state taxes for Arizona form 310 and form 301?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

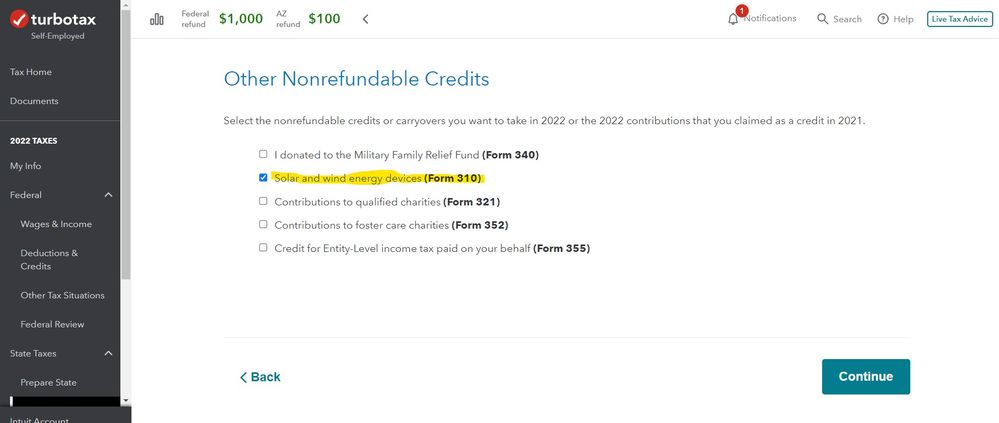

Yes, it does. The AZ Form 301 is a summary form for all the Arizona credits on your return, and the Form 310 is the Solar Energy Credit, which cannot exceed $1,000 per residence.

You will find the credits in the final part of the Arizona interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

Not finding any mention of AZ Form 310 in TT 2019 preparation. who can I call at intuit to find out about that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

Have 2019 TT premier w/AZ state tax software - nowhere did I see an option for selecting a tax credit for solar daylighting (AZ Form 310); although there was an option for solar hot water stub outs & elect vehicle outlets (Form 319). Am I missing something?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

Replying to my message above. Solution was to fill out form 310 longhand & then enter data as directed by form 310 into Form 301; only then did form 310 open in TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

These forms are not available in the Online version of Turbo Tax. I have tried searching the search bar and even though I fill out information about solar for Federal taxes, I am not prompted to enter any information for the state of Arizona for 2022.

Thanks

Kristin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

@kristobin The Arizona forms 310 and 301 are available with the 2022 TurboTax online editions.

Go to this TurboTax website for federal and state forms availability - https://form-status.app.intuit.com/tax-forms-availability/formsavailability?albRedirect=true&product...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

@DoninGA I see that they are available on that webiste, but they are not ACCESSIBLE. I have no way to open the form inside Turbo Tax. I have searched for "Form 310" "Form 310,Credit for Solar Energy Devices" "310,Credit for Solar Energy Devices" and can't get to a form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

You must have entered a solar credit on your federal tax return. You must also be an Arizona resident.

In the online editions for Arizona you can claim the credit on the Arizona state program web page -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

Correction to last post - You do not have to enter a solar credit on the federal return to be eligible for the AZ credit on Form 310

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

thank you so much! I didn't see that screen before today for some reason. And I was on hold with help for about 50 minutes. Really appreciate your help @DoninGA !!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

Ok I had a reply here, didn't see how to delete, so I am just amending it. I was wrong in my reply, not looking at the right screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does TurboTax include in state taxes for Arizona form 310 and form 301?

If your original return was already filed, you need to wait until the paperwork and finances are settled before filing an amended return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

melillojf65

New Member

RobertBurns

New Member

dc20222023

Level 2

johntheretiree

Level 2

Bwcland1

Level 1