- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

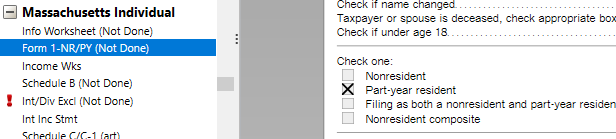

- Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Form 1 Nonresident and Part-Year Resident Tax Return is scheduled to be released on February 3, 2022.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Here is the schedule of state form availability for TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

I'm really confused by this form and hoping you can share some info. Like you, I also reside in NH full time but work in MA. To my knowledge I've never apportioned my taxes and have used TurboTax for years.. I have never completed this form myself, so is this something that is mailed to me by my employer just like a W-2 ? Also, reading the Form 1-NR/PY it says "You cannot apportion Massachusetts wages as shown on Form W-2." - So if that is the case, what is the point of filing this form? I am at a loss...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Was all your work in 2021 actually (physically) performed in Massachusetts? If so, all your income from that work is taxable by Massachusetts, and you must file a non-resident MA tax return.

In the Personal Info section of TurboTax, enter NH as your State of Residence, and indicate that you had Other State Income from MA.

You would only have to allocate your wages if some of your work was performed outside MA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Thanks for the reply. No, although working for MA company I worked remotely (from home in NH) from Jan 2021 to July7, 2021. When getting to the 1-NR/PY page I’m not able to process through it because I don’t have this form. everywhere I’ve read it says the form is not needed if your W2 shows all of the actual wages earned in MA. Well my W2 does show all of the actual wages earned in MA, so then why is this form needed ? That is my issue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Correct, since your w2 shows all wages as MA, and they were, no need to break out the MA portion.

MA taxes income earned from a MA source or a MA job. Since you worked for a MA organization, you have MA income and must pay MA tax. You need to fill out the MA non-resident form 1- NR/PY first to create the tax liability. THEN prepare your resident state return and it will generate a credit for your income already being taxed. The credit will be the lower of the state tax liabilities on the same income. You may owe your resident state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Hi Amy,

I only have retirement income and literally spent 6 months living in MA and six months living in NC. I have split my pension and IRA income as well as my dividend and interest income in half between the two states.

In trying to complete MA form 1-NR/PY, I cannot get it to accept my numbers and it is preventing me from filing.

Do I need to delete my state input info for MA and complete this form first?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Please clarify and be more specific @Ejkfox about what errors you are receiving from TurboTax that are preventing you from filing.

You can trying deleting one or both states. Sometimes this will clear up data clogs. However, part-year returns can be done in any order.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Can you file MA tax form 1-NR/PY on TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Yes. You select it in the beginning with the residency questions and then go through the income allocation section. If you are using desktop, update your software. If you are online, Contact Us as there is a problem.

@katelynmccoole

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Yes, MA tax form 1-NR/PY is available now.

If you are still having problems with this and you have allowed your software to update, click here for more help with this issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does anyone know when the MA tax form 1-NR/PY and others will be available in Turbo Tax? It seems odd they don't have this avail. I work in MA full time and live in NH.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17548411845

New Member

zena-moore

New Member

Gauntless

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Al2531

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

deniseh

Returning Member