- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Do I get my Virginia State Income Tax refunded if I am a non resident and a resident from Florida?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I get my Virginia State Income Tax refunded if I am a non resident and a resident from Florida?

Hello,

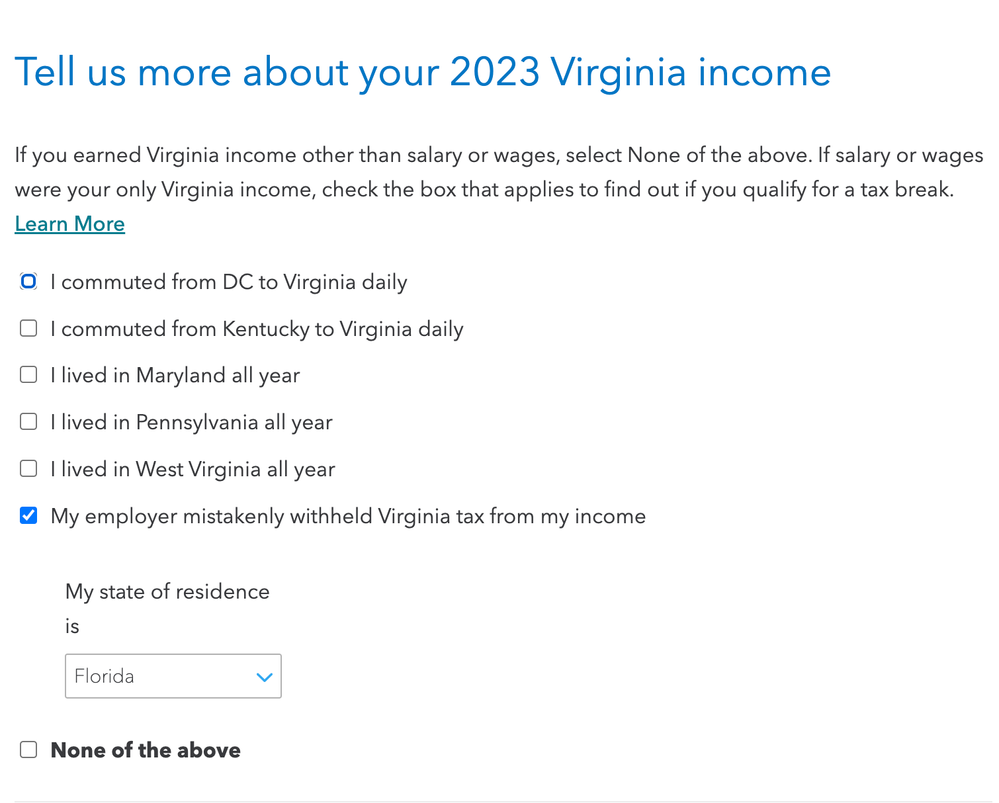

I had a 10 week internship at Virginia where I lived and received money in that state. However, my residency is Florida. Does this mean that I get the amount withheld from Virginia State Income Tax and do I have to fill the Virginia non-resident state tax? I am also unsure what to answer in the checkbox section (attached screenshot).

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I get my Virginia State Income Tax refunded if I am a non resident and a resident from Florida?

@TomD8 Thank you for the reply and the link. I am still confused with what I have to put in the check box. I did not receive any money other than salary or wages and the description mentions that "If you earned Virginia income other than salary or wages, select None of the above". What am I supposed to select in the picture option I provided in the original post? Do I put none of the above?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I get my Virginia State Income Tax refunded if I am a non resident and a resident from Florida?

Since you worked in VA, you will need to file a VA non resident tax return to claim the income you earned during those 10 weeks. Whether or not you get a refund depends on how much you made and how much they withheld to cover your tax liability to VA.

It was not a mistake for them to withhold money from your wages to VA as you do have to pay taxes on the income you earn in another state, even if your state does not levy income taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I get my Virginia State Income Tax refunded if I am a non resident and a resident from Florida?

@tumizoomi --

And you'll find Virginia's filing requirements for non-residents here:

https://www.tax.virginia.gov/residency-status#blocktabs-residency_status-3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I get my Virginia State Income Tax refunded if I am a non resident and a resident from Florida?

@Vanessa A Thank you for the reply, I am confused with what I have to put in the check box. I did not receive any money other than salary or wages and the description mentions that "If you earned Virginia income other than salary or wages, select None of the above". What am I supposed to select in the picture option I provided in the original post? Do I put none of the above?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I get my Virginia State Income Tax refunded if I am a non resident and a resident from Florida?

@TomD8 Thank you for the reply and the link. I am still confused with what I have to put in the check box. I did not receive any money other than salary or wages and the description mentions that "If you earned Virginia income other than salary or wages, select None of the above". What am I supposed to select in the picture option I provided in the original post? Do I put none of the above?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I get my Virginia State Income Tax refunded if I am a non resident and a resident from Florida?

Yes - none of the above. None of those options apply to you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

evilnachos123

New Member

jjhz

New Member

rwarhol1

New Member

hpccpatest

Level 2

tvdaredevil

Level 1