- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Did ability for multiple state returns change under Deluxe this year 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did ability for multiple state returns change under Deluxe this year 2020?

We have used Turbo Tax for quite a few years. Deluxe used to include state returns, but you could only e-file one. The rest had to be printed and mailed in. The description this year says "1 State via download". Does that mean that you can actually only process 1 state return on Deluxe now?

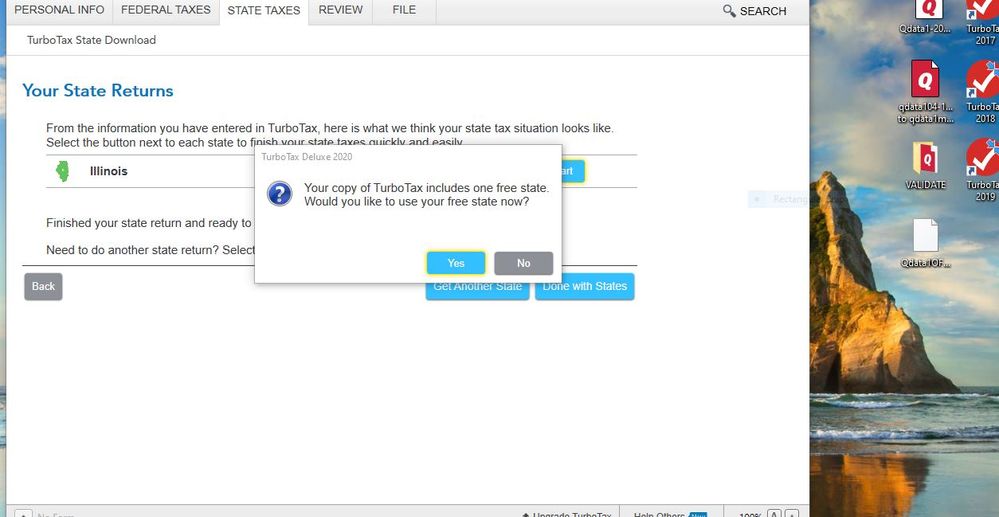

I started filling out our taxes. (We usually use 1 free e-file on ours, and then print out and mail the kids.) We are waiting on a form, so I tried starting my daughter's return. When it got to state returns, I was going to start hers. When I click on 'start' it says "Your copy of TurboTax includes one free state. Would you like to use your free state now?" To me that would imply we can only do 1 state return (not one state e-file.) Can someone please clarify if that has changed and that is now the case?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did ability for multiple state returns change under Deluxe this year 2020?

@pt1967 Once the federal tax return is completed, the program needs to start the state tax return. It has to download the state program to your computer. The state program is not automatically downloaded, you must request the download, so you should say Yes when asked to use your free state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did ability for multiple state returns change under Deluxe this year 2020?

When you purchase the Deluxe desktop edition from TurboTax you receive one free state program download included in the purchase price.

You can complete and file as many state tax returns as needed with the state program that was downloaded.

The desktop editions also come with 5 free federal tax return e-files. A state tax return can be e-filed with each federal return so you could create and e-file 5 federal tax returns and include a e-filed state return with each federal return.

There is an e-file charge for any state returns e-filed. Currently $20 for each return. This price will increase to $25 on March 1.

The state e-file charge can be avoided by printing and mailing the state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did ability for multiple state returns change under Deluxe this year 2020?

Hi DoninGA, thanks for your reply!

I am confused, though. (I am using the CD version/desktop version.) When I answered the question about do you want to use your free state now? And I clicked no, it would not take me past that screen/continue to do a state return. I used the 2019 version and I don't recall any questions like that. It let me finish the person, and then asked about e-filing or printing. It's like it won't let me actually do the return. Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did ability for multiple state returns change under Deluxe this year 2020?

@pt1967 Once the federal tax return is completed, the program needs to start the state tax return. It has to download the state program to your computer. The state program is not automatically downloaded, you must request the download, so you should say Yes when asked to use your free state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did ability for multiple state returns change under Deluxe this year 2020?

Thanks @DoninGA. I think I was confusing 1 state return ...not thinking one state like IL versus IN - but one return. Was able to get them done.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jliangsh

Level 2

rooksmith

Level 2

LP90A

New Member

Walt44

New Member

Laurencelover

New Member