- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

Note: I have posted the same post in get your taxes done yesterday, however, I think it would be better to post here to be specific to state tax filing. Please let me know if I have to delete the original post to avoid duplication.

My wife and I married in Jan 2021. I am on an F1 visa, and I live in Illinois as a Ph.D. student. I am still a nonresident alien since I am not in the US for more than five years. My wife lived in Maryland (MD) from Jan to Mar 2021. Since then, she moved to California (CA) for a new job on Apr 1st and living there. My wife is on H1B, and she is a resident alien. For the year 2021, we want to file jointly (MFJ) for the federal tax return by treating me, the nonresident spouse, as a resident for tax purposes (see IRS Nonresident Spouse), which is also our first year to make this choice.

Now we are wondering about the state tax return for CA, MD, and IL:

1. My wife does not have income from IL. She only has income from MD and CA when she lives there. She is a nonresident of IL.

2. I do not have income from MD and CA. I only have income from IL and I am a resident of IL. I have a visit and vacation in CA and then return back to IL, and I do not have any income from CA during my visit and vacation.

After reading the CA FTB website, we noticed that CA is a community property state. It seems we can only choose to file jointly for the CA state tax return since my wife has CA source income when she lives in CA, thus we are not qualified for the nonresident spouse exception, which is based on the CA 540NR instruction (see the Exception in Filing Status about the caution of Community Property States).

The IL allows filing the IL state tax return separately if one spouse is a resident of IL while the other is a nonresident of IL (see definition and filing status from IL Revenue) even if we file a joint federal return. And for MD, it also allows filing the MD state tax return separately if we file a joint federal return but were domiciled in different states on the last day of the tax year (see married persons in Determine Your Filing Status from MD Revenue).

Now we are wondering whether we can do the following to prepare each state's tax return with the TurboTax software:

1. For CA, create a married filing jointly (MFJ) return for federal tax and then generate the joint CA state tax. File the joint federal return and joint CA state return.

2. For MD state tax, create a Mock Married Filing Separately (MFS) federal return by only inserting all my wife's income, and use this MFS federal return to generate the MFS MD state return. File this separate MD state return for my wife.

3. For IL state tax, create a Mock MFS federal return by only inserting my income and use this MFS federal return to generate the MFS IL state return. File this separate IL state return for me since only me has IL income.

The questions are:

(Q1) Is it correct to file each state's return: MFJ CA return, MFS MD return, MFS IL return, as stated above?

(Q2) Is there anything that we need to be aware of when preparing each state tax? For example, the CA is a community property state, while the MD and IL are non-community property states.

I see a similar discussion here, but my case may be different, and I hope the tax experts could help me confirm my thinking. Thank you so much!

If my proposal is correct, then there is one more question about the filing of CA state tax:

I received the Ph.D. student Fellowship in Illinois. The fellowship is received without the need to perform services such as teaching or research. Based on the US-China tax treaty, the fellowship is exempted from federal tax even if I am a nonresident alien electing to file a joint return, because I am still qualified for the exception stated in the tax treaty's saving clause (see IRS Pub 519 Students, Apprentices, Trainees, Teachers, Professors, and Researchers Who Became Resident Aliens). My university has reported my fellowship (with income code 16 and exemption code 04 for box 3a) and other $5000 (with income code 20 and exemption code 04 for box 3a) in two separate Form 1042-S to indicate that they are exempted from federal and IL state tax based on the tax treaty. For our joint federal tax return, we want to report the income from my 1042-S in the Other Income by using this method, and attach two Form 8833 to explain them. By using this method, line 11 in federal Form 1040 will not include them.

However, we notice that the CA does not exempt the CA source income from the tax treaty (see CA FTB Publication 1031 Section K Residents of or Individuals in Foreign Countries). So the question is:

(Q3) Do I need to add the income amount (in my two Form 1042-S) back to the AGI in our joint CA state return, although those incomes in Form 1042-S are not CA source incomes? If I need to add them back, how should I correctly report them in CA Form 540NR and Schedule?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

The short answer is – if you file joint state returns, regard of which or how many states – your combined income will be taxed on those returns, and you will get credit for taxes paid to the other states.

You can pick and chose what states you want to file joint and what states you want to file separate.

Under your proposal:

Joint part-year California return. Claim a credit for tax paid to IL and MD on the separate returns. These will have to be entered manually since they are coming from mock returns. You would only get credit for IL tax paid for the part-year CA residency period, so you will have to do a proration.

You don’t have to worry about community property since you are filing joint federal and California.

Part-year separate Maryland tax return for your wife.

Full year separate Illinois tax return for you. Claim a credit for your portion of CA tax.

You will need to add back the tax treaty exempt amounts if you are filing a joint CA return. CA bases your tax rate on your total income and then taxes you on the CA ratio of that total tax.

Since you are using Download/CD, the easiest way to enter the addition is to use Forms mode.

- Tap Forms in the top right

- Find Schedule CA Adj

- Go to line 16a and enter your adjustment as an addition

- Tap Step-by-Step in the top right to get back to the interview mode

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

@ErnieS0 Thank you so much for your detailed answer!

Joint part-year California return. Claim a credit for tax paid to IL and MD on the separate returns. These will have to be entered manually since they are coming from mock returns. You would only get credit for IL tax paid for the part-year CA residency period, so you will have to do a proration.

Full year separate Illinois tax return for you. Claim a credit for your portion of CA tax.

If we do not want to claim the tax credit for CA joint tax return and IL separate tax return, can we just waive doing this? Since the amount is very small and we do not want to modify the file mannually

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

Since you are using Download/CD, the easiest way to enter the addition is to use Forms mode.

- Tap Forms in the top right

- Find Schedule CA Adj

- Go to line 16a and enter your adjustment as an addition

- Tap Step-by-Step in the top right to get back to the interview mode

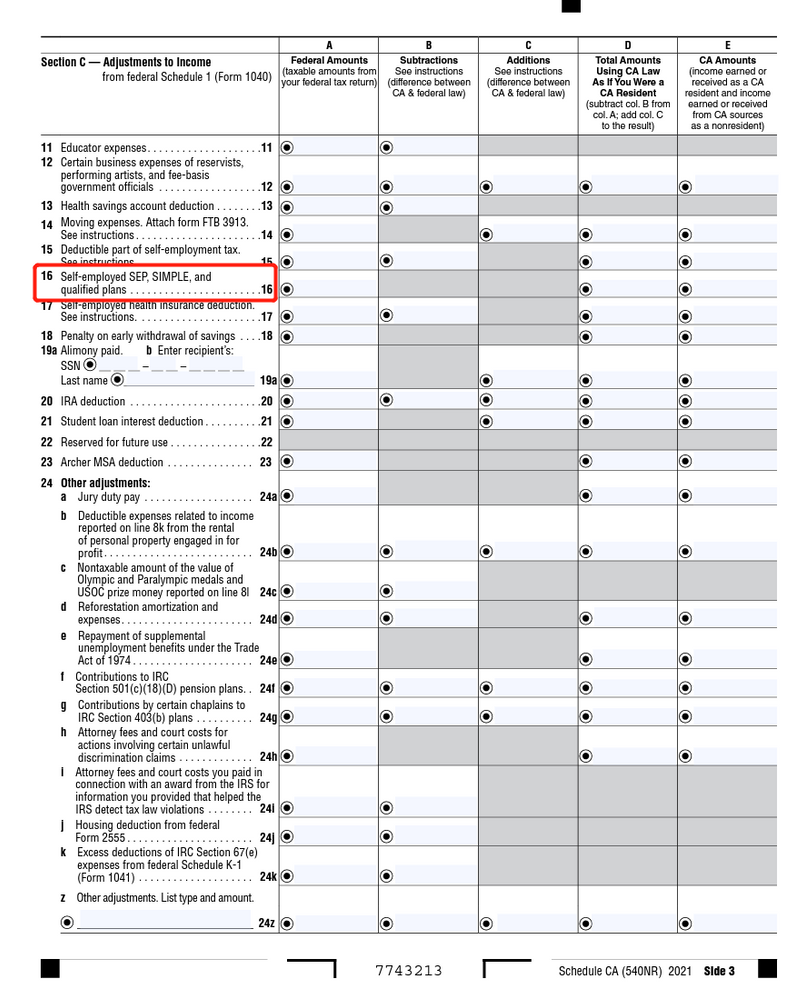

We are using the Schedule CA (540NR) since my wife is a part-year resident of CA and I am a non-resident of CA. We try to find the Schedule CA Adj. However, there is no line 16a. What we can see is as follow:

Line 16 is for Self-employed SEP, SIMPLE, and qualified plans, which we do not think is reasonable to add my tax treat exemption amount from IL here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

The instructions I gave you are for the TurboTax worksheet for Schedule CA (540NR).

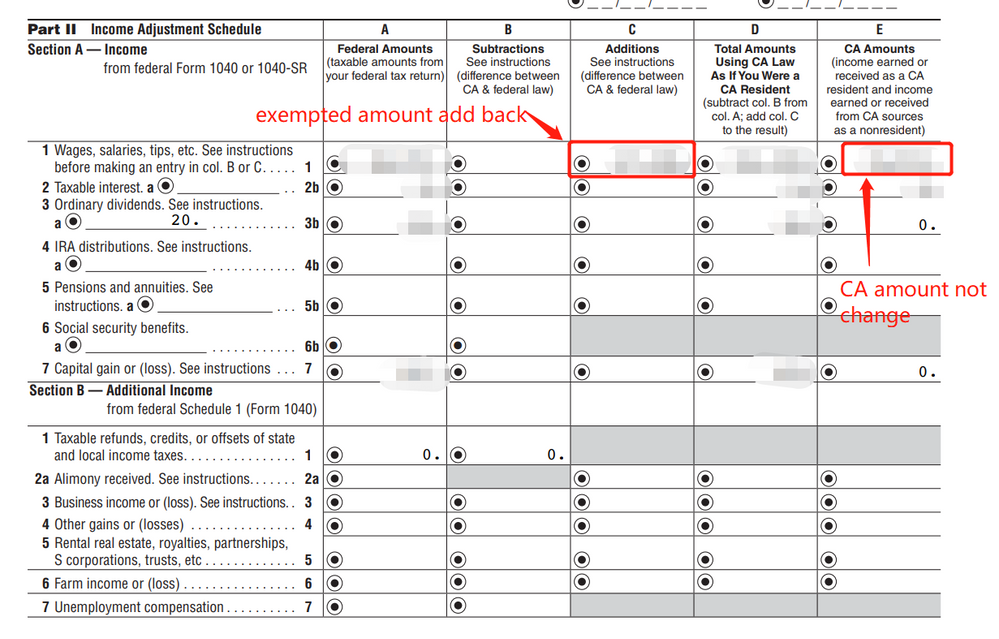

Publication 1031 that you cited says enter the amount on Schedule CA (540NR), Part II, Section A, line 1,

column C.

Since this is non=CA income you will also make an adjustment on Column E.

You are not able to make a direct entry in TurboTax on that field.

If you are preparing forms outside TurboTax in the future please contact the California Franchise Tax Board for help for specific forms help at Contact us.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

We finally find the correct Schedule CA Adj form in TurboTax windows software! And we notice that the TurboTax software actually does ask us whether we have any exempted tax treaty in the federal tax return that needs to be added back for the CA state tax return!

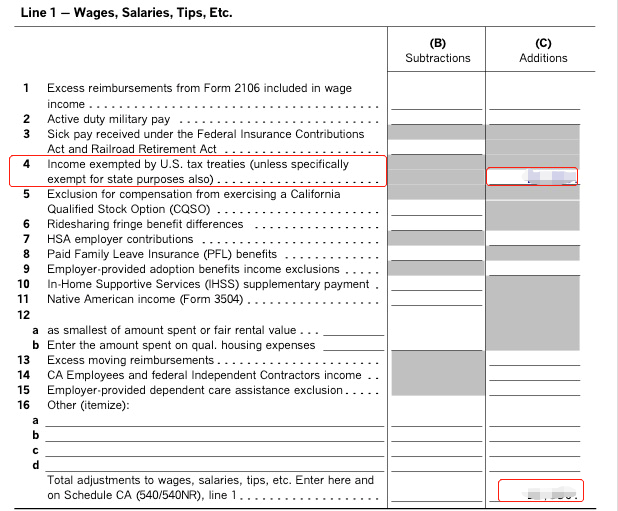

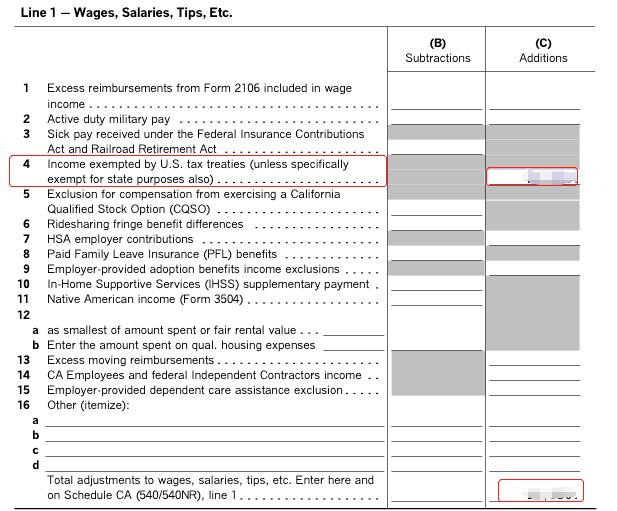

Therefore, we follow the TurboTax software step by step and enter the amount of our exempted tax treaty, and the Schedule CA Adj has generated automatically by TurboTax like this:

The software automatically fills the exempted tax treaty amount in Line 4 as Additions (Column C) in Schedule CA Adj. You mentioned Line 16a in your previous reply. So is it fine to fill it in Line 4 of Schedule CA Adj?

Then the automatically generated Schedule CA (540NR) by TurboTax looks like the following. The tax treaty exemption amount is automatically added back by TurboTax in Schedule CA (540NR), Part II, Section A, line 1, column C, which we think is correct based on Publication 1031. And the CA Amounts in line 1 Column E should not change since the Additions in line 1 Column C are non-CA source income. Is it correct?

And as I mentioned before, if we do not want to claim a tax credit for the joint CA state return and separate IL state return to avoid manually adding anything, can we just waive claiming them? We can accept paying more tax 🙂

And thank you @ErnieS0 so much for your clarification and we are so appreciative of your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

@ErnieS0 There is one more question about the third stimulus amount in the federal tax return when is asked by TurboTax software. My wife is on H1B for the whole year of 2021 and based on the Substantial Presence Test, she is a resident alien, but she did not receive the third stimulus amount. And as mentioned in my post, we are electing to treat me, the non-resident spouse, as a resident for tax purposes. Then will my wife be eligible for the Recovery Rebate Credit? And will I be ineligible for the Recovery Rebate Credit when treating me as a resident alien for tax purposes?

By the way, we find the Schedule CA Adj form in TurboTax software, and by following TurboTax's question in CA tax return filing, the TurboTax asks us to enter the amount of our exempted tax treaty in our federal tax return, and the Schedule CA Adj has generated automatically by TurboTax like the following image. The software automatically fills the exempted tax treaty amount in Line 4 as Additions (Column C) in Schedule CA Adj. You mentioned Line 16a in your previous reply. So is it acceptable to fill it in Line 4 of Schedule CA Adj?

And after doing this, we see that the tax treaty exemption amount is automatically added back by TurboTax in Schedule CA (540NR), Part II, Section A, line 1, column C, which we think is now correct based on Publication 1031. And the CA Amounts in line 1 Column E should not change since the Additions in line 1 Column C are non-CA source income. Is it the correct operation as you mentioned, to make an adjustment on Column E?

And if we do not want to claim a tax credit for the joint CA state return and separate IL state return to avoid manually adding anything, can we choose not to claim them?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

Yes. Your wife is eligible for the third stimulus.

Don’t change the treaty addition. Leave it on line 4a where TurboTax placed it.

Column E is California source income. You didn’t mention who is claiming the treaty exemption. It would be $0 if it is from Illinois income and unchanged if from CA income.

You do not have to claim an other state tax credit @JL_2021.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

Column E is California source income. You didn’t mention who is claiming the treaty exemption. It would be $0 if it is from Illinois income and unchanged if from CA income.

Only me is claiming the tax treaty exemption in the joint federal tax, and all the tax treaty exemptions are received by me from Illinois source (i.e., my university in Illinois). My wife, the resident alien, is the primary taxpayer in both our joint federal tax return and joint CA tax return and I am listed as her spouse such that she can claim me, the nonresident spouse, as a resident for tax purposes. Is it correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

Column E is California source income. You didn’t mention who is claiming the treaty exemption. It would be $0 if it is from Illinois income and unchanged if from CA income.

For clarification, let me say it in my way: for example, the original CA amount is all the income earned by my wife when she is a (part year) resident in CA, which is $A. And my tax treaty exemption from Illinois is $B. Then after we report the tax treaty exemption in our joint CA state tax return (i.e., added them back in line 1 Column C), the line 1 Column E should still be $A since the $B is not CA source income. Is it correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

Column E is California source income. You didn’t mention who is claiming the treaty exemption. It would be $0 if it is from Illinois income and unchanged if from CA income.

Only me is claiming the US-China tax treaty since I am a student and hence I still satisfy with the exception of the saving clause of US-China tax treaty. For clarification, let me say it in my way: for example, the original CA amount is all the income earned by my wife when she is a (part year) resident in CA, which is $A. And my tax treaty exemption from Illinois is $B. Then after we report the tax treaty exemption in our joint CA state tax return (i.e., added them back in line 1 Column C), the line 1 Column E should still be $A since the $B is not CA source income. Is it correct?

Just send it again in case you miss my reply 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cross three states, married couple living in different state, one nonresident spouse, each state tax filing

One more question: In the joint federal tax return, I use Form 8843 as evidence to state my F1 status since I am a student, and use Form 8833 to claim my tax-treaty exemption. Form 8843 and 8833 should be mailed with my federal tax return. For the joint CA state tax, do I still need to attach Form 8833 with the copy of Form 1040? And do I need to attach Form 8843 when mailing the joint CA state tax?

In case you miss my last reply:

Column E is California source income. You didn’t mention who is claiming the treaty exemption. It would be $0 if it is from Illinois income and unchanged if from CA income.

Only me is claiming the US-China tax treaty since I am a student and hence I am still satisfied with the exception of the saving clause of the US-China tax treaty. For clarification, let me say it in my way: for example, the original CA amount is all the income earned by my wife when she is a (part year) resident in CA, which is $A. And my tax treaty exemption from Illinois is $B. Then after we report the tax treaty exemption in our joint CA state tax return (i.e., added them back in line 1 Column C), the line 1 Column E should still be $A since the $B is not CA source income. Is it correct?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajm2281

Returning Member

ir63

Level 2

user17538710126

New Member

sakilee0209

Level 2

sburner

New Member