- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

We finally find the correct Schedule CA Adj form in TurboTax windows software! And we notice that the TurboTax software actually does ask us whether we have any exempted tax treaty in the federal tax return that needs to be added back for the CA state tax return!

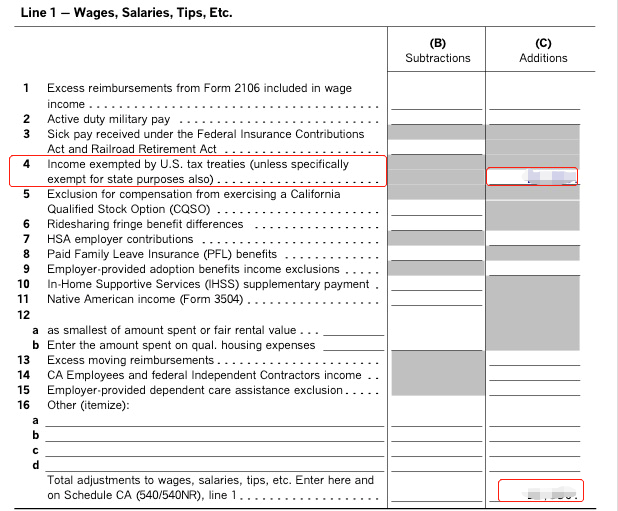

Therefore, we follow the TurboTax software step by step and enter the amount of our exempted tax treaty, and the Schedule CA Adj has generated automatically by TurboTax like this:

The software automatically fills the exempted tax treaty amount in Line 4 as Additions (Column C) in Schedule CA Adj. You mentioned Line 16a in your previous reply. So is it fine to fill it in Line 4 of Schedule CA Adj?

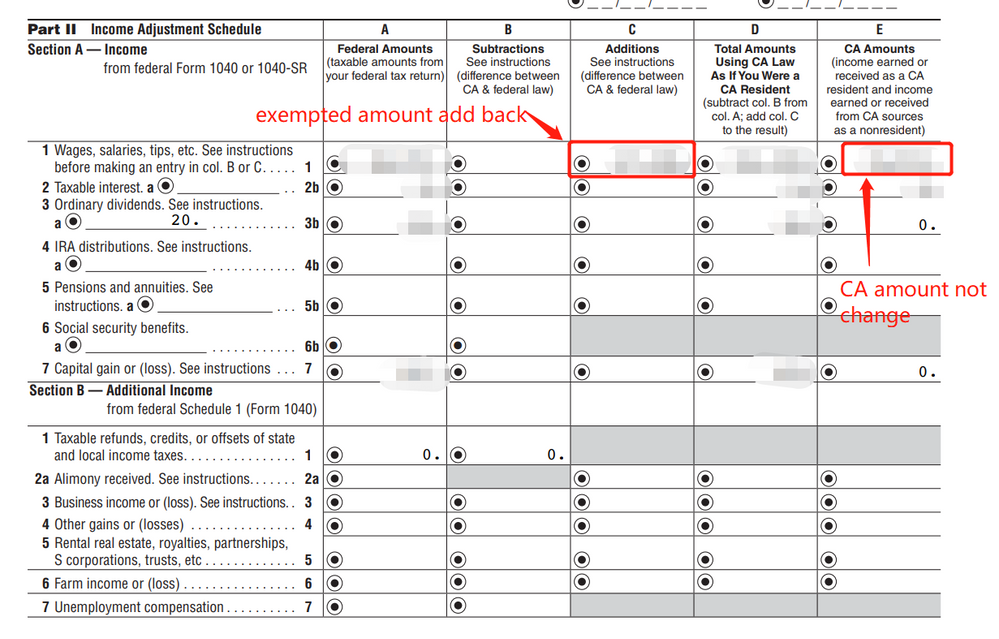

Then the automatically generated Schedule CA (540NR) by TurboTax looks like the following. The tax treaty exemption amount is automatically added back by TurboTax in Schedule CA (540NR), Part II, Section A, line 1, column C, which we think is correct based on Publication 1031. And the CA Amounts in line 1 Column E should not change since the Additions in line 1 Column C are non-CA source income. Is it correct?

And as I mentioned before, if we do not want to claim a tax credit for the joint CA state return and separate IL state return to avoid manually adding anything, can we just waive claiming them? We can accept paying more tax 🙂

And thank you @ErnieS0 so much for your clarification and we are so appreciative of your help!