- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- BOX 25 (Yes, it exists UNDER box 19B) on a NYC W2 - Please help on how to determine locality name after moving to PA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BOX 25 (Yes, it exists UNDER box 19B) on a NYC W2 - Please help on how to determine locality name after moving to PA

Spouse worked in NYC part year, then moved to PA, while still working in NYC.

The NYC W2 is populated as follows:

Box 15 Name of State: "NY"

Box 16 State Wages, ETC.: Specified dollar amount is entered.

Box 17 State Income Tax: Specified dollar amount is entered.

Box 18A Local Wages, ETC.: Specified dollar amount is entered.

Box 19A Local Income Tax: Specified dollar amount is entered.

Box 20A Locality Name: "NYC"

Box 20B Locality Name: BLANK - NO ENTRY

Box 18B Local Wages, ETC.: BLANK - NO ENTRY

Box 19B Local Income Tax: Blank - NO ENTRY

Box 27 Correction box - unchecked

Box 27 VOID box - Unchecked

BOX 25 AMT WITHHELD UNDER SEC 1127 - This box IS populated with a dollar amount.

I imagine that this amount in BOX 25 is possibly the tax that should be paid to PA, but one, I do not want to assume, and two, when the Turbo Tax software checks for errors, it is forcing me to enter a "LOCALITY NAME" in Box 20 for the amount entered in BOX 25.

Any insight, clarity and solution to this issue would be greatly appreciated. Thank you!!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BOX 25 (Yes, it exists UNDER box 19B) on a NYC W2 - Please help on how to determine locality name after moving to PA

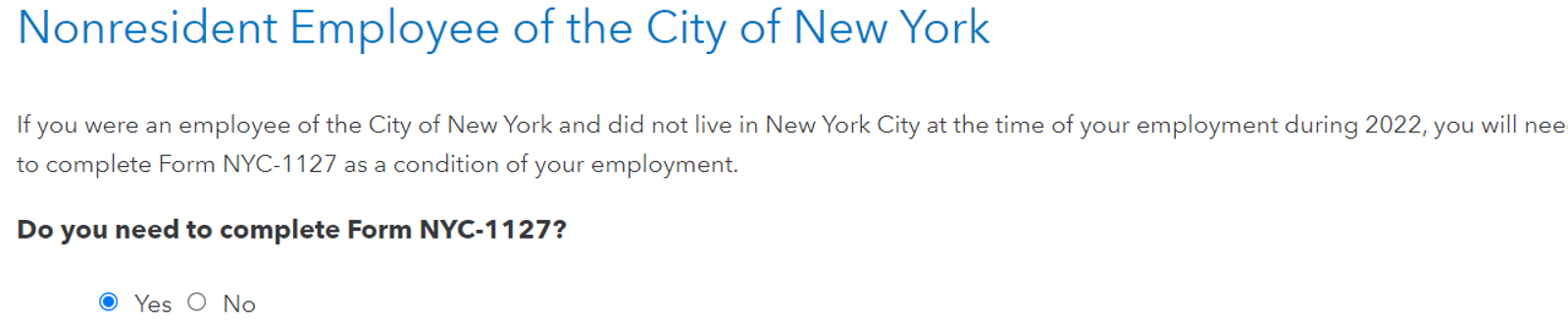

The locality would be New York City if she is a NYC employee and this is for the time she was a nonresident. Most New York City employees living outside of the five boroughs (hired on or after January 4, 1973) must file form NYC-1127. This form calculates the City waiver liability, which is the amount due as if the filer were a resident of NYC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BOX 25 (Yes, it exists UNDER box 19B) on a NYC W2 - Please help on how to determine locality name after moving to PA

Thank you so much for replying so quickly. One more question... Will the Turbo Tax software automatically generate form NYC-1127?

Much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BOX 25 (Yes, it exists UNDER box 19B) on a NYC W2 - Please help on how to determine locality name after moving to PA

Yes, TurboTax will file the NYC-1127 with your New York tax return. @ThoughtInMind

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BOX 25 (Yes, it exists UNDER box 19B) on a NYC W2 - Please help on how to determine locality name after moving to PA

Hi @MaryK4,

I tried entering NYC for locality name, but the Turbo Tax software is prohibiting me from moving forward citing that this is a duplicate entry.

I also just noticed that technically, the form with the box 25 is actually not labeled "W2", but is labeled, "N.Y.C. 1127.2 Wage and Tax Statement".

When does Turbo Tax prompt me to enter that? Do I not include this Box 25 dollar amount on the W2 form?

Thank you so much for your time!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BOX 25 (Yes, it exists UNDER box 19B) on a NYC W2 - Please help on how to determine locality name after moving to PA

You can fill out an NYC-1127 on TurboTax but it is available to print only. E-filing the NYC 1127 is not supported. Manually enter the allocation for NYC and print and mail the NYC-1127. The form became available for printing on January 26, 2023.

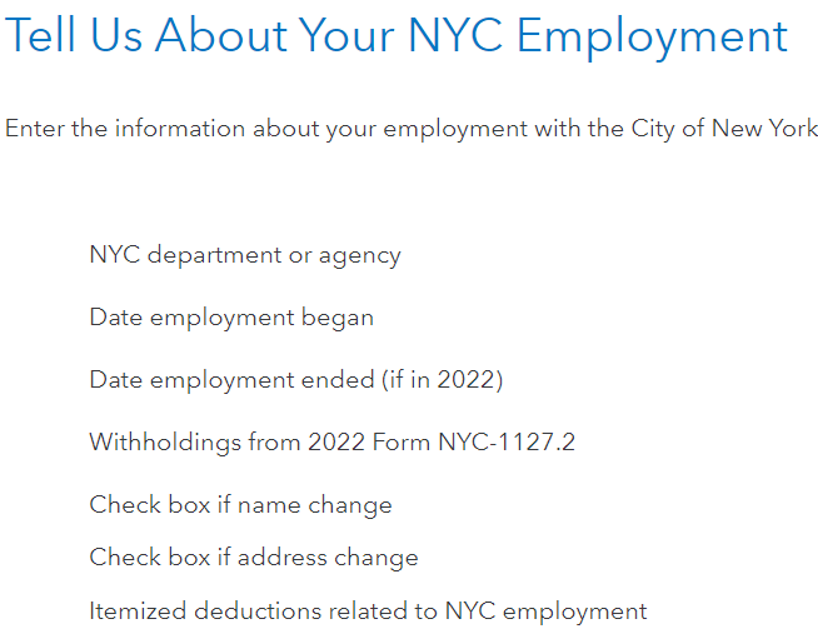

First, on the Federal side of entries, enter the NYC-1127 withholding in Box 14 and at the drop-down arrow scroll down towards the bottom and click on "other deductible state of local tax". That will include the tax for your Schedule A should you be able to itemize deductions.

When you begin your NYS return, to enter the 1127 information please follow these steps:

- When you get to "Credits and other taxes", click on start or update at the credits and other taxes box.

- Scroll down to "New York City and Metro Commuter Taxes" and click on "Start or Update"

- Follow the steps and answer the questions until the 1127 information is entered until you arrive at the last page and note the NYC-1127 address. NYC-1127 cannot be e-filed through TurboTax so must be e-filed directly with the NYC Department of Finance or mailed.

- Click Continue and you will arrive back at the summary Page.

The links below may be of assistance to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Ebun1

New Member

scarr416

Level 2

fguthrie10

New Member

mlaughlin86

New Member

lewis-cartee

Returning Member