- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Avoid double state tax on traditional IRA distribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid double state tax on traditional IRA distribution

I bought a traditional IRA back in 2011 while lived in NJ which was non-tax deduction for the state. I now lived in GA and converted the IRA to Roth in 2019. When I file the GA state tax, I was taxed for the IRA conversion for the GA state. What can be done to avoid the IRA distribution to be taxed again in GA?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid double state tax on traditional IRA distribution

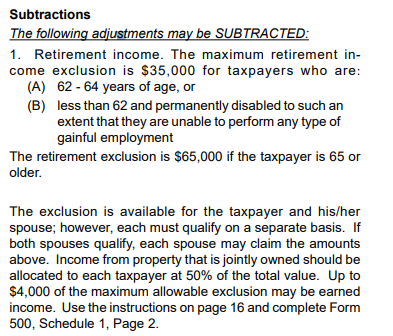

Georgia does provide a retirement income exclusion of $35,000 if you are 62-64 years old or less than 62 and permanently disabled. If you are 65 or older, you can get an exclusion of $65,000 for retirement income.

It appears you will only be taxed on the conversion in this case and will not be subject to taxation on the withdrawal should you choose to stay in Georgia.

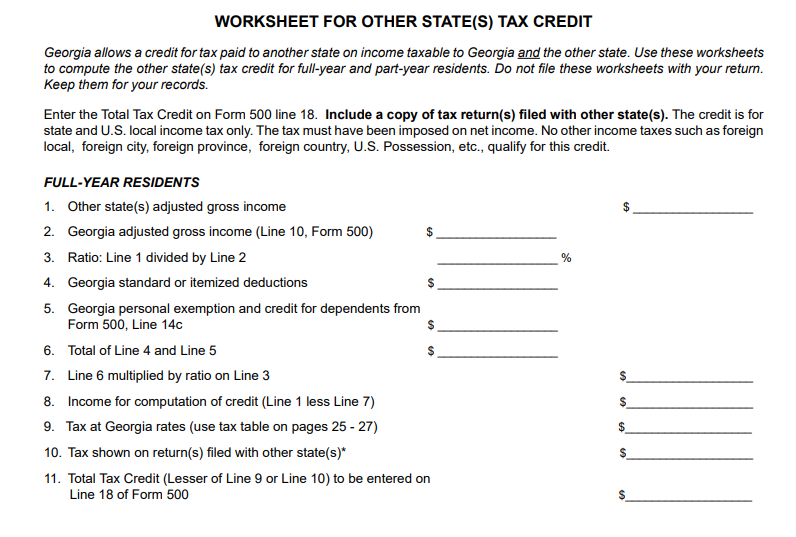

Your other option is to claim a credit for the taxes paid within New Jersey on the initial retirement amount.

You would claim this credit for the state of Georgia as a credit for taxes paid to another state. If you still have a copy of your 2011 return showing the taxes paid in New Jersey on the same income, then you may be able to claim a credit in Georgia in 2019 for the same income which is being taxed twice.

Please note you would need to include a copy of your 2011 New Jersey return showing the income being taxed previously for the credit to potentially be allowed.

Please be aware that there is no information provided in the Georgia regulations to indicate whether or not they would accept this approach. But as a taxpayer, you can indicate that this same income is being double-taxed by New Jersey and Georgia and as such, the credit claim should be allowed.

[Edited 3/7/20|2:02pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid double state tax on traditional IRA distribution

Georgia does provide a retirement income exclusion of $35,000 if you are 62-64 years old or less than 62 and permanently disabled. If you are 65 or older, you can get an exclusion of $65,000 for retirement income.

It appears you will only be taxed on the conversion in this case and will not be subject to taxation on the withdrawal should you choose to stay in Georgia.

Your other option is to claim a credit for the taxes paid within New Jersey on the initial retirement amount.

You would claim this credit for the state of Georgia as a credit for taxes paid to another state. If you still have a copy of your 2011 return showing the taxes paid in New Jersey on the same income, then you may be able to claim a credit in Georgia in 2019 for the same income which is being taxed twice.

Please note you would need to include a copy of your 2011 New Jersey return showing the income being taxed previously for the credit to potentially be allowed.

Please be aware that there is no information provided in the Georgia regulations to indicate whether or not they would accept this approach. But as a taxpayer, you can indicate that this same income is being double-taxed by New Jersey and Georgia and as such, the credit claim should be allowed.

[Edited 3/7/20|2:02pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

Liangtwn

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

tcondon21

Returning Member

kgsundar

Level 2

kgsundar

Level 2