- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

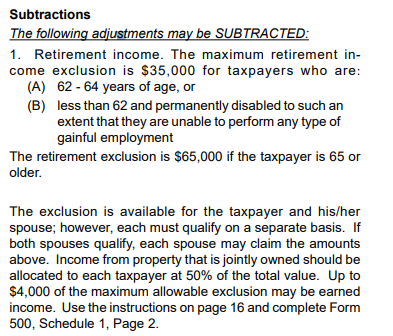

Georgia does provide a retirement income exclusion of $35,000 if you are 62-64 years old or less than 62 and permanently disabled. If you are 65 or older, you can get an exclusion of $65,000 for retirement income.

It appears you will only be taxed on the conversion in this case and will not be subject to taxation on the withdrawal should you choose to stay in Georgia.

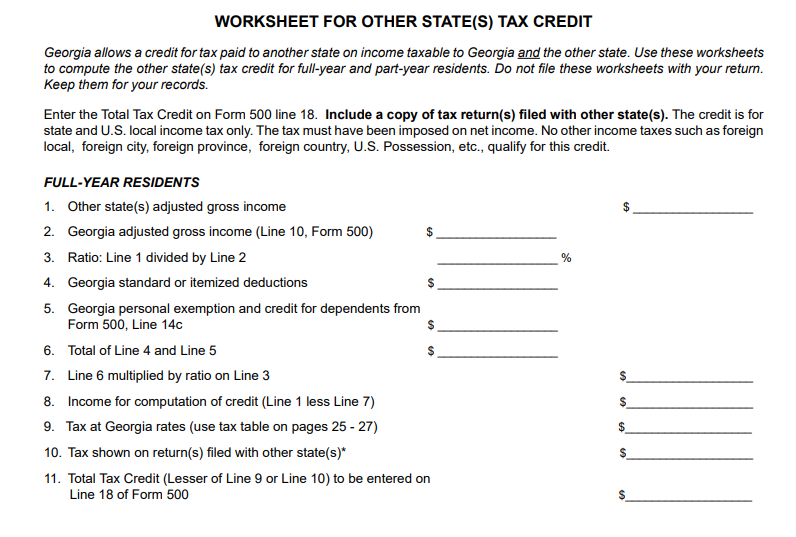

Your other option is to claim a credit for the taxes paid within New Jersey on the initial retirement amount.

You would claim this credit for the state of Georgia as a credit for taxes paid to another state. If you still have a copy of your 2011 return showing the taxes paid in New Jersey on the same income, then you may be able to claim a credit in Georgia in 2019 for the same income which is being taxed twice.

Please note you would need to include a copy of your 2011 New Jersey return showing the income being taxed previously for the credit to potentially be allowed.

Please be aware that there is no information provided in the Georgia regulations to indicate whether or not they would accept this approach. But as a taxpayer, you can indicate that this same income is being double-taxed by New Jersey and Georgia and as such, the credit claim should be allowed.

[Edited 3/7/20|2:02pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"