- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Are these Dividend CA-sourced?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these Dividend CA-sourced?

To help me determine how much CA State tax I need to pay being a non-resident.

MATTHEWS ASIA DIVIDEND

PARNASSUS MID CAP

INVESCO COMSTOCK

BLKRCK GLB DIV I

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these Dividend CA-sourced?

I cannot see your return. However, your dividend income is not allocated to your nonresident state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these Dividend CA-sourced?

Thank you @KatrinaB48

I didn't get what you mean by allocating. Do you mean I don't need to pay tax over dividends? If so would I put $0 on CA 540NR Part II Column E?

Do you also know how to calculate California State tax with interest, IRA distribution and Capital gain/loss?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these Dividend CA-sourced?

As a non-resident, you only pay taxes on income earned in CA. All dividends,interest, capital gain, IRA distributions would be zero on CA. Those items will be taxed by your resident state if they have a state tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these Dividend CA-sourced?

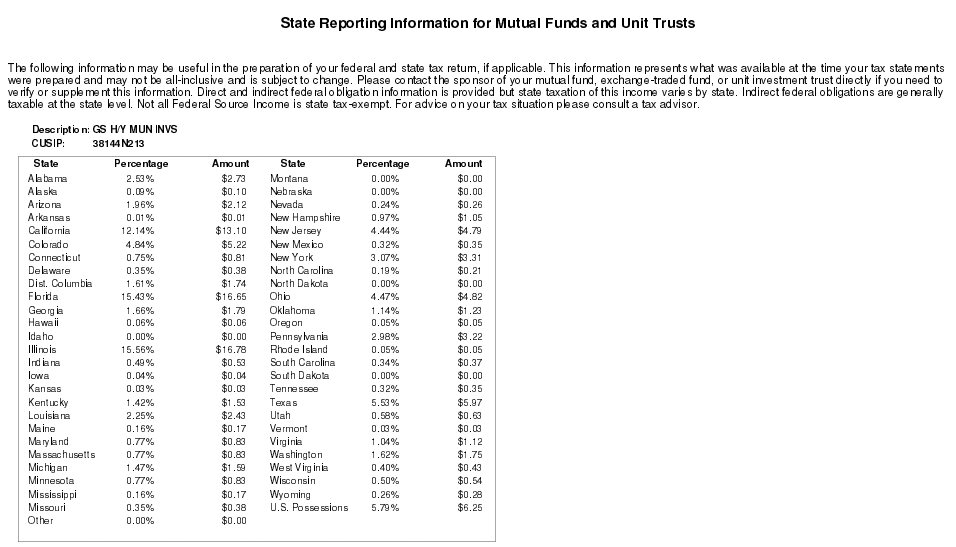

This is for tax-exempt interest. Does the following only apply for CA residents? I moved out of the US 7 years ago.

50% Tax-Exempt Interest

Certain mutual funds pay "tax-exempt interest" that may be taxable in California if a majority of the assets in the fund from which they were derived are from out-of-state obligations.

Your mutual fund tax-exempt income is not taxable in California if at least one of the following are true:

- 50% or more of the fund's assets are invested in U.S. obligations

- 50% or more of the fund's assets are invested in California tax-exempt obligations

- 50% or more of the fund's assets are invested in combination of U.S. and California tax-exempt obligations

Your annual statement or the statement provided with your 1099 will provide information on tax-exempt interest. The percentage breakdown between federal and states is usually on the back of the statement as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these Dividend CA-sourced?

Sorry I am just double-checking. My CPA has been declaring CA returns and these incomes even though I've moved out of the country 7 years ago. I've recently taken over and want to 100% sure before I amend the last 3 years tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these Dividend CA-sourced?

You will need to look at the annual statements over the last three years to see if those conditions apply and decide if your mutual fund tax-exempt income is taxable in California or not. since these are disclosure statements, there are usually detailed explanations and summaries to use as a guide. Read those and determine if it is worth amending the last three years from the date you filed your return or within two years of the date you paid the tax, whichever is later.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these Dividend CA-sourced?

Thanks for your response!

I got a bit confused now. Are you saying I might still need to pay tax in California on some mutual fund income being a non-resident?

Then I need to decide which of the funds I have are CA-sourced right?

I have the following page from the annual statement and to me it didn't really say much. Could you shed some light?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these Dividend CA-sourced?

This is what you posted above because this is the 50% tax exempt rule in California.

Your mutual fund tax-exempt income is not taxable in California if at least one of the following are true:

- 50% or more of the fund's assets are invested in U.S. obligations

- 50% or more of the fund's assets are invested in California tax-exempt obligations

- 50% or more of the fund's assets are invested in combination of U.S. and California tax-exempt obligations

So yes, if the assets in the funds do not meet the criteria listed above, your interest income is taxable in California whether you are a non-resident or not. To correctly determine if your taxable interest is taxable in California or not, you would need to examine the portfolios of each fund to determine the makeup of the fund assets. Since the portfolio's might change, you need to examine each year's fund portfolios to determine the asset makeup. My suggestion is to prepare a California non-resident return this year and report the interest earned from the mutual fund earned in California. If it doesn't produce a taxable event, then don't finish filing the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

madmanc20

Level 3

pjholland1

Level 1

lcgundo

Level 3

alexiaziebarth

New Member

jankrajnak

New Member