- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- 2 different mail in payment address for IL

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 different mail in payment address for IL

The 1040 instructions show to mail payment to:

PO Box 19027

Springfield, IL 62794-9027

The payment voucher form (1040-V) shows to mail payment to:

Illinois Dept of Revenue

Springfield, IL 62726-0001..

Where should I mail the payment?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 different mail in payment address for IL

Thanks for your reply. However, the question was regarding state tax return payments only, not federal taxes. I finally received an answer from the State:

If payment is being submitted with a return, it should be mailed to the PO BOX 19027.

If payment is being submitted without a return (and must include the payment voucher, e.g., estimated tax payments for 1099 employees, etc...), then payment should be sent to the 62726-0001 zip code address.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 different mail in payment address for IL

Per Illinois Department of Revenue website:

With Payment:

PO BOX 19027

SPRINGFIELD IL 62794-9027

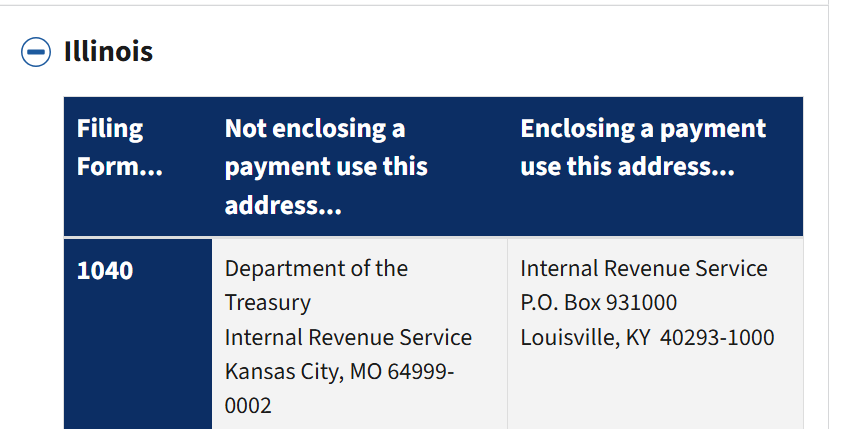

Per IRS website:

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

IRS - Where to file paper tax returns with or without a payment

[Edited 4/08/25 | 5:08pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 different mail in payment address for IL

Thanks for your reply. However, the question was regarding state tax return payments only, not federal taxes. I finally received an answer from the State:

If payment is being submitted with a return, it should be mailed to the PO BOX 19027.

If payment is being submitted without a return (and must include the payment voucher, e.g., estimated tax payments for 1099 employees, etc...), then payment should be sent to the 62726-0001 zip code address.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

deserteach

New Member

gossamershadow

Level 1

cparke3

Level 4

nscuham

New Member

Kaimi

New Member