- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- 1099C tax requirement in MA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099C tax requirement in MA

I foreclosed on my main home in 2012 and filed bankruptcy. I just received a 1099C dated 3/13/2019 and live in MA. Why did I receive this now this many years later? Why am I obligated to pay 5% Mass Tax on this now? Is there anyway to get around this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099C tax requirement in MA

As long as the debt has not been paid or canceled, there’s no statute of limitations on when a lender has to submit a 1099-C. The process of bankruptcy could be complicated to explain why it takes longer. To obtain the details, I would suggest you contact your bank or the issuer of the Form 1099-C.

Per its state tax law, Massachusetts does not honor the exclusion for mortgage forgiveness on the principal residence. You would have to pay the 5.1% tax on the amount. There is no way to avoid it. See the information below:

Generally debt forgiveness for a borrower who is personally liable on a loan is taxable income unless one of the following exceptions applies per Federal tax law:

- Occurs under Title 11 bankruptcy

- Occurs when the taxpayer is insolvent (Debts greater than Assets)

- Is qualified farm indebtedness

- Is qualified real property business indebtedness (other than C-corporations)

- Is qualified principal residence acquisition debt (up to $2M for MFJ) – expired December 31, 2013

Massachusetts, however, did not adopt the exclusion for mortgage forgiveness on principal residence. Thus, for home mortgage cancellation of debt only one of the first 4 exceptions listed above will prevent the debt forgiveness from being subject to MA income tax.

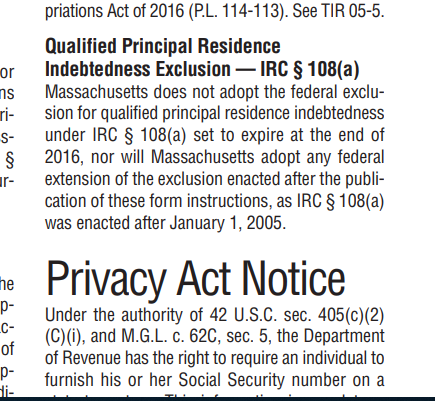

Also, click to read MA instrucitons, page 5 under Qualified Principal Residence Indebtedness Exclusion. See the image below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

waynelandry1

Returning Member

Lusby

New Member

ttla97-gmai-com

New Member

postman8905

New Member

johntheretiree

Level 2