- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

As long as the debt has not been paid or canceled, there’s no statute of limitations on when a lender has to submit a 1099-C. The process of bankruptcy could be complicated to explain why it takes longer. To obtain the details, I would suggest you contact your bank or the issuer of the Form 1099-C.

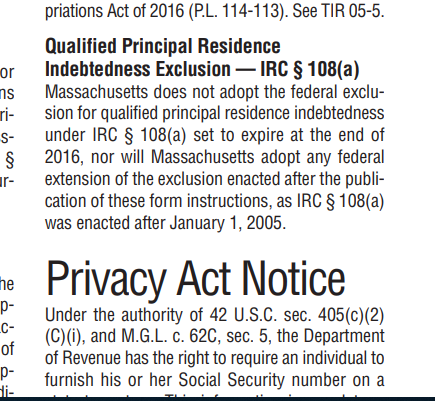

Per its state tax law, Massachusetts does not honor the exclusion for mortgage forgiveness on the principal residence. You would have to pay the 5.1% tax on the amount. There is no way to avoid it. See the information below:

Generally debt forgiveness for a borrower who is personally liable on a loan is taxable income unless one of the following exceptions applies per Federal tax law:

- Occurs under Title 11 bankruptcy

- Occurs when the taxpayer is insolvent (Debts greater than Assets)

- Is qualified farm indebtedness

- Is qualified real property business indebtedness (other than C-corporations)

- Is qualified principal residence acquisition debt (up to $2M for MFJ) – expired December 31, 2013

Massachusetts, however, did not adopt the exclusion for mortgage forgiveness on principal residence. Thus, for home mortgage cancellation of debt only one of the first 4 exceptions listed above will prevent the debt forgiveness from being subject to MA income tax.

Also, click to read MA instrucitons, page 5 under Qualified Principal Residence Indebtedness Exclusion. See the image below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"