- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

Unfortunately the form needed to report that does not even exist yet.

CARES Act retirement plan COVID-19 related distributions can be paid back over 3 years or the tax spread over 3 years.

That is reported on a new 8915-E form that is not yet available and there is no estimated release date since the form is still in the draft state at the IRS. There is no telling how long it will take the IRS to make the electronic form available. Typical it takes the IRS 2-4 weeks to release the electronic form specifications after the paper version is released. e-file providers must program from the electronic specifications.

The draft paper form is here:

https://www.irs.gov/pub/irs-dft/f8915e--dft.pdf

https://www.irs.gov/pub/irs-dft/i8915e--dft.pdf

Also to see if you qualify for a COVID-19 related distribution see:

https://www.irs.gov/newsroom/coronavirus-related-relief-for-retirement-plans-and-iras-questions-and-...

Quote:

Q3. Am I a qualified individual for purposes of section 2202 of the CARES Act?

A3. You are a qualified individual if –

You are diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers for Disease Control and Prevention;

Your spouse or dependent is diagnosed with SARS-CoV-2 or with COVID-19 by a test approved by the Centers for Disease Control and Prevention;

You experience adverse financial consequences as a result of being quarantined, being furloughed or laid off, or having work hours reduced due to SARS-CoV-2 or COVID-19;

You experience adverse financial consequences as a result of being unable to work due to lack of child care due to SARS-CoV-2 or COVID-19; or

You experience adverse financial consequences as a result of closing or reducing hours of a business that you own or operate due to SARS-CoV-2 or COVID-19.

Under section 2202 of the CARES Act, the Treasury Department and the IRS may issue guidance that expands the list of factors taken into account to determine whether an individual is a qualified individual as a result of experiencing adverse financial consequences. The Treasury Department and the IRS have received and are reviewing comments from the public requesting that the list of factors be expanded.

End quote

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

Unfortunately the form needed to report that does not even exist yet.

CARES Act retirement plan COVID-19 related distributions can be paid back over 3 years or the tax spread over 3 years.

That is reported on a new 8915-E form that is not yet available and there is no estimated release date since the form is still in the draft state at the IRS. There is no telling how long it will take the IRS to make the electronic form available. Typical it takes the IRS 2-4 weeks to release the electronic form specifications after the paper version is released. e-file providers must program from the electronic specifications.

The draft paper form is here:

https://www.irs.gov/pub/irs-dft/f8915e--dft.pdf

https://www.irs.gov/pub/irs-dft/i8915e--dft.pdf

Also to see if you qualify for a COVID-19 related distribution see:

https://www.irs.gov/newsroom/coronavirus-related-relief-for-retirement-plans-and-iras-questions-and-...

Quote:

Q3. Am I a qualified individual for purposes of section 2202 of the CARES Act?

A3. You are a qualified individual if –

You are diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers for Disease Control and Prevention;

Your spouse or dependent is diagnosed with SARS-CoV-2 or with COVID-19 by a test approved by the Centers for Disease Control and Prevention;

You experience adverse financial consequences as a result of being quarantined, being furloughed or laid off, or having work hours reduced due to SARS-CoV-2 or COVID-19;

You experience adverse financial consequences as a result of being unable to work due to lack of child care due to SARS-CoV-2 or COVID-19; or

You experience adverse financial consequences as a result of closing or reducing hours of a business that you own or operate due to SARS-CoV-2 or COVID-19.

Under section 2202 of the CARES Act, the Treasury Department and the IRS may issue guidance that expands the list of factors taken into account to determine whether an individual is a qualified individual as a result of experiencing adverse financial consequences. The Treasury Department and the IRS have received and are reviewing comments from the public requesting that the list of factors be expanded.

End quote

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

A little adjustment regarding the Retirement withdrawal qualifications from the IRS website: https://www.irs.gov/newsroom/coronavirus-relief-for-retirement-plans-and-iras

To be eligible for COVID-19 relief, coronavirus-related withdrawals or loans can only be made to an individual if:

- The individual (or the individual’s spouse or dependent) is diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (collectively, COVID-19) by a test approved by the Centers for Disease Control and Prevention (including a test authorized under the Federal Food, Drug, and Cosmetics Act);

- The individual experiences adverse financial consequences as a result of:

- The individual being quarantined, being furloughed or laid off, having work hours reduced, being unable to work due to lack of childcare, having a reduction in pay (or self-employment income), or having a job offer rescinded or start date for a job delayed, due to COVID-19;

- The individual’s spouse or a member of the individual’s household (that is, someone who shares the individual’s principal residence) being quarantined, being furloughed or laid off, having work hours reduced, being unable to work due to lack of childcare, having a reduction in pay (or self-employment income), or having a job offer rescinded or start date for a job delayed, due to COVID-19; or

- Closing or reducing hours of a business owned or operated by the individual, the individual’s spouse, or a member of the individual’s household, due to COVID-19.

Employers can choose whether to implement these coronavirus-related distribution and loan rules; however, qualified individuals can claim the tax benefits of the coronavirus-related distribution rules even if plan provisions aren't changed. Plan administrators can rely on an individual's certification that the individual is a qualified individual (unless the plan administrator has actual knowledge to the contrary), but that individual must actually be a qualified individual to obtain favorable tax treatment with respect to the distribution. Notice 2020-50 PDF provides a sample certification for plan administrators.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

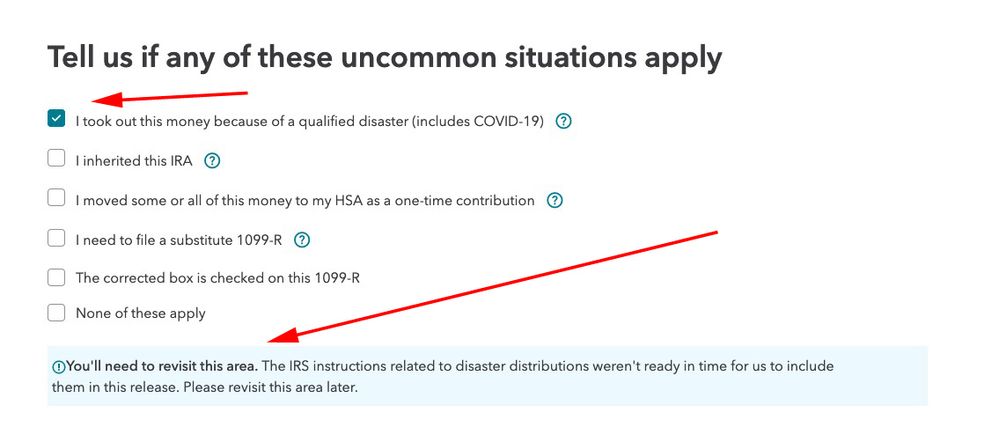

The screen to designate your 1099-R withdrawal as money taken out due to Covid-19 is found on the 1099-R input screen. Although the forms are not available to be e-filed yet, you may enter your information now and revisit the area in TurboTax at a later date.

You can input your 1099-R in TurboTax by following these steps:

- Open your return.

- Search 1099-R with the magnifying glass tool on top of the page.

- Click on the Jump to 1099-R link at the top of the results.

- Answer yes to the question Did you get a 1099-R in 2020?

- Click continue to the page Get ready to be impressed.

- Follow the on-screen instructions.

- On the page Tell us if any of these uncommon situations apply, put a check mark next to the statement I took out this money because of a qualified disaster (Covid-19). I have attached a picture at the bottom of my post for further guidance.

Please keep in mind that the 10% early withdrawal penalty may be waived on up to $100,000 of retirement funds withdrawn if you are a qualified individual impacted by coronavirus.

You are a qualified individual if:

- You, your spouse, or dependent are diagnosed with COVID-19

- You experience adverse financial consequences as a result of being quarantined, furloughed, or laid off

- You had hours reduced due to coronavirus

- You are unable to work due to your child care closing or reducing hours.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

Thank you! I have entered my information and I do qualify to waive the 10% early withdrawal penalty. My question now is does anyone have an idea of when the required 8915-E form will be available? This is all I'm waiting on to be able to complete my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

Probably not for another few weeks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

I have an updated Premier account and the image you show with the checkbox is not there. There are some individual pages with questions about an officer or corrected etc and whether or not I took a prior disaster loan in 2019 or paid back one but there is absolutely nothing about a qualified disaster (COVID).

Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

This is for 2020 1099-R withdrawals was copied from above.

The screen to designate your 1099-R withdrawal as money taken out due to Covid-19 is found on the 1099-R input screen. Although the forms are not available to be e-filed yet, you may enter your information now and revisit the area in TurboTax at a later date.

You can input your 1099-R in TurboTax by following these steps:

- Open your return.

- Search 1099-R with the magnifying glass tool on top of the page.

- Click on the Jump to 1099-R link at the top of the results.

- Answer yes to the question Did you get a 1099-R in 2020?

- Click continue to the page Get ready to be impressed.

- Follow the on-screen instructions.

- On the page Tell us if any of these uncommon situations apply, put a check mark next to the statement I took out this money because of a qualified disaster (Covid-19)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

That is not an option for me as indicated in my response. There is no field or box for Natural Disaster on my 1099-R input. I have been through it at least 20 times and it's just not there. I actually searched for the words and none of them were found on my tax return. I upgraded to the Premier version. In the past I used th

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

That is only in the online version. The CD/download desktop version does not have that interview question.

In any event the 8915-E form to report the COVID distribution will not be available for a while yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

THANK YOU!! I was so confused LOL. I have the download version. BOOOOOO... they should update the download version as I'm on a subscription.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

@nicollejoy wrote:

THANK YOU!! I was so confused LOL. I have the download version. BOOOOOO... they should update the download version as I'm on a subscription.

All the questions are the same as the desktop version, except for the COVID question, only they are in different places and not in a single list. The online version is much more "lead you by the hand" and not easy to jump around. The desktop is much more versatile.

The COVID question in the online version just says that it is not ready yet. When ready it will be included in both versions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

This will be my first time filing with a 1099-R. I withdrew money and qualify for the covid disaster tax break. However, I'm confused as to how I can claim this over 3 years. Is this done with the form we are awaiting from the IRS that will allow me to do so? Currently my 1099-R has the same value listed for boxes 1 and 2a. I assume I should not change the value in 2a to reflect 1/3 of the total income? Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

You will report this on a Form 8915-E. The IRS has not yet finalized the Form 8915-E for retirement plan distributions under the CARES act. So this form cannot be included in the TurboTax program. You will not be able to proceed until the form is available.

The IRS has not communicated when the form will be finalized for inclusion on the 2020 federal tax return.

We estimate it will be sometime in February 2021 before the form is available. You can watch this link for the form availability. Currently, the form is not listed here since there is no estimated date. Once there is, you will find the form listed with the date available.

IRS forms availability table for TurboTax individual (personal) tax products

Additionally, the IRS will not start processing returns until February 12, so waiting for this form is not slowing down the processing of your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TURBOTAX apply a penalty for qualified coronavirus-related 401K distributions? I took out the $1,500 because of a qualified disaster (COVID-19) under CARES.

On the link to the dates you provided it says that the efile is unavailable for this form. Does this mean I have to hand write my taxes....?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

karliwattles

New Member

PCD21

Level 3

2399139722

New Member

ilenearg

Level 2

Hypatia

Level 1