- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

If you are being asked to enter your prior year Roth IRA contributions, you must have taken a distribution from a Roth IRA in the current year. The prior year Roth IRA contributions are needed to determine whether any of your current year contribution is taxable.

If your distribution is less than your Roth IRA basis (the amount you contributed), then there will be no income tax imposed. If it is greater than your basis, then the distribution may or may not be taxable depending on other circumstances that would make it a qualified distribution (your age and how long you have had a Roth IRA account for example).

There is not really a good solution to overcome not having records showing the contributions. It is possible that your IRA custodian would have that information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

@frusfs I did take a distribution in 2020 but like I said I haven't contributed to my Roth in over 10 years. So if I say I contributed nothing in the prior year (I presume this means only the one year prior to the distribution?) then my distribution will be greater than my basis (if basis means only the prior year). However, there were many years prior that I contributed before quitting work. Your response seems to imply that because my distribution is more than my contribution (basis) I might be taxed. Doesn't make sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

Yes it makes sense because if your distributions exceed then this excess can be construed as earnings. Earnings are taxable income if not a qualified distribution. The main qualifier is that you own that Roth at least five-years otherwise known as the five-year holding period.

In your case, it sounds like you have owned your Roth more than five years thus you should not be taxed on additional earnings. I would suggest however you obtain a ballpark figure of all your contributions you made while you contributed to the plan so we can make Turbo Tax happy just so you don't receive these confusing messages.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

Thanks for your response. I think we are getting closer to a solution. The problem I have is that Turbo is asking me in input only the Roth contribution for the prior year. I presume that means only the ONE year prior and not all of the others that I contributed to my Roth. They then state that if my withdrawal exceeds my contribution that I may be require to pay taxes. So if I show zero contribution for the prior year all of my withdrawal could be taxed. Thus, I guess the best thing would be to show an amount greater than my withdrawal even though that is not correct. Seems like Turbo would be more precise and flexible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

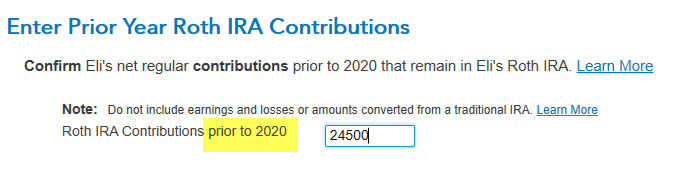

To be sure that the Roth distributions are treated properly, you need to enter the basis for the Roth accounts. This is done on the screen, Enter Prior Year Roth IRA Contributions. This means the total of all your regular contributions prior to 2020. [See screenshot below.]

You also need to have owned the Roth account for at least five years for the distribution to be nontaxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

Let me see if I understand this correctly. I pulled a distribution out of Roth IRA last year before the age of 59. Therefore, this means I will be taxed on the interest and 10% penalty for distribution before the correct age. Turbo tax is asking for ‘Roth IRA Contributions prior to 2021’. So I need to collect all December statements from the year I opened the Roth IRA to 2020 and add up all contributions I ever made for the life of the IRA. This would be what I enter. Correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

If you are not 59 1/2 when you do it, any amounts above your remaining contributions (total) would be taxable and subject to penalty, unless the exceptions to the penalty apply in your case.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

Read the answer but it does not explain to me why I'm being asked for prior year Roth IRA contributions. My understanding for tax free Roth IRA distributions is that I have to be over 59 1/2 (I am) and have the Roth IRA open for more than 5 years (it is). So why am I being asked this question???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

It may be that you need to complete form 8606 Nondeductible IRA's since you had distributions from a ROTH IRA during the year, as the instructions to that form require you to enter your basis in your ROTH IRA. From the instructions to Form 8606:

So, You may need to enter your basis, even though it will not affect the taxability of your IRA distribution depending on your age and time you held the investment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

What did you put in this box this year. I am in same situation and dont understand?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why am I being asked to "Enter Prior Year Roth IRA Contributions". I have been retired over 15 years and haven't made a contribution since there. I have no records.

If you had your Roth IRA for 5 years and are over 59 1/2 then you have a Qualified Distributions which are not taxable. Your Form 1099-R should have code T or Q and you do not need to answer the net contributions prior to 2024 question.

If you are under 59 1/2 then you will have to answer the question so TurboTax can calculate if your distribution is taxable. You can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. Therefore, TurboTax will know what your net contribution where prior to 2024. You will need to add all your Roth IRA contributions form prior years minus any Roth IRA distributions from prior years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lkjr

New Member

TMM322

New Member

happysue19

New Member

toddrub46

Level 4

binarysolo358

New Member