- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

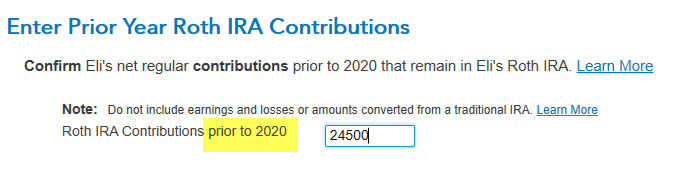

To be sure that the Roth distributions are treated properly, you need to enter the basis for the Roth accounts. This is done on the screen, Enter Prior Year Roth IRA Contributions. This means the total of all your regular contributions prior to 2020. [See screenshot below.]

You also need to have owned the Roth account for at least five years for the distribution to be nontaxable.

February 18, 2021

7:19 AM