- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Which option will this be taxed under

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option will this be taxed under

How will funds from a Traditional IRA be taxed if I do a withdrawal? The funds are invested into a Mutual fund.

Qualified dividends, Interest or IRA/Pension distributions.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option will this be taxed under

It will be IRA/Pension distributions.

Any interest/dividends or cap gains that the Mutual fund might have issued during the year, are considered to be within the IRA.....and anything you take out is considered as-if just a cash distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option will this be taxed under

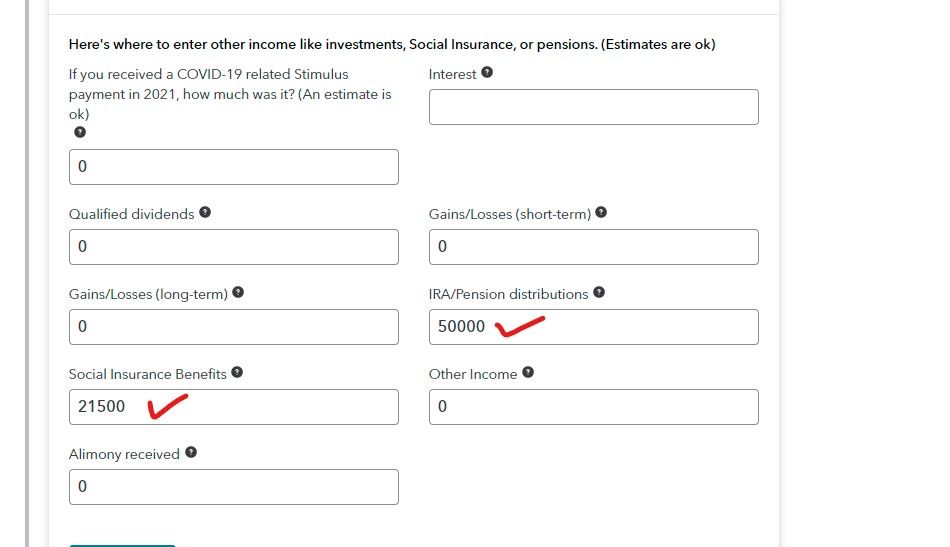

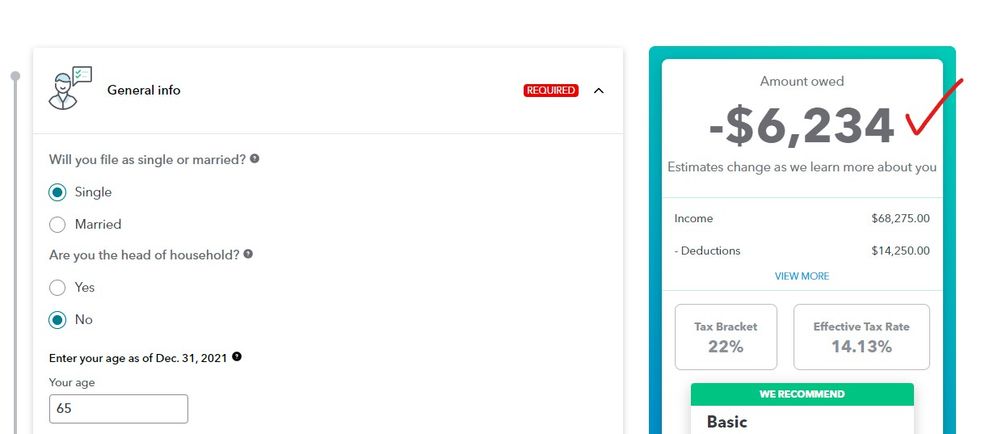

I ran the numbers using the turbotax calculator and I put in a hypothetical number ($50k) and it shows no fed tax is owed why is that? This is using a hypothetical Social Insurance Benefits number ($21,500)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option will this be taxed under

Did you enter the IRA distribution correctly ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option will this be taxed under

Sorry. I forgot to mention when I put the $50k in the Interest box it shows no tax owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option will this be taxed under

EVERYTHING coming out of an IRA is taxed as ordinary income ... put the distribution in the correct box for a correct estimate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option will this be taxed under

Right I think I follow now. I was just curious as to why there isn’t tax owed if I put the $50k in the Interest box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which option will this be taxed under

System is not fully functional for the 2021 tax year as it is being switched to the 2022 tax year since the 2021 tax program is operational. Note the spot for ordinary dividends is totally missing.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stefaniestiegel

New Member

rweddy

Returning Member

andrader05

New Member

latriciaaldermanboone9

New Member

smiklakhani

Level 2