- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Where do I deduct health care premiums for retired public safety officers according to the 2006 Pension Protection Act on my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I deduct health care premiums for retired public safety officers according to the 2006 Pension Protection Act on my taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I deduct health care premiums for retired public safety officers according to the 2006 Pension Protection Act on my taxes?

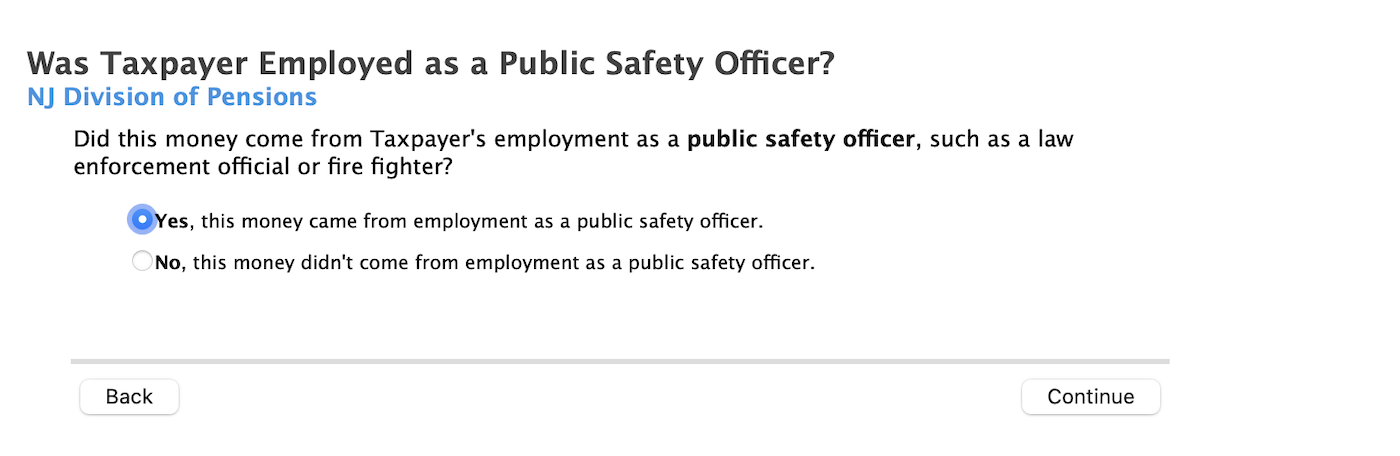

Enter this deduction by completing the 1099-R interview for your Public Safety Officer (PSO) 1099-R.

There are three successive screens that appear after entering the basic 1099-R information. If you answer the questions completely and correctly, the amount paid by your plan administrator for your health premiums will be deducted from the taxable total of your PSO pension.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I deduct health care premiums for retired public safety officers according to the 2006 Pension Protection Act on my taxes?

so is this saying that the $3000 public safety officers adjustment is automatically done once I complete the 1099R interview? my ins premium paid is $10,452. Once I enter that and check the box for public safety officer then it's already done correct? I called turbotax and they told me to deduct the $3000 from my premium, i.e. they told me to enter $7,452 for my ins premium. It deducted over $1,000 from my refund. This needs to be more clear next year, I've been working on this one deduction for 2 **bleep** days.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I deduct health care premiums for retired public safety officers according to the 2006 Pension Protection Act on my taxes?

Yes ..follow the interview screens then review the return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Viking99

Level 2

doubleO7

Level 4

swayzedavid22

New Member

RamGoTax

New Member

user17537283001

Returning Member