- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- What should I use for the address to the social security administration and what is the social security administration Payer's TIN?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should I use for the address to the social security administration and what is the social security administration Payer's TIN?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should I use for the address to the social security administration and what is the social security administration Payer's TIN?

You are trying to enter your SSA1099 in the wrong place. You do not need either of those pieces of information.

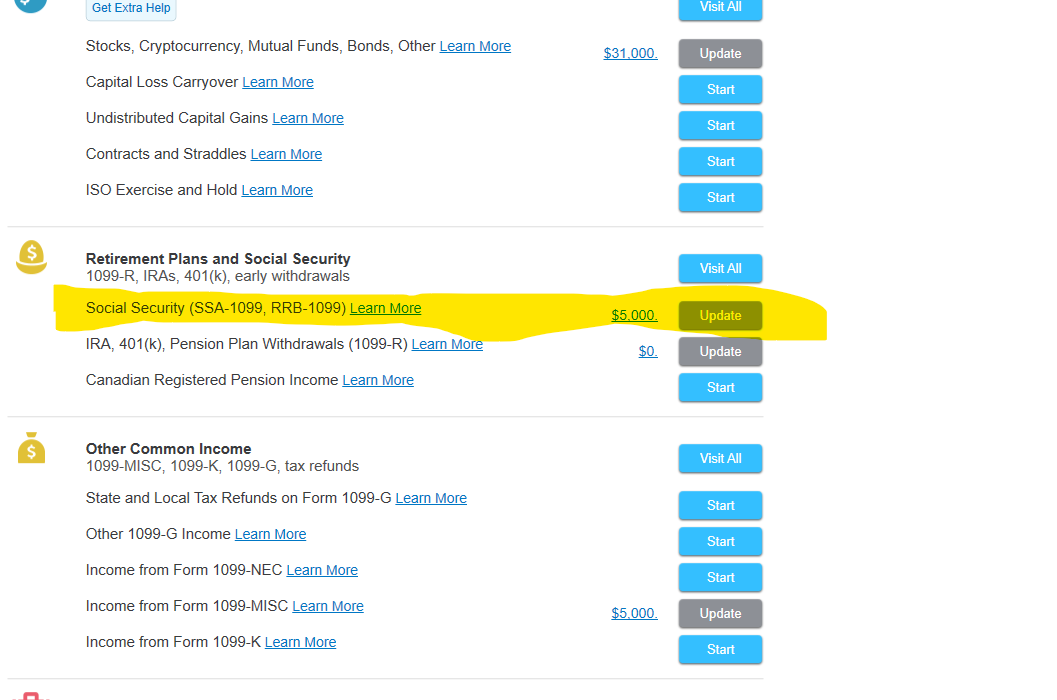

Go to Federal> Wages & Income>>Retirement Plans and Social Security (SSA1099 and 1099RRB) to enter your SSA1099.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should I use for the address to the social security administration and what is the social security administration Payer's TIN?

- Under Wages and Income the choices are: Social Security (SSA-1099, RRB-1099) & TurboTax is requesting SocSec address & TIN number. Will not let me efile without this information. Help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should I use for the address to the social security administration and what is the social security administration Payer's TIN?

If you are entering under

Wages & Income

Retirement Plans and Social Security

Social Security (SSA-1099, RRB-1099) START or UPDATE

You only get the boxes to enter the payments, you do not need to enter SocSec address & TIN number.

Please go back to that section and make sure you select "Social Security" and not "IRS, 401(k)' which is just below Social Security

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should I use for the address to the social security administration and what is the social security administration Payer's TIN?

This is not what my screen looks like. I did make the choices you indicated (SSA-1099) but when I tried to efile the program returned to the Social Security entry screen with highlighted blanks indicated for the TIN & the address. The instructions were/are that these blanks needed to be filled in before I could efile, other option was to mail original. Something is missing but I'm not able to figure it out. Should I try to file on the IRS site?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should I use for the address to the social security administration and what is the social security administration Payer's TIN?

@maciassk wrote:

This is not what my screen looks like. I did make the choices you indicated (SSA-1099) but when I tried to efile the program returned to the Social Security entry screen with highlighted blanks indicated for the TIN & the address. The instructions were/are that these blanks needed to be filled in before I could efile, other option was to mail original. Something is missing but I'm not able to figure it out. Should I try to file on the IRS site?

Sounds like you entered the SSA-1099 as a Form 1099-R because there is not a TIN or an address to enter for the SSA-1099

Delete the Form 1099-R

Click on Tax Tools on the left side of the online program screen

Click on Tools

Click on Delete a form

To enter Social Security benefits reported on form SSA-1099

Click on Federal Taxes (Personal using Home and Business)

Click on Wages and Income (Personal Income using Home and Business)

Click on I'll choose what I work on (if shown)

Scroll down to Retirement Plans and Social Security

On Social Security (SSA-1099, RRB-1099), click the start or update button

Or enter ssa-1099 in the Search box located in the upper right of the program screen. Click on Jump to ssa-1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should I use for the address to the social security administration and what is the social security administration Payer's TIN?

I'm having the same problem and the solution isn't working for me either. I entered the information manually and I'm still being asked to "correct" missing information (payer state) for SSA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What should I use for the address to the social security administration and what is the social security administration Payer's TIN?

You should not have to enter any address entering an SSA-1099. @aodum Make sure you are using the correct entry spot in TurboTax. If you accidentally started entering a 1099-R, delete that entry. Where do I enter an SSA-1099?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17649953619

New Member

macgillp

New Member

jm3

Level 3

mimi57001

Level 3

josephmarcieadam

Level 2