- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Same exact problem for me, felt like I was waiting forever for them to add the proper covid pension form to file federal, and now I still can't file because of this state nonsense. PLEASE FIX THIS ASAP, might just try and re-fill everything out with another software if turbotax keeps having these issues...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Same issue here, it says the forms are not updated but they were supposed to be finished yesterday from what I understood. Is anybody from TT working on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Same on Wisconsin. It keeps being blamed on the federal form, and every day we're being told it will be fixed "tomorrow".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Form 8915-E is available in both the CD/Download and online versions of TurboTax. If you are using the online version or after you have updated the CD/Download version be sure to go back through the 1099-R section in the federal return.

In the screens following the 1099-R entry screen:

- You will see a series of questions to see if you are exempt from the additional taxes on early withdrawals [Screenshot #1, below]; and

- You will be asked if you want to pay all the tax this year of just 1/3, with the rest reported over the next two years. [Screenshot #2] Check the box if want to pay tax on the entire retirement distribution in 2020.

Then proceed to your state return.

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

I had already done this correctly as you showed here, and had no issues with the federal portion, but when I got to the end of state filing (MI) it said that I needed to fix something and took me to a page about pension distributions where there was nothing to change. At the top it said some state forms relating to covid 19 withdrawals were not available yet. Again ... this is not an issue with answering the 8915e questions in the federal portion because I started fresh today from the beginning with no previous information saved. I ended up just efiling federal and will have to wait for the state portion to be fixed I guess.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

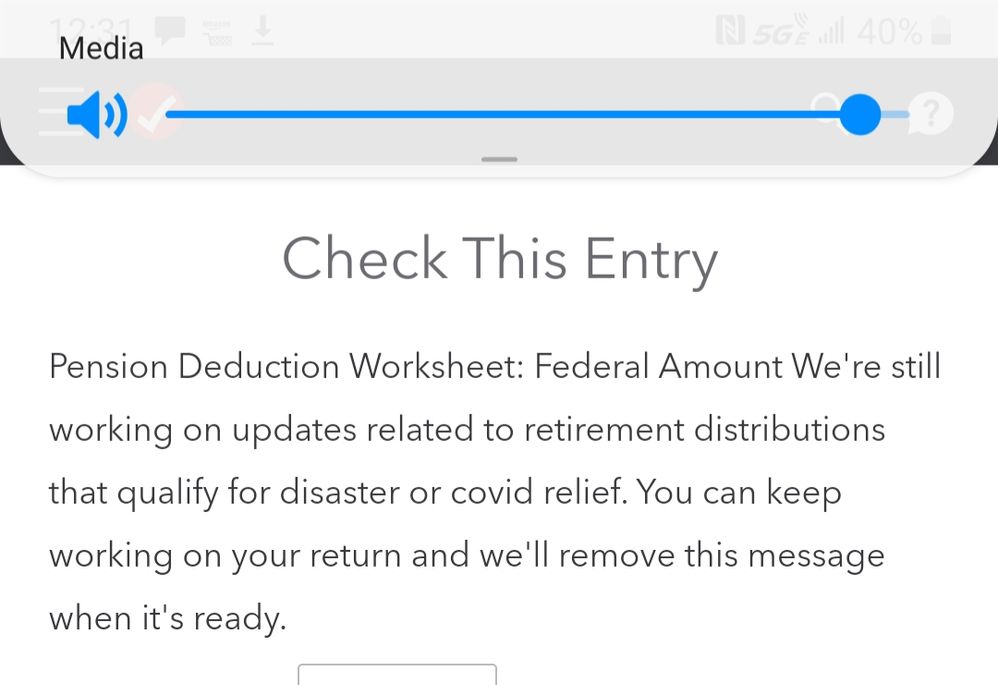

Here is a screenshot of the message

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

This is not a helpful response. We have all been stating that we have updated the federal portion, and the 8915-e is there without issue. There are still errors in the state returns.

I just called and spoke to customer service, and we combed through the entire return together. His advice was to wait for the updates on the state form to be completed.

Every response we've received so far on the forums is that that the state forms will be updated when the federal form has been released and is updated, which is has been. It appears there is no known timeline for a resolution on this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

As an alternative, you can e-file your federal return now and then e-file your state return later, when the federal return has been accepted. Please see this TurboTax Help article for details: How do I e-file my state after I already filed my federal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Im in NY and having the same issue too. This needs to be fixed asap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

I am also having issues. I cannot e-file the federal tax and state tax separately. When will this error be fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

This does not work as a Michigan filer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

As of today (2/27) my federal return shows that it has been accepted, however the problem with the state return still persists. When I go back to edit state all my information is brought over from the fed return, but when I finish it still gives me a message saying I have one thing to fix and takes me to the screenshotted error message and will not let me efile.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Same issue here. Just checked this morning and still the same issue. Federal was without issue. Now if I could only get this state to go through 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Did you fix this yet?? IM getting the exact same thing...any help?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chiroman11

New Member

LLarsen1

Level 1

wilsonbrokl

New Member

ddm_25

Level 2

v8899

Returning Member