- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

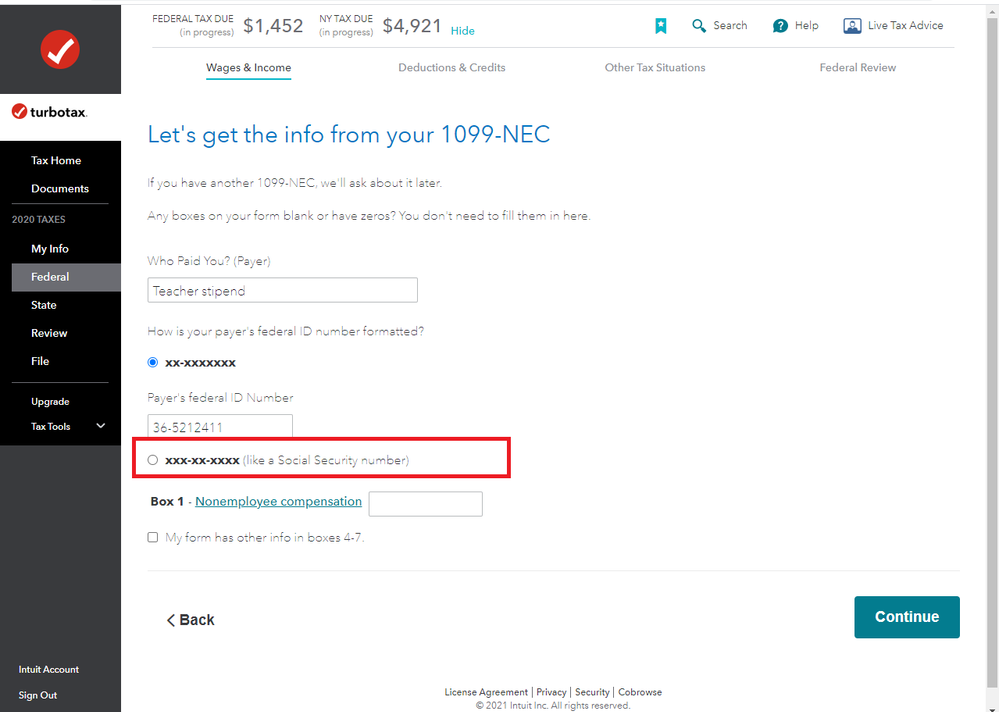

@neojgao If your 1099-NEC form has a Social Security Number instead of an Employer Identification Number:

- On the Let's get the info from your 1099-NEC screen, select the radio circle next to xxx-xx-xxxx instead of Payer's federal ID Number.

The 1099-NEC form specifically reports Nonemployee Compensation if you worked as a freelancer or contractor last year. Report your self-employment income on Schedule C, Profit or Loss From Business.

- If an expense is directly related to the work you do, you can deduct it as an expense.

- Work-related expenses reduce your taxes by lowering the amount of self-employment income you get taxed on

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

You can report the sum total of the income you received and report it as other self-employed income. To do this please follow these steps:

- Open or continue your return in TurboTax

- Search for self employment income (use this exact phrase, don't add a hyphen) and select the Jump to link at the top of the search results

- Answer Yes on the Did you have any self-employment income or expenses? screen

- When you get to the Let's enter the income for... screen you can enter the payments as "check" or "cash" under Other self-employed income.

The details of the 1099-NEC are not necessary as long as you report all the income you received.

Be sure to check What self-employed expenses can I deduct? to be sure you deduct all the expenses you can.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

@neojgao If your 1099-NEC form has a Social Security Number instead of an Employer Identification Number:

- On the Let's get the info from your 1099-NEC screen, select the radio circle next to xxx-xx-xxxx instead of Payer's federal ID Number.

The 1099-NEC form specifically reports Nonemployee Compensation if you worked as a freelancer or contractor last year. Report your self-employment income on Schedule C, Profit or Loss From Business.

- If an expense is directly related to the work you do, you can deduct it as an expense.

- Work-related expenses reduce your taxes by lowering the amount of self-employment income you get taxed on

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

Thank you for your response! But the 1099 NEC form doesn't have SSN either. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

Contact the company or organization that sent you the 1099-NEC form. They need to give you the Payer's TIN. Also, your SSN should be under Recipient's TIN.

- If they don't give you the Payer's TIN, you won't be able to e-file. You'll have to mail in your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

After I quit, the payer hates me. Now, he refuses to send me 1099-NEC & not give me his TIN. How can I report my income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

You can report the sum total of the income you received and report it as other self-employed income. To do this please follow these steps:

- Open or continue your return in TurboTax

- Search for self employment income (use this exact phrase, don't add a hyphen) and select the Jump to link at the top of the search results

- Answer Yes on the Did you have any self-employment income or expenses? screen

- When you get to the Let's enter the income for... screen you can enter the payments as "check" or "cash" under Other self-employed income.

The details of the 1099-NEC are not necessary as long as you report all the income you received.

Be sure to check What self-employed expenses can I deduct? to be sure you deduct all the expenses you can.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

Hi Experts,

1. I have a question about reporting income. I don't have 1099-NEC but I have this check including the payer's company name, address & phone number (like the image attached). Can I just enter the 1099-NEC without the payer's TIN? Will the software go through (I got Turbotax Home & Business)? If yes, would it result in an inquiry from the IRS because they don't see the payer's TIN?

2. I don't know how to create my own post to ask a question. I just come here and comment to ask. Can you tell me how to create my own post here on the forum?

[REMOVED PII]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

Please don't post the check image. We have removed it again for security reasons.

You can report this income without a 1099-NEC. Payments on Form 1099-NEC are for self-employment as a non-employee. You said that you have TurboTax Home & Business. If this payment was received for a business that you are reporting on a Schedule C, you can just add the income shown on the check to that business.

If you haven't started a business Schedule C into TurboTax yet, you can add a new business and include this income.

The amount of the check would be entered in TurboTax Home and Business on the screen:

- Go to Wages & Income

- Scroll down to Business Items

- Select Business Income and Expenses (Sch C) and Start or Update

- Follow the prompts and enter information about your business that received the check

- Continue to Enter Business Income That's Not on a 1099-NEC or a 1099-MISC

- In the space for Income or Sales, enter the amount of the check.

Here is a link to faq in Community. Check out How do I post a message? under Posting messages

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

Actually you don't need the 1099NEC. Just enter your total income as Cash or General. Only the total goes to Schedule C line 1. Just skip the 1099NEC part. You should be entering your income from your own records.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

The person I did the work for did not provide me with any Social Security or TIN number But TurboTax is requiring me to put something in. What do I put in when they do not want to give me their social?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

If you have a tax form - the payer's EIN is on there. If you did not receive a tax form, enter the income in Other Self-employment income - that entry does not require a form. @carat2stone

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

I have this same issue; however, I only have the Payers TIN (SSN) listed on my 1099NEC form as I was employed by a person- not a business. I have completed all of my forms, etc and now trying to efile, but I keeps giving me an error message saying, "Needs Review- I need to input the employers federal EIN". He does not have one because he is a person, not a business.

Does this mean I will not be able to efile? What can I do here to fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099 NEC I received does not have EIN on it but Turbotax desktop requires it. What should I do?

The SSN and EIN are the same length -you can enter the SSN.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mlc4

New Member

Mary2ube

New Member

doug72levy

New Member

eshwar_s

New Member

RLPerch

New Member