- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

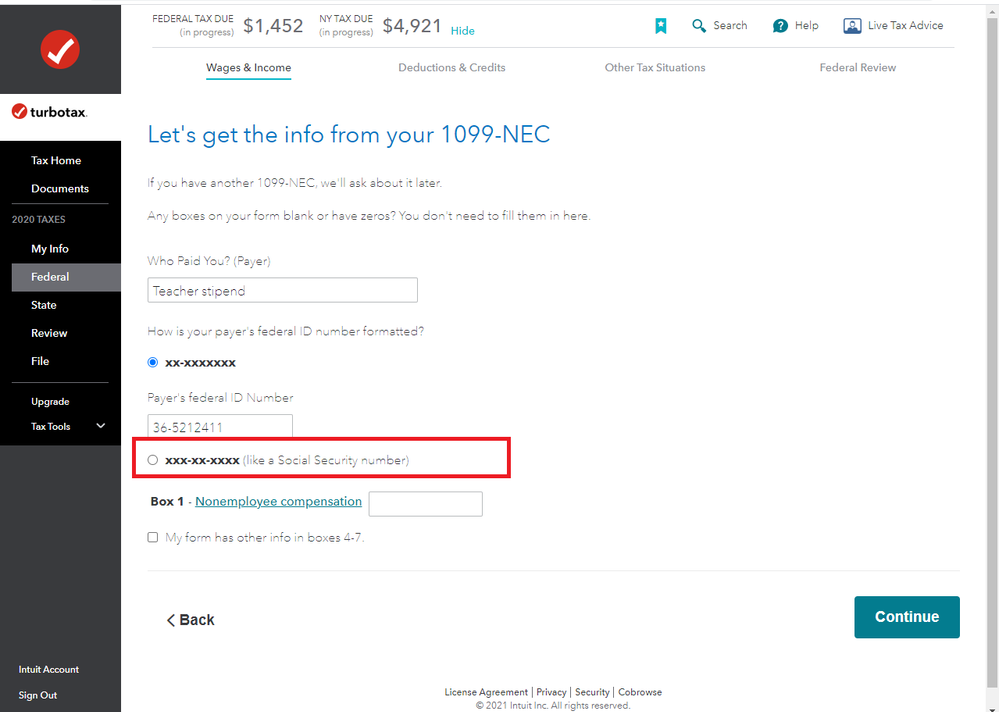

@neojgao If your 1099-NEC form has a Social Security Number instead of an Employer Identification Number:

- On the Let's get the info from your 1099-NEC screen, select the radio circle next to xxx-xx-xxxx instead of Payer's federal ID Number.

The 1099-NEC form specifically reports Nonemployee Compensation if you worked as a freelancer or contractor last year. Report your self-employment income on Schedule C, Profit or Loss From Business.

- If an expense is directly related to the work you do, you can deduct it as an expense.

- Work-related expenses reduce your taxes by lowering the amount of self-employment income you get taxed on

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 1, 2021

11:43 AM