- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- taking taxes out on SS, retirement and TSP deposits

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

taking taxes out on SS, retirement and TSP deposits

I retired on May 31th, 2020 and starting collecting SS in July, I also get my retirement from the USPS after 36 yrs, plus I have a deposit from my TSP. I believe I have state tax coming out of my TSP before getting the deposit. I've been told by friends that State taxes haven't been taken out of my SS and retirement. When I filed this yr, I was never asked through you guys/Turbo Tax, how much State tax did I paid on any of my deposits. How much money/% should I be holding out or is it already taken care of and I don't need to worry about it?

Thank you for your help -

Amy E Fowler

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

taking taxes out on SS, retirement and TSP deposits

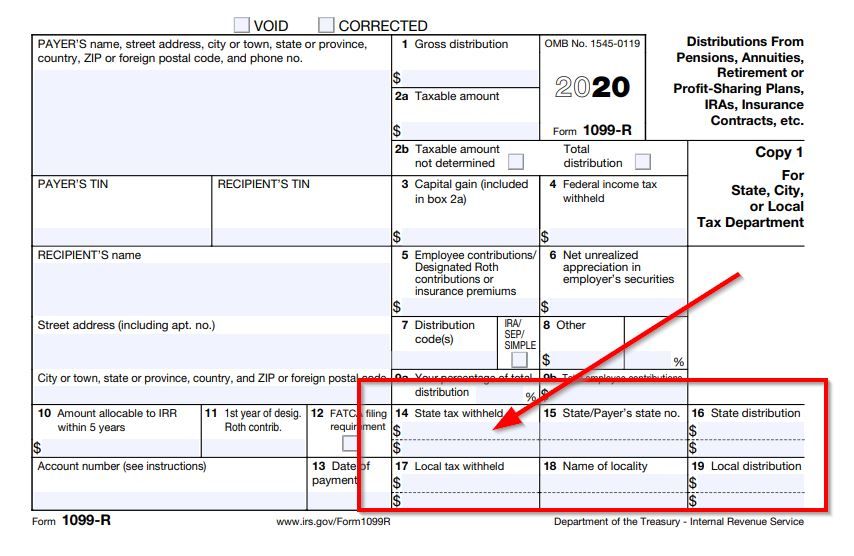

Any state withholding will be on your 1099R for retirement and TSP usually in box 12. Most states do not tax Social Security so you do not need to have any state withholding taken out of SS. When you signed up for the retirement and TSP you could have selected how much federal and state withholding to take out. You can give them a new withholding form if you want to have some deducted. Check with your retirement plan. When you did your 2020 tax return did you owe a lot to the State? Then you should have some state taxes taken out of your retirement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

taking taxes out on SS, retirement and TSP deposits

Are you an actual Turbotax expert?

Thank you for answering me! Yes, on my TSP I did have taxes taken out before I receive my deposit. I'm not sure if my retirement deposits already have taxes out or not, and you're telling me I don't pay State taxes on SS?

Thank you - amy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

taking taxes out on SS, retirement and TSP deposits

Hi Amy,

Nice speaking with you and I hope retirement finds you exhilarated!

To clarify your question:

- Your are retired

- Your receive monthly USPS pension benefits

- You receive monthly income from your Thrift Savings Plan

- You receive monthly Social Security Benefits

- Lastly how are state state taxes withheld

Ok, many states do not tax or fully tax retirement benefits.

Therefore, I recommend:

- Contact a TurboTax Live professional for a speedy, accurate answer.

- Alternatively, contact your state's Department of Revenue

- By phone

- Online (will be quicker)

- Lastly review your year-end retirement income statements

- 1099-R

- 1099-SSA

Thank you for inquiring Amy

All the best!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

taking taxes out on SS, retirement and TSP deposits

Hi, I am also a FERS Postal retiree (12-31-19). I am not withholding state taxes from my pension, since my state (Missouri) isn’t taxing my federal pension. You are probably not yet finalized. You can probably add a state deduction to your pension after you are finalized, if you think you need to. It might not be necessary. Ask a retired friend that lives in your state if they were charged state taxes in 2020, when they filed. A lot of states do not tax federal pensions. I haven’t yet withdrawn from my TSP. When I do, I might owe some Missouri state tax on my tsp withdrawal. I do not know if Missouri will tax my social security payments. I won’t get my first SS until December.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

taking taxes out on SS, retirement and TSP deposits

Colorado does State tax, but I was never asked about the paid State taxes on my return. I was thinking it might be because I only collected for 6 mos - June thru Dec '20. The only problem I ran into was having to repay the $600.00 stimulus money I had received. Apparently I didn't claim it and had to pay it back.

Thank you - amy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

taking taxes out on SS, retirement and TSP deposits

I'm thinkin' I'll just wait until I file next yr to see how much I need to pay and then go from there.

Thank you - a.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

taking taxes out on SS, retirement and TSP deposits

You are not asked about state taxes paid, you would have entered it from your 1099R form in box 14. Check your 1099R. Yes you could have had state withholding taken out for 2020. But as the other post said some states do not tax federal pensions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

taking taxes out on SS, retirement and TSP deposits

I only received 1 1099-R for TSP and form SSA-1099 which didn't have a box #14, plus I only collected $14,500 from SS. I didn't go over the $20,000, so maybe that's why I didn't pay CO State tax???

Thank you - a.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rdemick54

New Member

jenniferheuberger10

New Member

mysert

Level 1

spe319

New Member

mrjonathan1981

New Member