- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Solo 401k Profit Sharing Contribution for spouse

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k Profit Sharing Contribution for spouse

Where to input the Solo 401k Profit Sharing Contribution for spouse?

It's a single member LLC with the spouse as the only W2 employee. The owner used schedule C.

For the owner, to report Employer Matching (Profit Sharing) Contributions under Self-Employed Individual and Roth 401(k) Plans will be counted as Self-employed Retirement contributions and reduce tax. But when fill the Profit Sharing Contribution for the W2 spouse employee, it did not count as contribution and have no tax change.

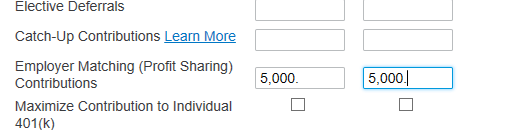

Below is a simple example, $5000 profit Sharing Contribution for the owner and $5000 for the W2 spouse employee. The total is $10000, but only $5000 was counted as contribution. The W2 spouse employee's profit Sharing contribution (no matter what number, even tried $50000) has no impact on the tax.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k Profit Sharing Contribution for spouse

Enter your wife’s profit sharing as a business expense since she is an employee.

- Tap Forms in the right corner

- Find Schedule C in the left column

- Tap Schedule C and enter the contribution on line 19, Pension and profit sharing plans

- Tap Step-by-Step in the top right where Forms used to be to go back to the interview mode.

For an explanation see the post by tax guru @dmertz: Problems entering Solo 401(k) for myself and spouse

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k Profit Sharing Contribution for spouse

Right. The LLC's profit-sharing contribution for your spouse is a business expense, not a self-employed retirement deduction. Note that the profit-sharing contribution must be the same base contribution rate for you and your spouse. With the maximum 25% base rate, the maximum contribution for your spouse is 25% of compensation and for you is 25% / (1 + 25%) = 20% of net-earnings from self-employment. Net earnings from self employment are net profit from self-employment minus the deductible portion of self-employment taxes. Of course because the profit-sharing contribution for your spouse reduces your net profit, it reduces the amount of the profit sharing contribution for yourself a bit (unless your net earnings exceed the $290,000 cap on the amount of income on which the calculation is made).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k Profit Sharing Contribution for spouse

Thanks a lot!! @ErnieS0 @dmertz

1. Does the pension startup credit apply to solo 401k? A Single-member LLC with only spouse as W2 employee.

2. The Single-member LLC 's tax will be reported using schedule C. So the max contribution rate for both owner and spouse will be 20%, right?

3. For profit contribution of the spouse, is it calculated as 20% of spouse's W2 wage (BOX 1 in W2) ?

4. For profit contribution of the owner, it will be 20% of net-earnings of self-employment, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k Profit Sharing Contribution for spouse

- Section 45E of the tax code requires that at plan have has at least one employee eligible to participate who is not a highly compensated employee: https://www.law.cornell.edu/uscode/text/26/45E

- The maximum base rate is 25%. From that the maximum profit sharing contribution for the self-employed individual is 25% / (1 + 25%) = 20%. The profit sharing contribution for all participants must be based on the same base rate, so if compensation is under the $290,000 limit, if 20% net earnings is contributed for the owner, 25% of W-2 wages must be contributed for the W-2 employee.

- 25%

- 20%

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k Profit Sharing Contribution for spouse

Thanks a lot. @dmertz

I did not get the point of " the profit sharing contribution for all participants must be based on the same base rate".

Which is correct?

for example,

If the W2 spouse receives 20% profit sharing contribution of W2 wage in BOX1, what's the rate for the owner of SMLLC? 1/(1+20%)=17.7%?

Or

Can the W2 receive 20% profit sharing contribution while the owner receives any rate like 10%?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k Profit Sharing Contribution for spouse

Sorry, I wrote the formula wrong. I should have written 1 - 1 / (1 + BaseRate) or BaseRate / (1 + BaseRate). For a 25% base rate the self-employed rate is 25% / (1 + 25%) = 20%. I've corrected that. For a 20% base rate contributed on behalf of the W-2 employee, the self-employed rate must be 20% / (1 +20%) = 16.6667%. The self-employee rate for each whole percentage point increment of the base rate is listed in Rate Table for Self-Employed in Chapter 6 of IRS Pub 560.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rudy-kessinger

Returning Member

rudy-kessinger

Returning Member

rudy-kessinger

Returning Member

rudy-kessinger

Returning Member

WWBinPA

Returning Member