- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo 401k Profit Sharing Contribution for spouse

Where to input the Solo 401k Profit Sharing Contribution for spouse?

It's a single member LLC with the spouse as the only W2 employee. The owner used schedule C.

For the owner, to report Employer Matching (Profit Sharing) Contributions under Self-Employed Individual and Roth 401(k) Plans will be counted as Self-employed Retirement contributions and reduce tax. But when fill the Profit Sharing Contribution for the W2 spouse employee, it did not count as contribution and have no tax change.

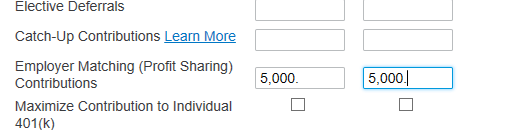

Below is a simple example, $5000 profit Sharing Contribution for the owner and $5000 for the W2 spouse employee. The total is $10000, but only $5000 was counted as contribution. The W2 spouse employee's profit Sharing contribution (no matter what number, even tried $50000) has no impact on the tax.